The market witnessed a familiar intraday pattern of “green in the morning, red in the afternoon,” but the extent of losses was mitigated. There was a sharp dip towards the end of the afternoon session, pushing the VN-Index to its intraday low of -3.7 points before recovering to close just below the reference point, down 1.6 points (-0.12%). VNSmallcap was the only index in positive territory and the only group to maintain liquidity compared to the previous day.

For most of the afternoon, the VN-Index struggled below the red line, hitting its low at 2:15 pm. In the last 15 minutes of continuous matching and ATC, prices rebounded slightly, with about 50 codes successfully reversing, mainly in the Smallcap group. Specifically, at the bottom, the VN-Index recorded 111 rising codes/258 falling codes, and at the close, it was 153 rising codes/209 falling codes.

VNSmallcap ended the session up 0.15% with 65 gainers/88 losers, while VN30-Index fell 0.15% with 9 gainers/18 losers, and Midcap decreased by 0.5% with 21 gainers/41 losers. Notably, the five stocks that hit the ceiling on the HoSE were all from the Smallcap group: PET, HTL, HVN, HVH, and QCG. Overall, about half of the 58 stocks that rose by more than 1% on the exchange were also Smallcaps.

Naturally, the liquidity of small-cap stocks tends to be low. PET was the only stock to trade over 100 billion VND (reaching 114.9 billion VND). The stocks that saw strong gains also traded in the range of a few billion to a few tens of billion, such as HTL, HVH, QCG, HAR, HTN, HHS, ORS, DBD, DRC, and PVP. These stocks rose between 2% and the ceiling. Overall, the Smallcap basket accounted for about 9.3% of the total matched value on the HoSE today, which is not significantly different from last week’s average market share (9.1%). However, this group maintained the most stable liquidity on the exchange, with a decrease of only about 5% today, compared to a 30% drop in Midcap and a 23% drop in VN30 compared to the previous day.

A notable feature of this session was the slow inflow of money. In the afternoon, due to a rapid decline, selling pressure hit buy orders at lower prices, resulting in a nearly 34% increase in trading volume compared to the morning session on the HoSE. Including the HNX, the total trading volume increased by 33%. However, for the entire session, the total matched value of the two exchanges was less than 12,500 billion VND, a decrease of 25% from the previous day and the lowest in the last seven sessions.

The slowdown in trading speed and liquidity is often observed as the market approaches the futures expiration date. Investors tend to reduce their exposure rather than worry about a deteriorating market outlook. On the other hand, there is a shift in capital due to portfolio restructuring based on expectations of third-quarter financial results. This is particularly evident in the blue-chip group, which saw a significant decrease in liquidity compared to the previous day but still accounted for nearly 52% of the HoSE’s market weight.

