| VN-Index Faces Pressure and Continues to Lose Points in the October 24 Session |

|

Source: VietstockFinance

|

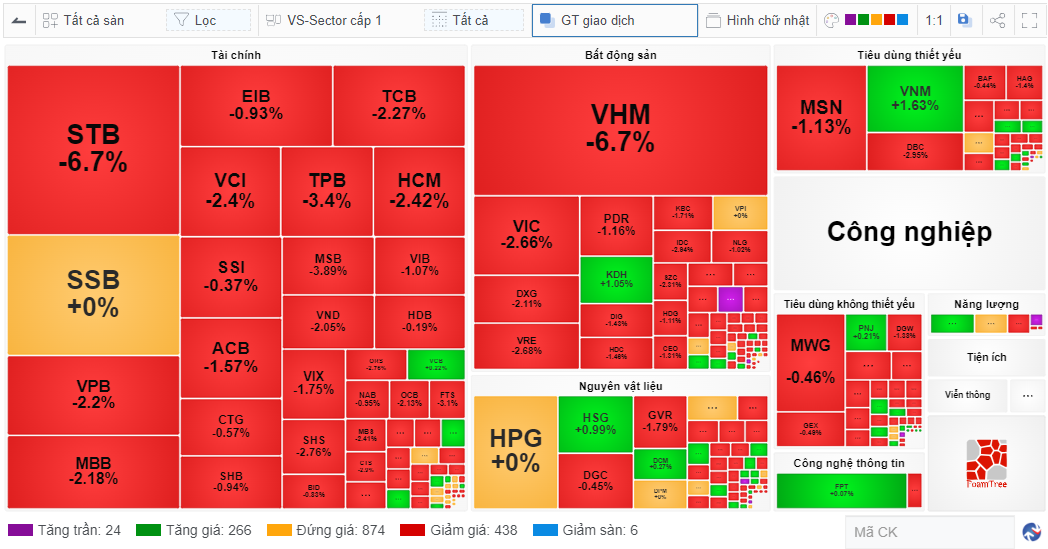

At the close of October 24, Vietnamese stock indices were painted in red. VN-Index lost 13.49 points to 1,257.41, HNX-Index dropped 1.81 points to 224.69, and UPCoM-Index fell 0.06 points to 92.06. The market’s trading value exceeded 17,070 billion VND, a significant increase in the afternoon session.

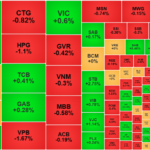

The market breadth was tilted towards 444 declining stocks, while only 290 stocks rose, and the remaining 874 stocks were unchanged. Despite the widespread losses, the negative performance of banks, securities, and real estate stocks largely impacted the market’s points.

It is evident on the market map in terms of trading value that these three groups together occupy large areas, thereby covering the market with red.

In the banking group, many stocks witnessed sharp declines, such as MBB, TPB, EIB, VPB, ACB, MSB… especially STB, which was close to the floor price. The securities group, including VCI, HCM, SSI, VND, and VIX, also experienced notable declines.

Real estate stocks brought a lot of “pain” to investors as they fell sharply, with the trio of VHM down 6.7%, VIC down 2.66%, and VRE down 2.68%, alongside other stocks such as DXG, PDR, DIG, HDC, KBC, and NLG, which were also in the red. A few exceptions included KDH, which rose 1.06%, and QCG, which hit the ceiling price.

|

Bank, securities, and real estate stocks negatively impacted the market

Source: VietstockFinance

|

The impact of bank and real estate stocks on the market was significant due to their large market capitalization. These stocks naturally ranked among the top stocks negatively affecting the VN-Index.

Specifically, VHM alone took away more than 3.1 points, followed by VIC and STB, which took away more than 1 point each, and a series of other bank and real estate stocks. In total, these top 10 stocks took away more than 9.6 points from the VN-Index, contributing to the 13.49 points “evaporated” today.

| VHM Takes Away a Significant Number of Points from VN-Index |

Foreign investors also contributed to the declining session, with a net sell-off of nearly 254 billion VND, a strong figure compared to recent sessions. Today also marked the tenth consecutive net selling session, contrary to investors’ expectations of a reversal.

| Foreigners Have Been Net Sellers for 10 Consecutive Sessions |

Recently, conflicts worldwide have caused concerns, and the State Bank of Vietnam unexpectedly resumed bill withdrawals after a nearly two-month hiatus due to the strong appreciation of the USD exchange rate.

The resumption of bill withdrawals affects investors’ sentiment and impacts interbank market liquidity. Investment channels are interconnected, thereby affecting the short-term market liquidity.

