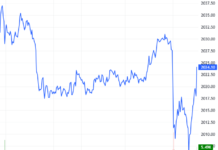

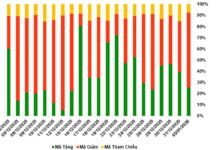

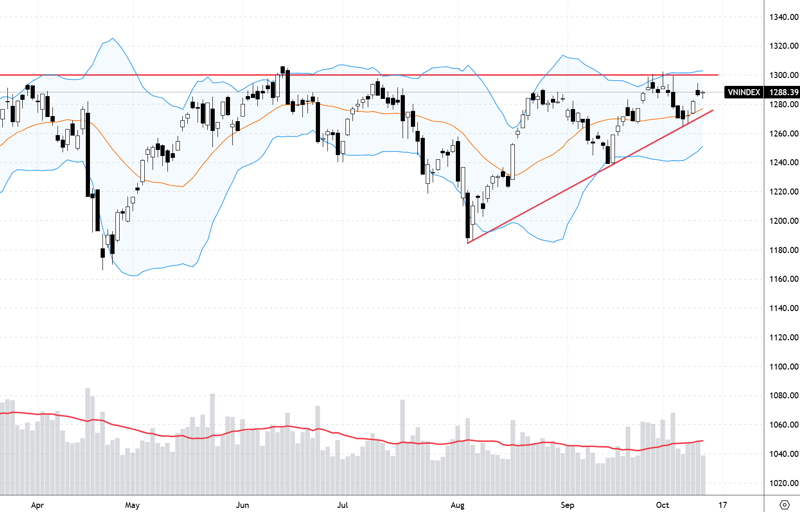

Quarterly business results for Q3 2024 are pouring in, but market movements have not shown commensurate reactions. Last week, the VN-Index fell for the first three consecutive sessions, recovered on Thursday, but faltered in the final session. The index also retreated once again after approaching the 1,300-point mark. The average matched transaction liquidity on the HoSE floor also did not show any progress and even slightly decreased.

However, the strong gain on Thursday helped the VN-Index establish a higher bottom and maintain a narrowing adjustment amplitude, preserving the short-term uptrend since the early August 2024 bottom. According to experts, this is a positive technical development as a trend continuation pattern is forming, promising a breakthrough opportunity. However, liquidity is still a factor that makes experts cautious, and in fact, the market has had several breakthrough opportunities in the past few weeks but has been unsuccessful.

Commenting on the Q3 2024 earnings effect, experts still expect profit information to support the market, and in fact, this is the force that makes the adjustment paces smaller. However, there are also many cases where stocks with good financial reports do not increase in price. According to experts, investors can act depending on their state and strategy. If it is short-term speculation, the poor stock response may be due to “information already reflected in the price,” and the holding ratio should be reduced, especially if margin is being used. If it is a long-term investment, the good Q3 results will gradually be reflected in the long-term price trend, especially as Q4 prospects are more positive. Therefore, investors can continue to hold or even buy more when the price retreats.

Technically, continuously creating higher bottoms and moving within a narrowing amplitude are signs similar to the “Ascending Triangle” pattern. This may indicate a continuation of the uptrend.

Nghiêm Sỹ Tiến

Nguyễn Hoàng – VnEconomy

The market fluctuated unpredictably last week, partly due to the appearance of the derivatives expiration session. VN-Index fell in the first three sessions of the week but recovered in the last two sessions and created a higher bottom than the October peak. Some opinions assessed this as a positive technical signal when the index fluctuated with an increasingly narrow adjustment and continuously hugged the 1,300-point region, consolidating the breakthrough opportunity. What are your thoughts on this?

Nguyễn Việt Quang – Director of Business Center 3 Yuanta Hanoi

The index’s adjustment amplitude is getting narrower and narrower, and it is currently hovering around the 1,300-point mark. Many people believe that this is a positive development and that the index is following a pattern of narrowing trading amplitude. However, the excessive narrowing, along with the VN-Index chart resembling a beautiful painting, gives me a different perspective. I believe that when you climb to the “peak” of a mountain, you will see the most beautiful scenery. In addition, on Thursday, the index had momentarily broken through the trend channel formed by the August 5, September 17, and October 7 bottoms, along with the negative developments on Friday. Therefore, from my perspective, I remain cautious rather than excited, and I have implemented risk management measures by significantly reducing my position. When the market convincingly surpasses the 1,300-point mark, I will consider reinvesting, and it won’t be too late.