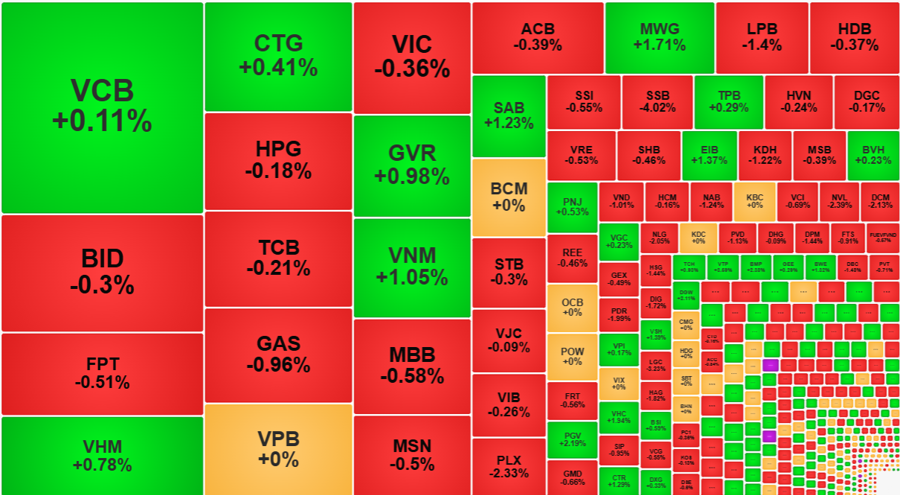

The ability of large-cap stocks to provide support in recent sessions has been unclear, and the only contributing factor is their lack of significant declines. In this session, out of the ten largest stocks by market capitalization, only four were in the green, while five were in the red. The gainers rose marginally, while the losers did not exert much pressure. The biggest loser was GAS, down 0.96% in market cap, ranking seventh in the index, while VHM rose 0.78% in market cap, ranking fourth. VCB, the largest stock by market cap, also gained 0.11%. Overall, while they didn’t provide a boost to the upside, the tug-of-war within a narrow range of fluctuations among these large-cap stocks played a significant role in stabilizing the index today.

With the breadth heavily skewed to the downside, many stocks faced stronger selling pressure in the afternoon compared to the morning. The number of codes falling more than 1% doubled from the morning session (72 codes), and there were notable liquidations in stocks like DBC, which fell 1.48% with a matched value of 228.3 billion VND; VND, down 1.01% with a matched value of 208 billion VND; DCM, down 2.13% with a matched value of 197.7 billion VND; PDR, down 1.99% with a matched value of 170.9 billion VND; and HSG, down 1.44% with a matched value of 109.4 billion VND… Real estate stocks still accounted for a large portion of the market’s biggest losers today, despite some notable gainers, including QCG, which hit the ceiling. The varying degrees of support from different streams of money continue to create differentiation within groups, even if it’s just in terms of amplitude.

Foreign investors increased their selling in the afternoon, with net withdrawals reaching approximately 207 billion VND compared to 123.8 billion VND in the morning session. This was the fourth consecutive session of notable net selling by foreign investors, with total sell-side value on the HoSE reaching nearly 1,830 billion VND.

“Failed Attempt, Cash Back to Bank Stocks”

The market witnessed a significant upswing in the afternoon session, with the VN-Index rallying towards the peak of 1,294 points achieved in the morning. However, in the last 15 minutes of continuous matching, a surge of sell orders caused a series of declines across stock prices. The ATC session delivered the final blow, pushing the index below the reference point.

The Flow of Funds: What to Do When Stocks Have Good Earnings but Prices Don’t Soar?