The appreciation of the US Dollar is attributed to several reasons, including investors’ expectations that the Fed will cut interest rates at a slower pace than previously predicted, robust US economic data easing recession fears, and the seasonal nature of the Vietnamese market in October due to the high demand for USD for import, production, and business activities aimed at exports during Christmas and New Year. However, this trend is likely to be short-lived.

14:10: “Land” Stocks Plunge, Market Struggles

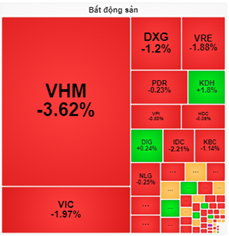

Continuing the downward trend from the morning session, the market opened the afternoon session with further losses. As of 14:00, VN-Index fell 5.42 points to 1,265.48, HNX-Index dropped 1.14 points to 225.37, and UPCoM-Index declined 0.19 points to 91.93. Real estate stocks plunged en masse, creating immense pressure on the indices.

The red dominated with 425 declining stocks, especially real estate stocks, which were among the sectors with the sharpest declines, at 1.77%. Moreover, due to their large market capitalization, this group also exerted immense pressure on the market.

|

Notable in the real estate sector were the trio of VIC, which fell 1.97%, VHM, which dropped 3.62%, and VRE, which declined 1.88%, all among the top 10 stocks with the most negative impact on the VN-Index. Besides this trio, numerous other “land” stocks also fell, including DXG, PDR, NLG, KBC, HDC, and IDC… while KDH and DIG were among the few exceptions that rose as of now.

In contrast, large-cap stocks such as MSN, VNM, and VCB rose but were insufficient to balance the market.

Market liquidity showed signs of increasing in the afternoon session. In terms of foreign investors, selling pressure intensified, and the net selling value exceeded 200 billion VND. Notable net sold stocks included HPG, with more than 75 billion VND, VRE with over 53 billion VND, and DGC with more than 43 billion VND.

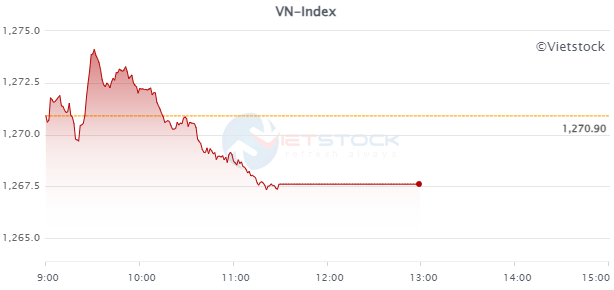

Morning Session: Ending the Tug-of-War with a “Plunge”

After a tug-of-war in the first half of the morning session, the market quickly ended this stalemate but in a downward direction. From the session’s high of over 1,274 points, VN-Index fell sharply by 7 points to 1,267 points without any significant recovery.

Source: VietstockFinance

|

The “bloodbath” was vividly illustrated as the market breadth tilted towards the declining side, with 348 stocks falling versus 257 rising stocks. It is evident that many bank and real estate stocks are performing negatively and impacting the market.

Regarding large-cap stocks, the tug-of-war was evident as the top 10 stocks positively impacting the VN-Index contributed nearly 2.3 points, led by VNM (0.7 points) and VCB (0.5 points). In contrast, the top 10 stocks negatively impacting the index took away more than 2.1 points, with VHM (0.7 points) and VIC (0.5 points) exerting the most pressure.

Considering sector performance, there was a balance, with 12 sectors rising and 12 sectors falling. However, the impact on the market was tilted towards the declining side.

On the rising side, four sectors increased by more than 1%: food and essential goods retail (up 5.17%), transportation (up 1.76%), semiconductors (up 1.46%), and telecommunications (up 1.23%).

On the declining side, only the real estate sector fell by more than 1%. However, due to its large market capitalization, it significantly impacted the market’s points. Besides real estate, the banking sector, another large-cap sector, fell by 0.11%.

|

The number of rising and falling sectors was equal at the end of the morning session

Source: VietstockFinance

|

Foreign investors temporarily net sold more than 111 billion VND, focusing on HPG with more than 48 billion VND and VRE with nearly 37 billion VND. Conversely, they net bought VNM with over 54 billion VND and SSI with almost 45 billion VND. If net selling continues today, foreign investors will mark the tenth consecutive net selling session.

The current VN-Index movement shows similarities with other Asian markets. Nikkei 225, Hang Seng, and Shanghai Composite also entered a downward phase in the second half of the morning session.