Nghiêm Sỹ Tiến – Investment Strategy Specialist, KBSV Securities

Technically, continuously creating higher bottoms and moving within a narrowing amplitude are signs similar to the “Ascending Triangle” pattern. This may indicate a continuation of the uptrend, following the sideways accumulation sequences with decreasing liquidity and forming higher support points.

After numerous failed tests, the resistance zone around 1,300 points is exerting significant pressure on the market’s psychology, causing profit-taking and ratio reduction to dominate when the index approaches this level again. Nonetheless, with the short-term uptrend being preserved, the probability still favors the scenario in which the VN-Index will successfully conquer the aforementioned resistance threshold.

Lê Đức Khánh – Analysis Director, VPS Securities

The accumulation region revolving around the old peak is narrowing, and the trading amplitude is shortening. The sideways accumulation pattern is meticulous and preparing for a breakthrough opportunity to reach a new peak. I believe this development will likely occur next week or, at the latest, the final week of October.

Capital Flow Trend: As the Q3 Earnings Season Begins, Will This Time Be Different?

Exchange Rate Surges, State Bank Issues Bills to Absorb Money

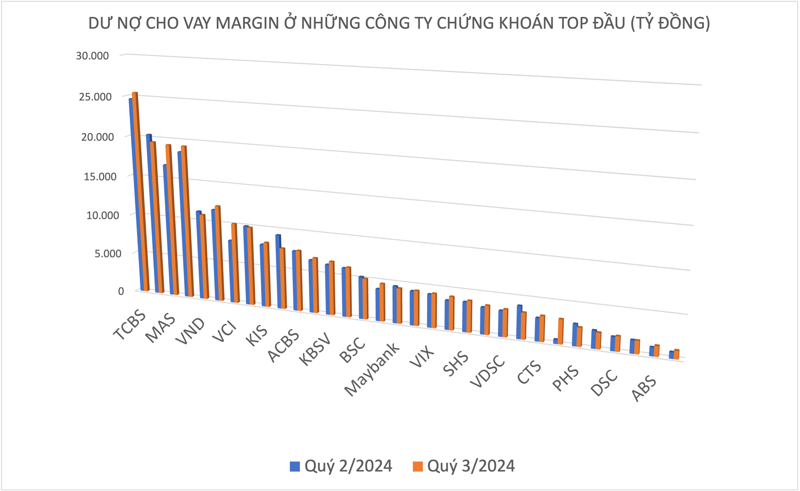

Margin Lending Sets Another Record High of VND 235,000 Billion, but It’s “Harmless”

Nguyễn Thị Mỹ Liên – Analysis Department Head, Phu Hung Securities Company

From a technical standpoint, the VN-Index’s fluctuations are forming a VCP pattern with a narrowing amplitude. Typically, this is a positive pattern that provides an opportunity to initiate a new uptrend if it breaks through the 1,300-point level. However, it is essential to consider that every pattern has a certain success rate. Over the past 1-2 weeks, I have noticed that the market has had a few chances for buying force to participate and contribute to the pattern’s completion, but this has not materialized. If the buying force does not show more positive changes this week, I believe caution is warranted.

Lê Minh Nguyên – Senior Director of Individual Customers, Rong Viet Securities

In the last trading session, the VN-Index closed at the support level of 1,285.46 points and is likely to continue testing this support level. If the market maintains this support level in the new trading week, it will consolidate the opportunity to approach the 1,300-point region. However, with the current low liquidity, it is likely that the market will continue to move sideways within the range of 1,240 to 1,300 points for accumulation rather than breaking through the 1,300-point threshold. In this information trough phase, we cannot expect a strong market breakthrough but should anticipate gradual accumulation as we await more supportive information in the latter part of the year.

