Liquidity in the market increased compared to the previous trading session, with the VN-Index matching volume reaching over 643 million shares, equivalent to a value of more than VND 16 trillion; HNX-Index reached over 41.7 million shares, equivalent to a value of more than VND 851 billion.

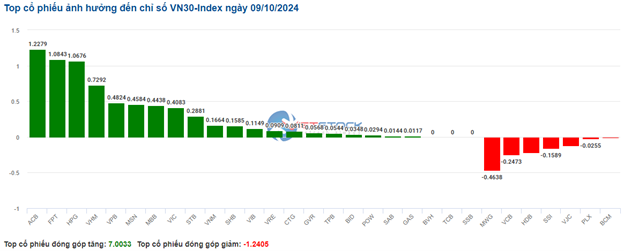

The VN-Index started the afternoon session on a more optimistic note as buying pressure intensified, pushing the index into positive territory. In terms of impact, VHM, HPG, ACB, and BID were the most positive influences on the VN-Index, contributing over 3.4 points to the gain. On the other hand, VCB, MWG, VNM, and HDB were the most negative influences, taking away 1.2 points from the overall index.

| Top stocks with the most significant impact on the VN-Index on 09/10/2024 |

Similarly, the HNX-Index also witnessed a fairly positive performance, driven by gains in DTK (+3.33%), SHS (+1.95%), VCS (+1.93%), and IDC (+0.89%)…

|

Source: VietstockFinance

|

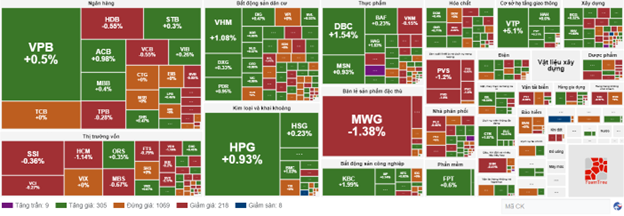

The telecommunications sector was the top-performing group, surging 3.3% mainly due to gains in VGI (+4.09%), CTR (+3.82%), YEG (+1.09%), and ELC (+1.03%). This was followed by the industrials and materials sectors, which rose 2.55% and 1.36%, respectively. On the flip side, the energy sector witnessed the steepest decline in the market, falling by -0.63%, dragged down by PVS (-1.2%), PVD (-1.25%), BSR (-0.41%), and PVC (-1.5%).

In terms of foreign trading activities, foreign investors continued to be net sellers on the HOSE exchange, offloading more than VND 151 billion worth of shares. The selling pressure was concentrated on VPB (VND 283.68 billion), MWG (VND 193.88 billion), HDB (VND 91.51 billion), and CTG (VND 63.84 billion). On the HNX exchange, foreign investors net sold over VND 27 billion worth of shares, focusing on PVS (VND 49.8 billion), SHS (VND 6.34 billion), VGS (VND 3.14 billion), and NTP (VND 1.63 billion).

| Foreign investors’ buying and selling activities |

Morning Session: Mixed Performance Across Major Indices

Buying interest was mainly focused on large-cap stocks, helping the VN-Index stay in positive territory throughout the morning session. However, the HNX and UPCOM exchanges witnessed contrasting performances. Specifically, at the end of the morning session, the VN-Index climbed 3.24 points, or 0.25%, to 1,275.22 points. Meanwhile, the HNX-Index fell 0.29% to 230.85 points, and the UPCOM-Index dropped 0.25% to 92.21 points. The market breadth remained tilted towards gainers, with 329 advancing stocks versus 261 decliners.

The VN-Index recorded a trading volume of nearly 288 million shares, equivalent to a value of over VND 7.2 trillion. The HNX-Index witnessed a trading volume of nearly 20 million shares, with a value of over VND 416 billion.

HPG, VHM, ACB, and FPT were the key pillars supporting the index, contributing almost 2.5 points to the VN-Index‘s gain. Conversely, VCB, MWG, HDB, and VNM exerted negative pressure, taking away more than 1 point from the overall index.

Most industry groups maintained their upward momentum. The telecommunications sector stood out, leading the market’s advance with a gain of over 3%, mainly driven by the outstanding performance of two large-cap stocks, VGI (+4.09%) and CTR (+3.28%). Following closely was the industrials sector, which attracted strong buying interest, climbing nearly 1.5%. Notable performers included ACV (+3.81%), VEF (+3.02%), VTP (+6.41%), SJG (+9.09%), VCG (+1.64%), HHV (+1.68%), and HAH (+1.45%).

Additionally, the real estate sector also witnessed a solid recovery during the morning session, with a broad-based rally. Notable gainers included VHM (+1.56%), VIC (+0.86%), KBC (+1.99%), NLG (+1%), PDR (+1.19%), SZC (+2.34%), and NTC (+2.66%). The banking sector exhibited a mixed performance, with ACB surging nearly 2% while most other stocks posted slight gains or losses of less than 1%.

On the downside, the energy sector faced intense selling pressure, falling nearly 1% by the end of the morning session. Notable losers included PVD (-1.78%), PVS (-1.44%), and BSR (-0.82%). The non-essential consumer goods sector also came under significant pressure, dragged down by MWG (-1.53%), OIL (-1.54%), FRT (-0.56%), and PNJ (-0.42%).

Foreign investors maintained their net selling stance, offloading more than VND 84 billion worth of shares on the HOSE exchange during the morning session. The most notable transaction was in MWG, where foreign investors net sold over VND 123 billion, far exceeding the net selling value of other stocks. On the HNX exchange, foreign investors net sold nearly VND 33 billion by the end of the morning session, with sudden selling pressure appearing in PVS (nearly VND 44 billion).

