Market liquidity decreased compared to the previous trading session, with the VN-Index‘s matched trading volume reaching over 455 million shares, equivalent to a value of more than 10.4 trillion VND; the HNX-Index reached over 41.4 million shares, equivalent to a value of more than 768 billion VND.

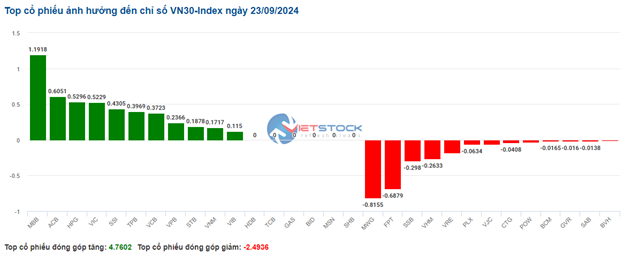

The tug-of-war around the reference price continued in the afternoon session, and the strong selling pressure intensified towards the end of the session, causing the VN-Index to sink into the red. In terms of impact, BID, FPT, SSB, and TCB were the most negative stocks, taking away more than 1.6 points from the index. On the other hand, VCB, SSI, BVH, and LPB were the most positive stocks, but their impact was insignificant.

| Top 10 stocks with the strongest impact on the VN-Index on September 23, 2024 (in points) |

Similarly, the HNX-Index also had an unoptimistic performance, with the index negatively impacted by KSV (-2.24%), HUT (-1.19%), SHS (-1.31%), and PVS (-0.72%)…

|

Source: VietstockFinance

|

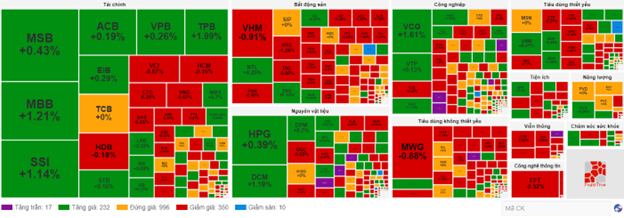

The telecommunications industry had the largest decrease in the market at -2.32%, mainly due to VGI (-2.82%), YEG (-1.41%), CTR (-2.71%), and ELC (-1.42%). This was followed by the information technology industry and the industrial sector, with decreases of 0.99% and 0.57%, respectively. On the other hand, the essential consumer goods industry had the best recovery in the market, with green signals appearing in VNM (+0.28%), MCH (+2.21%), QNS (+2.52%), and SBT (+0.75%).

In terms of foreign trading, they returned to net buying with more than 78 billion VND on the HOSE floor, focusing on HCM (64.48 billion), VCB (41.4 billion), NAB (40.3 billion), and MWG (36.75 billion). On the HNX floor, foreigners net bought more than 30 billion VND, focusing on MBS (9.94 billion), IDC (9.01 billion), SHS (6.3 billion), and TNG (5.27 billion).

| Foreign Trading Buy – Sell Net |

Morning Session: Market Polarization

The tug-of-war within a narrow range continued, with the selling side temporarily having a slight advantage. At the end of the morning session, the VN-Index fell slightly by 0.68 points, equivalent to 0.05%, to 1,271.36 points; the HNX-Index decreased by 0.3%, reaching 233.6 points. The market breadth recorded 396 decreasing stocks and 239 increasing stocks.

The trading volume of the VN-Index reached nearly 269 million units, equivalent to a value of more than 5.9 trillion VND. The HNX-Index recorded a volume of nearly 21 million units, with a value of nearly 398 billion VND.

In terms of impact, VCB is bearing the market with a contribution of more than 1 point increase for the VN-Index. This was followed by VIC, MBB, and HPG, which also contributed more than 1 point increase to the index. On the contrary, VHM, GVR, MWG, and SSB are the stocks with the most negative impact, taking away more than 1 point from the VN-Index.

The industry groups recorded a polarized performance, with most groups fluctuating slightly below 1%, except for the telecommunications industry, which decreased significantly by nearly 2%. Notable stocks in this group include VGI (-2.37%), CTR (-2.11%), ELC (-1.02%), and YEG (-1.19%).

The real estate group put considerable pressure on the overall market as selling pressure was concentrated in large-cap stocks such as VHM (-0.69%), BCM (-0.7%), VRE (-1.54%), NVL (-1.32%), and SSH (-0.89%). However, the green signals of VIC (+1.18%), NLG (+0.6%), DXG (+0.32%), IJC (+1.07%), NTL (+3.81%), etc., prevented the group from falling too sharply.

On the increasing side, the essential consumer goods group showed positive signals from MCH (+1.68%), QNS (+2.1%), SBT (+1.51%), and LSS (+3.28%). Nevertheless, the industry index only increased slightly by 0.18% as selling pressure prevailed in stocks such as IDP (-6.84%), VHC (-0.55%), HAG (-2.34%), HNG (-2.17%), VLC (-1.05%), etc.

The financial sector also exhibited clear polarization. Notable stocks in the increasing group included VCB (+0.88%), VPB (+0.53%), MBB (+1.01%), TPB (+1.32%), MBS (+1.76%), and SSI (+0.95%). Conversely, red signals continued to dominate many stocks such as BID, CTG, TCB, SSB, EIB, VND, VCI, etc.

Foreigners are trading rather “gloomily” after an exciting session last weekend, with a slight net sell-off of nearly 14 billion VND on the HOSE floor in the morning session. The selling volume was most significant in SSI stock (34 billion). Meanwhile, the FUEVFVND fund certificate was net bought by foreigners for more than 70 billion VND this morning, far exceeding the value of other bought stocks. On the HNX floor, foreigners net bought more than 9 billion VND, focusing on buying MBS and SHS stocks.