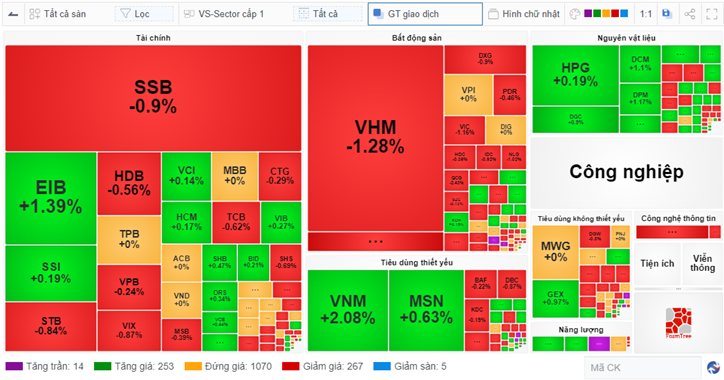

10:40: Tug-of-War with Low Liquidity

The market continued to exhibit a tug-of-war in the first half of the morning session, briefly surpassing the 1,274-point level but quickly falling back below the reference level, with liquidity remaining low.

Source: VietstockFinance

|

The market was in a tug-of-war, and liquidity remained low, with only over 3,790 billion VND as of 9:30, further indicating the cautious sentiment prevailing in the market at the moment.

In a highly contrasting development, even a slight movement of large-cap stocks could significantly impact the market’s points.

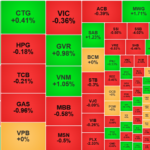

On the market map in terms of trading value at 9:30, many large “blocks” of green and red were interspersed. These included EIB (up 1.39%), SSI (up 0.19%), VCI (up 0.14%), HCM (up 0.17%), VNM (up 2.08%), MSN (up 0.63%), and HPG (up 0.19%) in the green… Conversely, notable stocks in the red were SSB (down 0.19%), HDB (down 0.56%), STB (down 0.84%), and VHM (down 1.28%)…

|

The market map showed many large green and red “blocks” interspersed

Source: VietstockFinance

|

In the context of a tug-of-war market, foreign investors also did not show a clear direction today.

Opening: Caution Prevails in Early Trading

VN-Index fluctuated around the reference level, indicating a tug-of-war between buyers and sellers. It is evident that the market sentiment was cautious in the early minutes of the session.

As of 9:30, VN-Index gained 2.46 points to 1,273.36, HNX-Index rose 0.24 points to 226.74, while UPCoM fell 0.13 points to 91.99.

The market breadth was relatively balanced, with 219 rising stocks and 181 declining stocks, while 1,209 stocks were unchanged. The cautious sentiment was also reflected in the low trading value of the market, which stood at just over 714 billion VND.

The green dominated most industry groups, but the increases were mild, with only two sectors rising more than 1%: transportation (up 1.41%) and food and essential goods retail (up 8.62%). However, these sectors’ proportion compared to the market scale was not high.

Among the few declining sectors, specialized services and commerce fell the most, with a 1% drop, followed by real estate, which decreased by 0.39%.

The Rising Pessimism

The VN-Index witnessed a significant decline, forming a bearish Black Marubozu candlestick pattern and breaching the middle line of the Bollinger Bands. The MACD and Stochastic Oscillator indicators continue on a downward trajectory, reinforcing the sell signal. Moreover, persistent foreign net selling sends a cautious message to investors about the market’s outlook in the near term.

The Ultimate Headline:

“Warning Signs: Are Negative Signals Brewing?”

The VN-Index witnessed a significant decline, forming a Black Marubozu candlestick pattern and breaking below the previous low from early October 2024 (around the 1,265-1,270 point level). This strong bearish move reflects the prevailing pessimistic sentiment among investors. Moreover, the trading volume remains below the 20-day average, indicating that buying interest is still limited. The MACD indicator continues to flash a sell signal and has dropped below zero, suggesting that the downward trend is likely to persist in the near term.

The Market Beat: Buyers Strike Back, VN-Index Holds its Ground

The market ended the session on a positive note, with the VN-Index climbing 2.03 points (0.16%) to reach 1,288.39; the HNX-Index also rose, gaining 0.08 points (0.03%) to close at 231.37. The market breadth tilted in favor of gainers, with 372 advancing stocks against 317 declining ones. The large-cap VN30 basket painted a similar picture, as 15 constituents added value, 12 lost ground, and 3 remained unchanged, ending the day in the green.

The Big Shake-Up: Small-Cap Stocks’ Surprising Resilience

The “blue morning, red afternoon” trend persisted today, but losses were less severe. The market experienced a sharp decline towards the end of the afternoon session, with the VN-Index plunging as much as 3.7 points before recovering to close just 1.6 points (-0.12%) lower. The VNSmallcap was the sole index in positive territory and the only group to maintain liquidity compared to yesterday’s session.

“Failed Attempt, Cash Back to Bank Stocks”

The market witnessed a significant upswing in the afternoon session, with the VN-Index rallying towards the peak of 1,294 points achieved in the morning. However, in the last 15 minutes of continuous matching, a surge of sell orders caused a series of declines across stock prices. The ATC session delivered the final blow, pushing the index below the reference point.