A spectacular derivatives expiry session. With pressure relieved, sentiment remained cautious throughout the morning, causing the index to continue dipping, but as the afternoon progressed, buying momentum intensified, and the market staged a strong recovery, surging 7 points to close at 1,286 points. The market breadth was much improved, with 224 gainers dominating over 128 losers. The two large-cap groups, banking and real estate, led the rally, with most stocks in these sectors turning green.

Banks displayed strong unity, with all but HDB ending in solid gains, including STB, LPB, MBB, TPB, and ACB. Large-cap banks, such as VCB, BID, CTG, and TCB, also closed in the green but with relatively milder gains. Meanwhile, several real estate stocks soared to the daily limit, including NHA, PDR, and DXG, while others, such as CEO, DIG, NVL, HDC, and NLG, posted significant advances.

Securities firms kept pace with the market, as SSI, VCI, VIX, VND, and MBS climbed by an average of 2%. No sector was left behind, as most other groups, including Materials, Software, Telecom, and Energy, also painted a lush green picture. The stocks that contributed the most to the market’s gains today were VCB, BID, MBB, STB, ACB, CTG, and MSB, with the banking group alone contributing nearly 4 points to the overall index.

Funds are flowing into the market, with combined liquidity across the three exchanges reaching VND18,000 billion, while foreign investors continued to offload holdings, with a net sell value of VND418.8 billion, including VND359.3 billion in matched orders.

On the foreign buying side, Financial Services and Oil & Gas sectors dominated the matched orders. The top foreign-bought stocks were STB, MSN, DXG, VCI, EIB, SSI, BMP, DIG, NTL, and PLX.

On the selling side, Real Estate dominated the foreign matched orders. The top foreign-sold stocks were HDB, DBC, KDH, NLG, VHM, GMD, GVR, VNM, FPT.

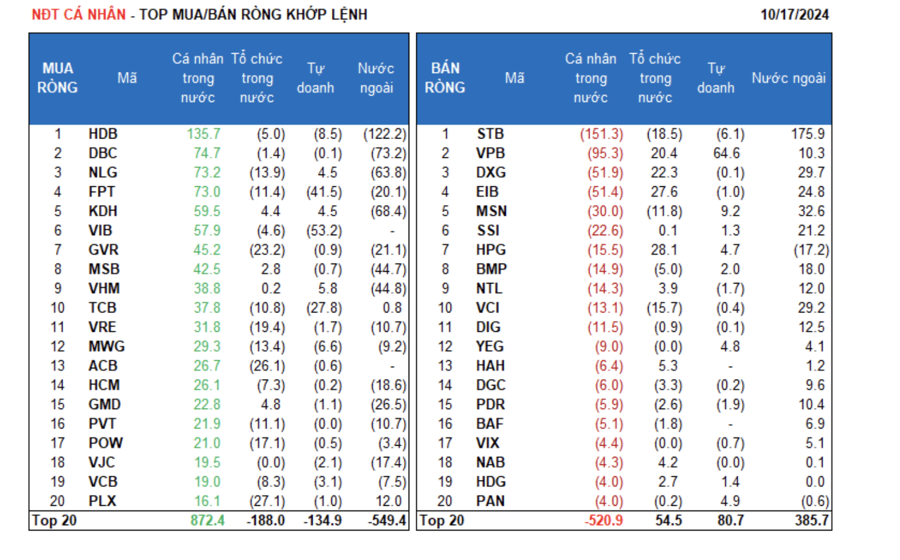

Individual investors net bought VND353.8 billion, including VND603.9 billion in matched orders.

In terms of matched orders, they net bought 13 out of 18 sectors, mainly focusing on Real Estate. The top stocks bought by individual investors included HDB, DBC, NLG, FPT, KDH, VIB, GVR, MSB, VHM, and TCB.

On the selling side, they net sold 5 out of 18 sectors, mainly focusing on Basic Materials and Media & Publishing. The top stocks sold by individual investors included STB, VPB, DXG, EIB, MSN, SSI, BMP, NTL, and VCI.

Proprietary trading accounts net bought VND261.7 billion, including a net sell value of VND38.0 billion in matched orders.

In terms of matched orders, proprietary trading accounts net bought 8 out of 18 sectors, with the strongest buying interest in Food & Beverage and Construction & Materials. The top stocks bought by proprietary trading accounts today were VPB, VNM, MSN, MBB, PC1, VHM, PNJ, PAN, YEG, and HPG. On the selling side, they focused on the Banking sector, offloading VIB, FPT, TCB, CTG, HDB, E1VFVN30, MWG, SHB, STB, and SSB.

Domestic institutional investors net sold VND211.2 billion, including VND206.5 billion in matched orders.

In terms of matched orders, domestic institutions net sold 15 out of 18 sectors, with the largest net sell value in the Banking sector. The top stocks sold by domestic institutions included PLX, ACB, GVR, VRE, STB, POW, VCI, VNM, MBB, and PNJ. On the buying side, they focused on Basic Materials, with the top purchases being HPG, EIB, DXG, VPB, BWE, HAH, GMD, KDH, GEX, and NAB.

Today’s matched and negotiated trades totaled VND3,251.2 billion, up 85.6% from the previous session and contributing 17.5% to the overall value.

Notable negotiated trades were observed in MSB, with 11.3 million shares worth VND152.6 billion traded between foreign institutions.

Individual investors also participated in negotiated trades, focusing on the Banking sector (STB, HDB, SSB), FPT, and GEX.

Money flow distribution shifted towards Real Estate, Banking, Securities, Steel, and Textiles, while decreasing in Construction, Chemicals, Food & Beverage, Retail, and Software.

In terms of matched orders, money flow distribution increased in the mid-cap sector (VNMID) while decreasing in the large-cap (VN30) and small-cap (VNSML) sectors.

The Stock Market Journal: A Force to be Reckoned With

An impressive turnaround emerged during the derivatives expiry session. Whether this was a pull-up effect or not, the recovery rhythm was broad-based, with good leadership and momentum.

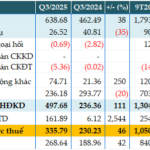

“A Significant Spike in Margin Lending: DNSE’s Third-Quarter Report Shows a 65% Surge in Margin Debt Since the Start of the Year.”

In Q3 2024, DNSE Securities’ margin lending outstanding balance witnessed a remarkable 65% year-to-date surge, significantly contributing to the firm’s robust financial performance. This quarter, DNSE reported a 12% increase in revenue, totaling VND 193.7 billion, along with a 10% rise in net profit, amounting to VND 44.3 billion, compared to the same period in 2023.

The Flow of Funds: What to Do When Stocks Have Good Earnings but Prices Don’t Rise?

The Q3 2024 earnings season is in full swing, yet market movements have not reflected commensurate reactions. Last week, the VN-Index declined for the first three sessions, rebounded on Thursday, but faltered in the final trading session. The index once again retreated as it approached the 1,300-point mark. The HoSE’s average matching liquidity did not show any significant improvement and even witnessed a slight decline.

The Savvy Solo Investor: Betting Big on Bank Stocks

Self-employed net buy of 447.7 billion VND, with a net buy of 132.0 billion VND in matching orders. Today’s top net buy orders by self-employed investors included FUEVFVND, STB, VNM, ACB, and VPB.