10:40 a.m.: Tug-of-War Around the Reference Price

The hesitant psychology is present, and the selling pressure is somewhat dominant, so the main indices are still fluctuating around the reference price. As of 10:40 a.m., the VN-Index increased slightly by 0.65 points, trading around 1,271 points. The HNX-Index decreased by 0.53 points, trading around 233 points.

Stocks in the VN30 basket are highly polarized, with red signals slightly dominating. Specifically, MWG, FPT, SSB, and VHM took away 0.82 points, 0.69 points, 0.3 points, and 0.26 points from the overall index, respectively. On the other hand, MBB, ACB, HPG, and VIC are being bought strongly and contributed more than 2.8 points to the VN30-Index.

Source: VietstockFinance

|

With the tug-of-war situation from the beginning of the session, the real estate group is having the most negative impact on the market as selling pressure is concentrated in large-cap stocks such as VHM, which decreased by 0.8%, DIG decreased by 0.44%, VRE decreased by 1.03%, KDH decreased by 0.4%, etc. However, some stocks maintained a positive performance, such as NTL, which increased by 4.76%, DXG increased by 0.64%, VIC increased by 1.06%, NLG increased by 0.6%, etc.

Among them, NTL stock surged strongly right after the opening and is currently testing the Middle line of the Bollinger Bands, accompanied by a significant increase in volume in the morning session. It is expected to exceed the 20-day average volume at the end of the session, indicating a rather optimistic outlook. Currently, the price of NTL has successfully broken through the previous short-term adjustment trend as MACD and Stochastic Oscillator have given positive signals, further reinforcing the current recovery trend.

Source: https://stockchart.vietstock.vn/

|

In addition, the telecommunications industry continued to record a significant decline of more than 1.6%. The selling pressure mainly focused on stocks such as VGI, which decreased by 2.08%, CTR decreased by 1.81%, YEG decreased by 0.65%, ELC decreased by 1.22%, etc.

On the other hand, the financial stock group is still trying to support the market, leading the recovery group with a modest increase of 0.26% due to the current polarization. Specifically, SSI increased by 1.14%, MBB increased by 1.21%, VPB increased by 0.26%, TPB increased by 1.99%, and ACB increased by 0.39%… Conversely, red signals still prevailed in stocks such as HDB, which decreased by 0.18%, TCB decreased by 0.21%, HCM decreased by 0.33%, CTG decreased by 0.42%, etc., but the decrease was not too significant.

Compared to the beginning of the session, buyers and sellers were quite determined, with more than 990 codes standing still and sellers slightly dominating with 350 decreasing codes (10 floor codes) while there were 232 increasing codes (17 ceiling codes).

Source: VietstockFinance

|

Opening: Maintaining a slight increase

At the beginning of the September 23 session, the VN-Index increased by more than 4 points, reaching 1,276.11 points. Meanwhile, the HNX-Index also slightly increased, reaching 234.37 points.

As of 9:30 a.m., large-cap stocks such as VCB, MBB, and HPG were pulling the market with a total increase of more than 2 points. On the other hand, VHM, FPT, and MWG led the group with the most negative impact on the market, but the decrease was less than 1 point.

Energy stocks are continuing to lead the market this morning. Notably, stocks such as BSR increased by 0.84%, PVD increased by 0.18%, PVS increased by 0.3%, PVB increased by 0.33%, etc.

In addition, financial stocks also maintained stable growth from the beginning of the session, with stocks such as SSI increasing by 1.71%, HCM increasing by 0.16%, VND increasing by 0.33%, ACB increasing by 1.17%, TPB increasing by 2.

The Market Beat: A Rapid Decline, A Strong Surge in the Expiry of Derivatives

The VN-Index faced pressure throughout the morning session and the early minutes of the afternoon, dipping below 1,272 points. However, true to the nature of an expiration day for derivatives, the VN-Index staged a strong comeback, closing above 1,286 points. This impressive turnaround was largely driven by the banking, securities, and real estate sectors, which provided the much-needed boost to push the index higher.

Vietstock Weekly 14-18/10/2024: Aiming for July 2024 Highs

The VN-Index rallied and staged a strong recovery last week after retesting the middle line of the Bollinger Bands. However, trading volume fell below the 20-week average, indicating that investors are becoming cautious again. In the coming week, the index has the opportunity to target the old peak of July 2024 (corresponding to the 1,290-1,300 point range). If the index can surpass this crucial threshold, we may see a more positive outlook emerge.

Market Beat: Buyers Return in Afternoon Trade, VN-Index Surges Over 9 Points

The market ended the session on a positive note, with the VN-Index climbing 9.87 points (0.78%) to reach 1,281.85, while the HNX-Index gained 0.25 points (0.11%), closing at 231.77. The market breadth tilted in favor of the bulls, as evident from the advance-decline ratio of 411:256. A similar trend was observed in the VN30 basket, with 22 stocks advancing, 6 declining, and 1 remaining unchanged, resulting in a sea of green on the screen.

The Market Pulse: The Crucial 1,300-Point Threshold

The VN-Index retreated to close a week of volatile trading. Investor caution persisted as trading volume remained below the 20-week average. Additionally, the index continued to struggle as it approached the September 2024 high (1,290-1,300 points range). If the index recovers with improved liquidity in the coming phase, it is highly likely to surpass this range.

The Market Beat: The Tug-of-War Continues

As of the market close, the VN-Index dipped 1.06 points (-0.08%), settling at 1,285.46, while the HNX-Index witnessed a decline of 0.91 points (-0.4%), closing at 229.21. The market breadth tilted towards decliners, with 364 stocks falling against 315 advancing stocks. The VN30-Index basket saw a relatively balanced performance, with 13 stocks in the red, 12 in the green, and 5 unchanged.