Nguyễn Hoàng – VnEconomy

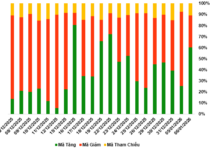

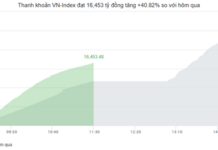

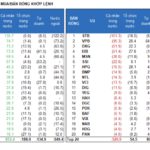

Last week, you anticipated that capital flow would be more positive this week as earnings reports emerged. However, we have not witnessed a clear change in liquidity, and transactions have even slightly decreased. Meanwhile, statistics show that individual investors have been net buyers continuously with a substantial scale. It seems that investors remain cautious, or is the market’s capital flow truly weakening? How do you assess the demand for margin loans at this point?

Nguyễn Thị Mỹ Liên – Analysis Department Head, Phu Hung Securities Company

Positive financial results will be reflected in stock prices, and capital will flow into those stocks if their valuations remain attractive. However, this will not improve the overall market liquidity. In reality, during the past week, domestic individual investors’ net buying was due to net withdrawal orders from foreign investors. It appears that the buying force is still relatively weak, and investors’ psychology remains cautious as the VN-Index struggles to surpass the 1,300 threshold. Therefore, investors should maintain a moderate position and refrain from using margin loans during this period.

In the current phase, I assess that the demand for margin loans is moderate, and the current supply is still abundant.

Nguyễn Việt Quang

Nghiêm Sỹ Tiến – Investment Strategy Specialist, KBSV Securities

Quite a few enterprises have announced their Q3 2024 financial results so far, but overall, profits are showing signs of stagnation or even decline in some sectors. The subpar performance may have been reflected in the market’s liquidity in recent sessions, with more cautious transactions. These data may not be negative enough to trigger a sell-off, but they are also unlikely to generate a significant buying force. Therefore, at least in the first half of Q4 2024, the demand for margin loans will unlikely experience a dramatic surge.

Nguyễn Việt Quang – Director of Business Center 3 Yuanta Hanoi

In my opinion, many investors still hold a certain proportion of stocks and closely monitor the market’s movements to decide whether to increase or decrease their positions. This also contributes to the market’s lackluster liquidity. In the current phase, I assess that the demand for margin loans is moderate, and the current supply is still abundant.

Lê Minh Nguyên – Senior Director of Individual Customers, Rong Viet Securities

The earnings reports that have emerged contain some positive aspects, but it seems that the market is awaiting more favorable information to attract capital inflows and spur a breakthrough. Currently, individual domestic investors dominate the market, while large capital remains on the sidelines, observing and awaiting clearer opportunities to participate. The VN-Index is moving sideways within a narrowing amplitude, and liquidity has not increased despite the supportive Q3 financial results. This indicates that the demand for margin loans is also not high at the moment, and short-term trading has become more challenging.

The accumulation region revolving around the old peak is narrowing, and the trading amplitude is shortening. The sideways accumulation pattern is meticulous and preparing for a breakthrough opportunity to reach a new peak. I believe this development will likely occur next week or, at the latest, the final week of October.

Lê Đức Khánh

Lê Đức Khánh – Analysis Director, VPS Securities

During this phase, investors may still need and utilize margin loans, but it is crucial to reiterate the importance of controlling the number of stocks in their portfolios and carefully selecting stocks. If the opportunity is uncertain, the stock price performance is favorable, the stock’s liquidity is high, and the trading style is rapid, using margin loans can be effective. However, value investors are likely to use them less frequently.

Nguyễn Hoàng – VnEconomy

Foreign capital unexpectedly returned to strong net selling last week, ending the previous four weeks of balanced transactions, with some weeks even recording substantial net buying. Has the exchange rate effect faded, or are foreign investors also taking profits around the 1,300-point peak?

Nghiêm Sỹ Tiến – Investment Strategy Specialist, KBSV Securities

The return of foreign capital to net selling may be attributed to the recent sharp rise in exchange rates. Several factors are believed to be the cause, including the increase in the DXY Index, the surge in USD foreign currency demand, and the outflow of large amounts of USD from the system. Generally, foreign capital in the stock market is quite sensitive to exchange rate fluctuations, and this issue should also be monitored as the net selling of foreign capital may impact the market’s overall trading psychology, especially in the context of limited supportive information.

Lê Minh Nguyên – Senior Director of Individual Customers, Rong Viet Securities

In my opinion, it is understandable that foreign capital has returned to net selling as the VN-Index approaches the 1,300-point mark amid low liquidity and large capital remaining on the sidelines, observing and awaiting clearer opportunities to participate.

