Bank stocks became the main driver of the VN-Index in September, with the index surpassing the 1,300-point mark at one point. However, strong profit-taking pressure soon after caused it to turn downward again.

A number of bank stocks posted strong gains in the past month, including VPB, which rose nearly 12%; ACB, up 6.3%; MBB, up 5.36%; and TCB, up 6.7%…

As of September 27, 2024, credit and deposit growth for the whole system was estimated at 8.53% and 4.79% year-to-date, respectively. These figures remain in line with the State Bank of Vietnam’s (SBV) targeted credit growth rate of 14-15% for 2024. Additionally, with the pressure on exchange rates easing, the SBV has stopped issuing bills since the end of August 2024 but continues to provide liquidity through the OMO channel and maintains interbank interest rates for overnight loans at a relatively high level in the last days of September 2024 (around 4%) before gradually decreasing.

Commenting on this, BSC believes that this is consistent with the picture of accelerating credit growth. BSC maintains its forecast of 14% and 10% for credit and deposit growth in 2024, respectively. The main driver is expected to be the private sector, centered on banks that benefit from credit limit adjustments following the SBV’s circular in late August 2024, such as ACB (forecasted at +15.6%), HDB (+23.4%), MSB (+19.2%), TCB (+20.0%), and some other names that have advantages due to the takeover of weak credit institutions like MBB (+19.4%) and VPB (+24.0%).

BSC believes that economic growth targets will be the priority of the regulators in the last three months of the year, especially after the negative impact of Typhoon Yagi. Therefore, it is expected that the deposit interest rate of state-owned banks will be maintained at the current level until the end of the year, averaging about 4.7% for 12-month terms, in line with the SBV’s orientation to support the economy’s lending needs. Note that the interest rates of private banks are still expected to increase slightly by the end of the year, as mentioned in the previous report.

Moreover, compared to the record amount of state treasury deposits at state-owned banks, which reached nearly VND 292 trillion at the end of Q2/2024 (the highest in the last two years), the continued increase in deposit mobilization in recent months, and the sharp decrease in state treasury deposits at commercial banks from September 2024 to early October 2024, indicate efforts to disburse public investment in the last months of the year, thereby releasing a significant amount of money into the economy.

The acceleration of public investment in the last months of the year often results in a significant budget deficit in Q4. The forecast of an increase in net foreign currency assets at commercial banks due to the cooling down of exchange rates and the trend of rising remittances in Q4 to serve the holiday season is the basis for expecting an additional source of money to flow into the market in Q4/2024, alongside the momentum from private sector credit.

Therefore, BSC believes that the growth of money supply, including deposit and credit growth, will narrow the gap in the coming months, bringing more sustainability to the growth.

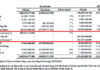

With the low base of profit recorded in Q3/2023, BSC estimates that the total pre-tax profit of the tracked banks in Q3/2024 will reach a high of 20% thanks to the continued acceleration of credit growth and the expected stability of the industry’s average NIM. The forecast for pre-tax profit growth in 2024 is 16%, corresponding to a 15% increase in Q4/2024 compared to the same period last year.

In early October 2024, the SBV announced and is seeking feedback on a draft circular to support customers affected by Typhoon Yagi. According to estimates, the total debt affected by Typhoon Yagi is about VND 165 trillion, or 1.16% of the system’s credit as of mid-September 2024. In relation to Circular 02, which has the same nature, the SBV stated that the total restructured debt of the system is now VND 230 trillion (1.62% of the system’s credit).

This draft is more supportive to banks as it allows for multiple rescheduling of repayment periods for both due and overdue loans and considers indirect impacts, such as those affecting the customers’ partners. With this supportive policy, the impact of typhoon damage on banks’ balance sheets is expected to be minimal, and thus, there is no significant effect on the 2024 forecast.

Looking ahead to 2025, BSC assesses the outlook for bank stocks as positive, with a forecasted pre-tax profit growth of 22% for the tracked banks. Notably, some banks are expected to achieve outstanding profit growth next year, including CTG (forecasted at +24%), MBB (+20%), STB (+33%), TCB (+22%), and VPB (+32%).

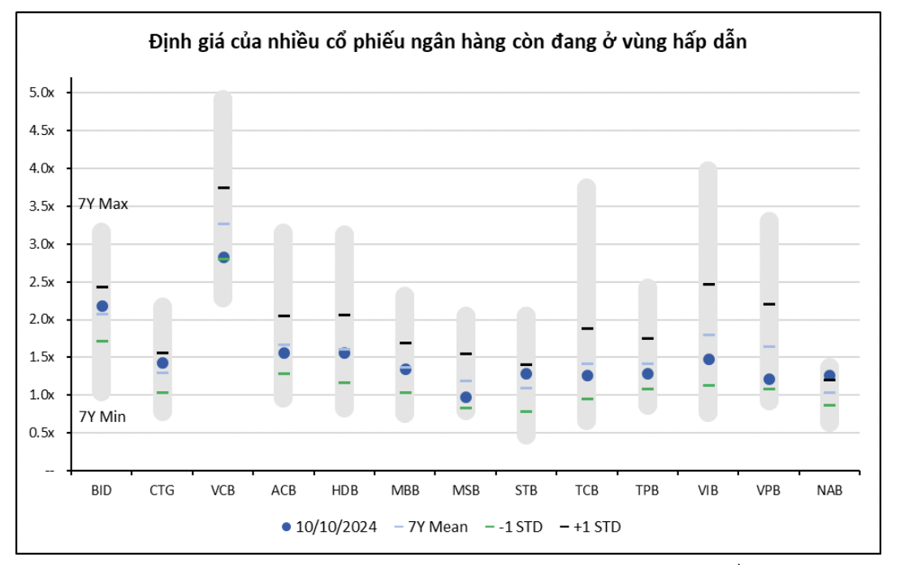

In terms of valuation, the growth prospects for next year are not yet reflected in the stock prices, as many banks are currently trading at relatively low valuations compared to their historical levels. Therefore, BSC recommends accumulating bank stocks for a medium to long-term perspective, even if the short-term profit growth outlook does not hold significant surprises. Banks with strong and sustainable growth momentum that have not yet been reflected in their valuations include ACB, CTG, MBB, TCB, and VPB.