10:45 am: Securities Stocks Lose Ground After FTSE Decision

Market sentiment turned cautious, leading to a choppy performance across the major indices. The VN-Index edged up 1.88 points, hovering around 1,273 points. Meanwhile, the HNX-Index slipped 0.61 points, trading around 230 points.

Most stocks in the VN30 basket witnessed strong upward momentum. Among them, ACB, FPT, HPG, and VHM contributed 1.23 points, 1.08 points, 1.07 points, and 0.73 points to the VN30 index, respectively. On the flip side, MWG, VCB, HDB, and SSI were among the few stocks that faced selling pressure, taking away more than 1 point from the index.

Source: VietstockFinance

|

The current market rally is being led by stocks in the credit institution and real estate sectors, with modest gains of 0.14% and 0.69%, respectively.

Source: VietstockFinance

|

Within the banking sector, stocks exhibited a mixed performance, with a slightly positive market breadth. Specifically, VPB rose 0.75%, BID gained 0.2%, STB climbed 0.3%, and ACB advanced 1.18%… The remaining stocks remained unchanged or faced mild selling pressure, such as HDB, SSB, VCB, and TPB.

Following closely, the real estate sector also contributed to the market’s upward momentum. Buying interest was mainly focused on residential and mixed-use real estate stocks, such as VHM (+1.08%), PDR (+1.19%), DXG (+0.98%), and DIG (+0.7%)… Additionally, industrial real estate stocks also witnessed a broad-based rally, including KBC (+1.99%), SZC (+1.65%), SIP (+0.41%), and NTC (+3.02%)… Moreover, the retail real estate giant VRE posted a decent gain of 0.54%.

However, it is worth noting that the securities sector failed to keep up with the overall market’s positive sentiment, with most stocks trading in negative territory after the news that FTSE decided to keep Vietnam on the watchlist for potential upgrade to Secondary Emerging Market status but did not proceed with the upgrade in the October 2024 review, despite the efforts to address the prefunding issue (Circular No. 68/2024/TT-BTC dated September 18, 2024).

Among the securities stocks, the two heavyweights, SSI and HCM, which were expected to benefit directly from the aforementioned Circular, faced selling pressure and declined by 0.55% and 1.14%, respectively. Additionally, VCI fell 0.27%, BVS dropped 1.69%, MBS slid 0.67%, and FTS lost 0.79%, while several other securities stocks posted mild losses. Only a handful of stocks in the sector managed to stay in positive territory, including ORS, VFS, CTS, and VND, but their gains were insignificant.

Compared to the opening, the market continued to witness choppy trading, with over 1,000 stocks trading around reference prices. However, the buying side maintained a slight advantage, with more than 300 stocks advancing and over 210 stocks declining.

Source: VietstockFinance

|

Opening: Market Maintains Mild Upside

At the start of the trading session on October 9, the VN-Index climbed over 2 points to reach 1,274.28 points. Meanwhile, the HNX-Index edged higher, settling at 231.66 points.

In the October 2024 market classification report, Vietnam remained on the watchlist for potential upgrade to Secondary Emerging Market status.

FTSE Russell continued to maintain its assessments regarding the “DvP Settlement Cycle,” the process of opening new accounts, and facilitating trading activities between foreign investors in stocks that have reached or are close to reaching the foreign ownership limit.

As of 9:30 am, large-cap stocks such as GVR, HPG, and MBB propelled the market higher, contributing over 1 point to the gain. On the other hand, VPB, VPB, and PGV led the negative influences on the market, but their impact was relatively limited, resulting in a loss of less than 0.5 points.

Telecommunications services stocks took the lead in the market rally this morning, with the sector advancing 1.04%. Notably, stocks such as VGI (+1.57%), CTR (+1.56%), VNZ (+0.54%), and YEG (+0.22%) outperformed the broader market.

<

The Market Pulse: The Crucial 1,300-Point Threshold

The VN-Index retreated to close a week of volatile trading. Investor caution persisted as trading volume remained below the 20-week average. Additionally, the index continued to struggle as it approached the September 2024 high (1,290-1,300 points range). If the index recovers with improved liquidity in the coming phase, it is highly likely to surpass this range.

The Market Beat: The Tug-of-War Continues

As of the market close, the VN-Index dipped 1.06 points (-0.08%), settling at 1,285.46, while the HNX-Index witnessed a decline of 0.91 points (-0.4%), closing at 229.21. The market breadth tilted towards decliners, with 364 stocks falling against 315 advancing stocks. The VN30-Index basket saw a relatively balanced performance, with 13 stocks in the red, 12 in the green, and 5 unchanged.

The Market Beat: Selling Pressure Mounts, VN-Index Dips into the Red

The market closed with the VN-Index down 5.69 points (-0.44%) to 1,279.77 and the HNX-Index down 1.78 points (-0.78%) to 227.43. The market breadth tilted towards decliners with 473 losers and 228 gainers. The large-cap stocks in the VN30-Index basket painted a similar picture, with 23 stocks declining, 5 advancing, and 2 unchanged.

The Rising Pessimism

The VN-Index witnessed a significant decline, forming a bearish Black Marubozu candlestick pattern and breaching the middle line of the Bollinger Bands. The MACD and Stochastic Oscillator indicators continue on a downward trajectory, reinforcing the sell signal. Moreover, persistent foreign net selling sends a cautious message to investors about the market’s outlook in the near term.