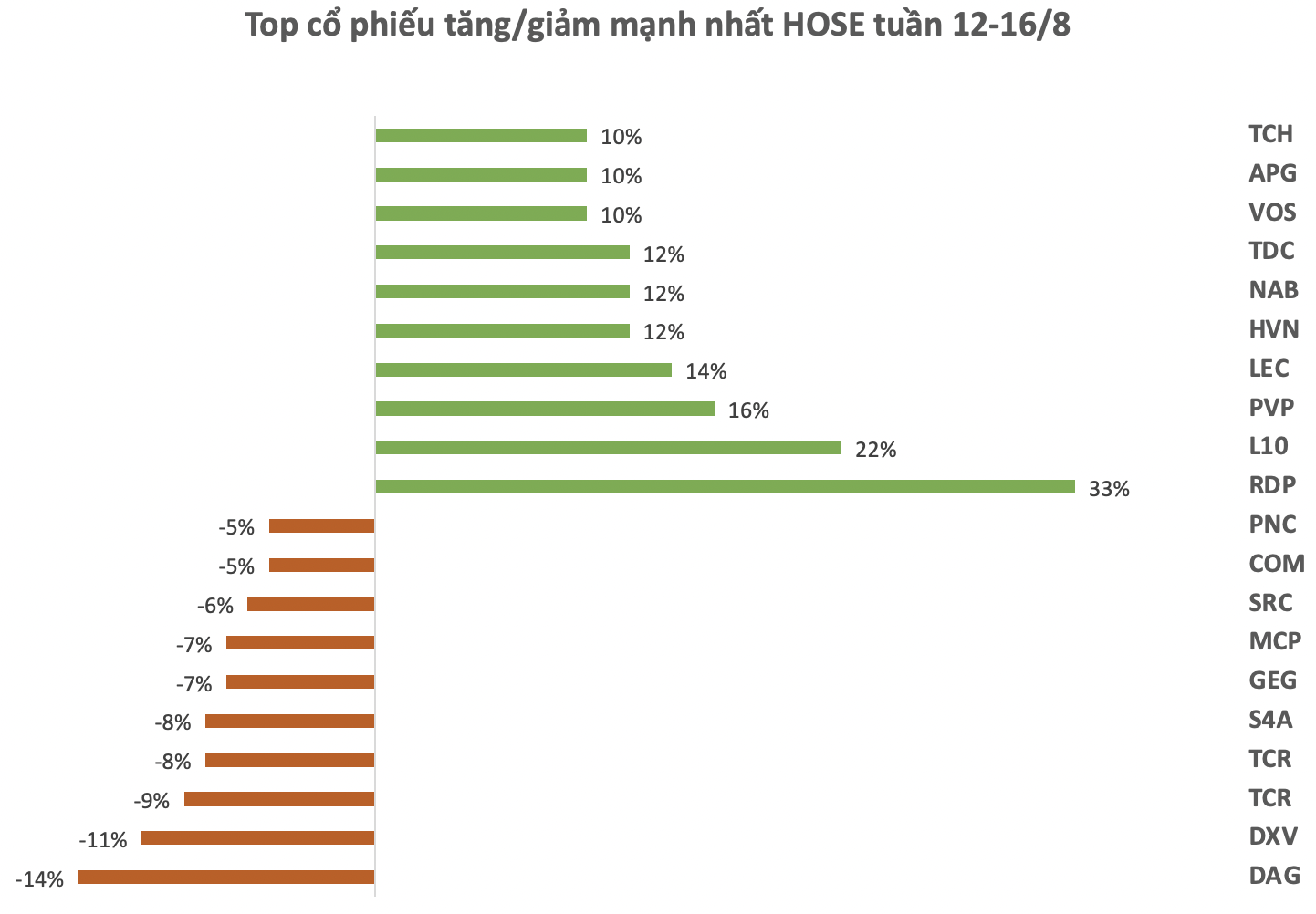

The Q3 2024 earnings season is in full swing, yet market movements have not reflected commensurate reactions. Last week, the VN-Index declined for the first three consecutive sessions, rebounded on Thursday, but faltered in the final trading session. The index once again retreated as it approached the 1,300-point mark. The HoSE’s average matching liquidity did not show any significant improvement and even witnessed a slight decline.

The Cash Flow Crisis: VN-Index Plunges as Foreign Investors Sell-Off

The market was sluggish this morning as investors refrained from buying. Sell orders gradually pulled back to very low prices, allowing sellers to offload their positions. Apart from the first few minutes when the VN-Index was slightly positive, the market plunged throughout the morning session, closing at its lowest point with four times as many losers as gainers.

“Undervalued Banking Stocks: Unlocking the Potential for Robust Growth”

“We recommend accumulating bank stocks for a medium to long-term vision, even if short-term profit growth prospects don’t present many surprises. The aforementioned banks have strong and sustainable growth motivations and are undervalued compared to their potential; these include ACB, CTG, MBB, TCB, and VPB. These financial institutions have robust fundamentals and are well-positioned to capitalize on Vietnam’s growing economy and thriving business sector. With their diverse revenue streams and expanding digital presence, these banks are poised to deliver stable returns and outperform the market. This accumulation strategy is a prudent approach to investing in Vietnam’s financial sector, offering a balanced risk-reward proposition for investors with a long-term horizon.”