Nguyễn Thị Mỹ Liên – Analysis Department Head, Phu Hung Securities Company

The strong net selling by foreign investors last week was significantly influenced by the rebound in exchange rates, along with the escalating geopolitical tensions. The USD Index has been continuously increasing since the end of September and has reached its highest level in over two months. Additionally, the SBV was forced to intervene to ease the pressure on the exchange rate by issuing bills worth up to VND 12,300 billion after a nearly two-month hiatus.

Foreign capital continues to flow between markets, and I believe that foreign investors are adopting a more cautious approach as October presents various variables, including the US presidential election, the extent of the Fed’s interest rate cuts in 2024, tensions in the Middle East and the Korean Peninsula, and the attractiveness of risky assets like stocks has diminished due to their reduced valuations.

Over the past 1-2 weeks, I have noticed that the market has had a few chances for the buying force to participate and contribute to the pattern’s completion, but this has not materialized. If the buying force does not show more positive changes this week, I believe caution is warranted.

Nguyễn Thị Mỹ Liên

Nguyễn Việt Quang – Director of Business Center 3 Yuanta Hanoi

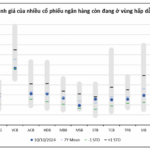

After a long period of trading in Vietnam, foreign capital has also made strategic adjustments to better adapt to our market. When encountering strong resistance zones or sharp increases in stock prices, such as in the case of bank stocks, it is understandable that they would take profits. Regarding the Fed’s interest rate cuts, foreign capital also needs time to flow between markets.

Lê Đức Khánh – Analysis Director, VPS Securities

The pressure to sell or take profits may increase in the zone around the old peak or during rapid stock price increases, as seen in bank stocks. The reduction in the proportion of stocks held by foreign investors is also understandable and appropriate in this context.

Nguyễn Hoàng – VnEconomy

Many stocks have released their financial results, but their prices have not progressed significantly, and some have even decreased last week. How should investors react in this situation?

Nguyễn Việt Quang – Director of Business Center 3 Yuanta Hanoi

It is common for stock prices to remain unchanged or deviate from financial results. This can be explained by the phrase, “information has been reflected in the price.” Regarding investor actions, I believe it depends on the stock’s movements and financial results. Here are some examples: if a stock surges to a strong resistance zone before releasing good financial results but fails to increase further, consider taking profits; if a stock plunges to a strong support zone and releases poor financial results but does not fall further, investors can consider buying more or holding the stock, waiting for a rebound to sell…

Nghiêm Sỹ Tiến – Investment

The Cash Flow Crisis: VN-Index Plunges as Foreign Investors Sell-Off

The market was sluggish this morning as investors refrained from buying. Sell orders gradually pulled back to very low prices, allowing sellers to offload their positions. Apart from the first few minutes when the VN-Index was slightly positive, the market plunged throughout the morning session, closing at its lowest point with four times as many losers as gainers.

The Savvy Investor: Pouring Money into the Market, a Smart Strategy?

Individual investors today bought a net amount of 353.8 billion VND, of which their net buying value via matched orders was 603.9 billion VND.

“Undervalued Banking Stocks: Unlocking the Potential for Robust Growth”

“We recommend accumulating bank stocks for a medium to long-term vision, even if short-term profit growth prospects don’t present many surprises. The aforementioned banks have strong and sustainable growth motivations and are undervalued compared to their potential; these include ACB, CTG, MBB, TCB, and VPB. These financial institutions have robust fundamentals and are well-positioned to capitalize on Vietnam’s growing economy and thriving business sector. With their diverse revenue streams and expanding digital presence, these banks are poised to deliver stable returns and outperform the market. This accumulation strategy is a prudent approach to investing in Vietnam’s financial sector, offering a balanced risk-reward proposition for investors with a long-term horizon.”

The Flow of Funds: What to Do When Stocks Have Good Earnings but Prices Don’t Rise?

The Q3 2024 earnings season is in full swing, yet market movements have not reflected commensurate reactions. Last week, the VN-Index declined for the first three sessions, rebounded on Thursday, but faltered in the final trading session. The index once again retreated as it approached the 1,300-point mark. The HoSE’s average matching liquidity did not show any significant improvement and even witnessed a slight decline.