Trading was lackluster this morning due to a lack of buying interest from investors, with sell-side orders gradually pushing prices down. Except for the first few minutes when the VN-Index was slightly positive, the market trended downward for the rest of the morning session, ending at the lowest point with four times as many losers as gainers.

Today marks the futures expiration, and caution prevailed after three consecutive losing sessions. Large-cap stocks failed to stabilize the market despite VCB and VIC trading in the green. The number of declining stocks far outweighed the gainers in the VN30 basket (25 losers vs. 3 gainers).

The VN-Index opened at its intraday high, gaining nearly four points before plunging to a loss of 5.61 points (-0.44%) at the midday break. The decline was driven by weakness in the large-cap sector, but the overall breadth also indicated selling pressure across the market. While the index had 162 gainers to 71 losers in the initial minutes, the gap widened to 159 gainers to 127 losers by 10:00 AM, then to 108 gainers to 185 losers by 11:00 AM, and finally ending with just 67 gainers versus 270 losers.

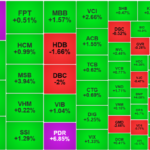

The VN30-Index closed the morning session down 0.42%, with only three stocks in positive territory: VCB (+0.33%), VIC (+0.24%), and ACB (+0.19%). All other large-cap stocks, except for the unchanged TCB, traded in the red. Fortunately, the declines among the large-caps were relatively modest, with HPG leading the losses with a 0.92% drop. Eight stocks in the basket, however, posted losses of more than 1%, with SSB and GVR down 2.1% and 1.66%, respectively.

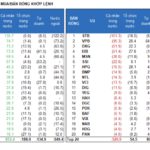

On the HoSE, out of the 270 declining stocks, 78 fell by more than 1%. Notably, four stocks with significant volume traded over VND 100 billion: MSN (-1.24%) with VND 216.9 billion, HDB (-1.11%) with VND 137.7 billion, DBC (-2.84%) with VND 122 billion, and HCM (-1.32%) with VND 101.6 billion. Total trading value on the exchange decreased by over 6% from the previous morning session, reaching just over VND 4,766 billion. Many stocks witnessed sharp declines coupled with low liquidity, indicating a withdrawal of funds.

Beyond the impact of the futures expiration, the contraction in trading activity also reflected investor disappointment with the 1300-point region, as the market has been unable to break through this level. As a result, investors are neither motivated to add to their positions nor ready to “liquidate” their portfolios, leaving the market in the hands of sellers, who now dictate the pace of price declines.

Stocks that managed to buck the downward trend this morning mostly had modest trading volumes, with a few transacting just a few hundred million to a few billion dong. Among the 67 gainers, 22 stocks rose by more than 1%, but none stood out in terms of liquidity. While YEG, HVH, PVP, MSH, TIP, and NO1 posted strong gains, their trading volumes were relatively low, with YEG’s VND 13.7 billion being the highest. This level of liquidity does not provide a reliable indication of price movement as it involves only a small number of participants.

Foreign investors continued their net selling streak on the HoSE, withdrawing another VND 288.8 billion this morning. This marks the fourth consecutive session of net selling, with each session exceeding VND 100 billion in value. While no single stock experienced a significant sell-off, the selling pressure was broad-based across many stocks. Notable stocks sold by foreign investors included HDB (-VND 48.3 billion), VHM (-VND 27.2 billion), HPG (-VND 24.5 billion), and DBC (-VND 20.1 billion). On the buying side, STB stood out with a net purchase of VND 72.3 billion. This persistent net selling trend suggests that this week is shaping up to be a record-breaking week for foreign net selling, marking the fourth consecutive week of outflows.

The VN-Index ended the morning session down 5.61 points, closing at 1273.87. The October low was 1269.93, and the intramonth low was 1264.65. With the index retreating to levels close to the recent short-term low, hopes for a more positive market sentiment driven by third-quarter financial reports have, so far, been dashed.

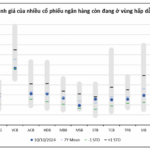

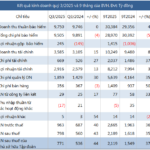

“Undervalued Banking Stocks: Unlocking the Potential for Robust Growth”

“We recommend accumulating bank stocks for a medium to long-term vision, even if short-term profit growth prospects don’t present many surprises. The aforementioned banks have strong and sustainable growth motivations and are undervalued compared to their potential; these include ACB, CTG, MBB, TCB, and VPB. These financial institutions have robust fundamentals and are well-positioned to capitalize on Vietnam’s growing economy and thriving business sector. With their diverse revenue streams and expanding digital presence, these banks are poised to deliver stable returns and outperform the market. This accumulation strategy is a prudent approach to investing in Vietnam’s financial sector, offering a balanced risk-reward proposition for investors with a long-term horizon.”

The Cash Flow Crisis: VN-Index Plunges as Foreign Investors Sell-Off

The market was sluggish this morning as investors refrained from buying. Sell orders gradually pushed the market down to very low price levels. Except for the first few minutes when the VN-Index was slightly green, the market plummeted for the rest of the morning session, closing at its lowest point with four times as many losers as gainers.

The Big Turnaround: Bank Stocks and Real Estate Make a Comeback to Lead the Market Surge

After a sluggish morning session, the market suddenly witnessed a surge of aggressive buying, propelling stock prices upward and triggering a broad reversal. The VN-Index surged past the reference point to close at the highest level of the day, led by a remarkable performance from banking and real estate stocks in this unexpected turn of events.