I. MARKET ANALYSIS FOR OCTOBER 22, 2084

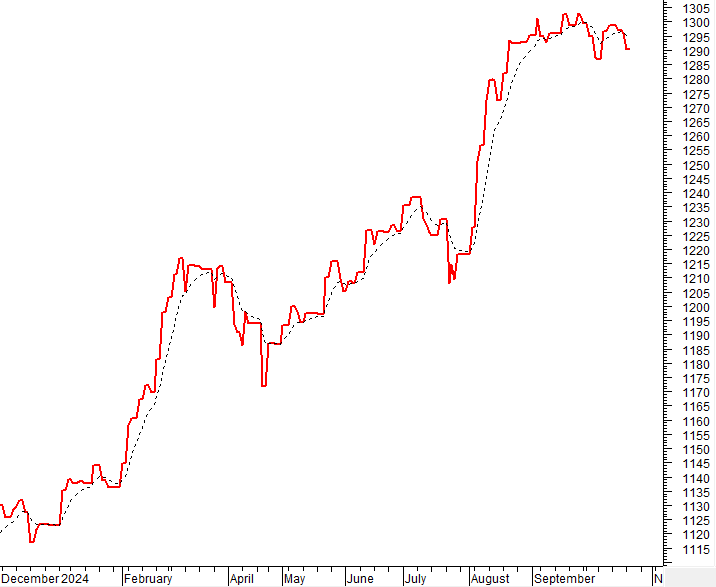

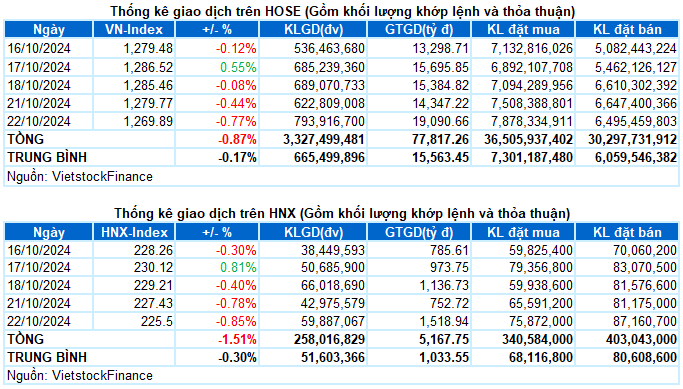

– The main indices continued to fall during the trading session on October 22nd. Specifically, VN-Index closed 0.77% lower at 1,269.89 points, while HNX-Index dropped by 0.85% to reach 225.5 points.

– The trading volume on HOSE exceeded 728 million units, a 25.5% increase compared to the previous session. The trading volume on HNX also rose by 25.3%, reaching nearly 53 million units.

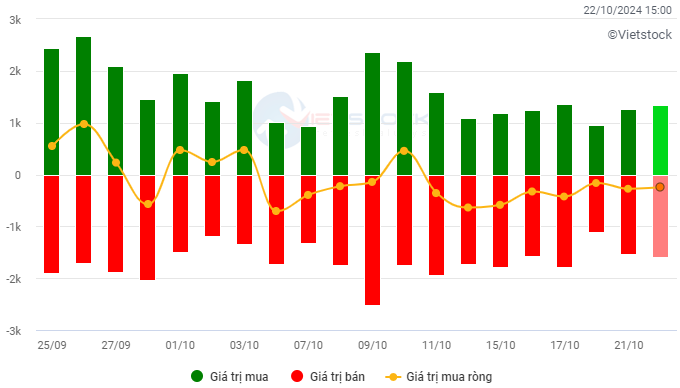

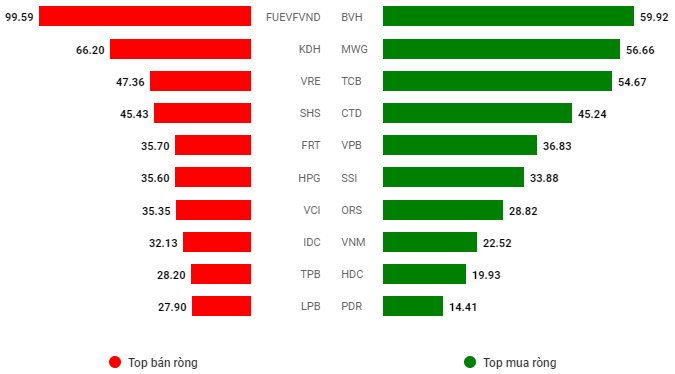

– Foreign investors extended their net selling streak on the HOSE and HNX exchanges, with net selling values of nearly VND 160 billion and VND 87 billion, respectively.

Trading value of foreign investors on HOSE, HNX, and UPCOM exchanges by day. Unit: VND billion

Net trading value by stock ticker. Unit: VND billion

– Investors experienced yet another challenging trading session. The absence of support from the usual large-cap stocks caused a lackluster morning session, with the indices mostly trading within a narrow range below the reference level. In the afternoon session, selling pressure suddenly intensified, especially in large-cap stocks, causing the market to plunge. There were brief recovery efforts towards the end of the session, but they were not significant. On October 22nd, the VN-Index fell by 9.88 points to 1,269.89.

– In terms of impact, the 10 stocks that had the most negative influence on the VN-Index were all from the VN30 group, costing the index nearly 7 points. GVR and BID exerted the most pressure, with each stock taking away more than 1 point from the VN-Index. On the other hand, VHM, EIB, and MWG tried to hold on to the green but only managed to add less than 1 point to the overall index.

– The VN30-Index closed 0.67% lower at 1,348.92 points, with 23 declining stocks, 5 advancing stocks, and 2 unchanged stocks. GVR was at the bottom with a drop of more than 4%, followed by VRE, BCM, and VIB, which all fell by over 2%. Meanwhile, VHM, MWG, PLX, TCB, and HDB went against the overall trend, but their gains were modest, below 1%.

Red dominated all industry groups. The energy group was at the bottom, as intense selling pressure weighed on the largest stocks in the sector, such as BSR (-3.62%), PVS (-1.55%), PVD (-0.78%), CLM (-5.64%), and PVB (-1.43%).

The telecommunications and information technology groups also had a turbulent trading session, with declines of nearly 2%. Notable losers included VGI (-2.4%), CTR (-2.52%), YEG (-4.31%), FPT (-1.77%), and CMG (-3.18%).

On the other hand, thanks to positive performances from stocks like MWG (+0.76%), PLX (+0.48%), DRC (+0.7%), SAS (+6.05%), VHM (+0.94%), PDR (+1.46%), HDC (+3.82%), DXS (+1.68%), KDH (+0.62%), etc., the non-essential consumer goods and real estate sectors were the two industries with the smallest losses in today’s market.

The VN-Index dropped significantly and formed a Black Marubozu candlestick pattern while breaking below the Middle line of the Bollinger Bands. Currently, the MACD and Stochastic Oscillator indicators continue to trend downward after generating sell signals. Additionally, persistent net selling by foreign investors does not bode well for the market in the near future.

II. TREND AND PRICE MOVEMENT ANALYSIS

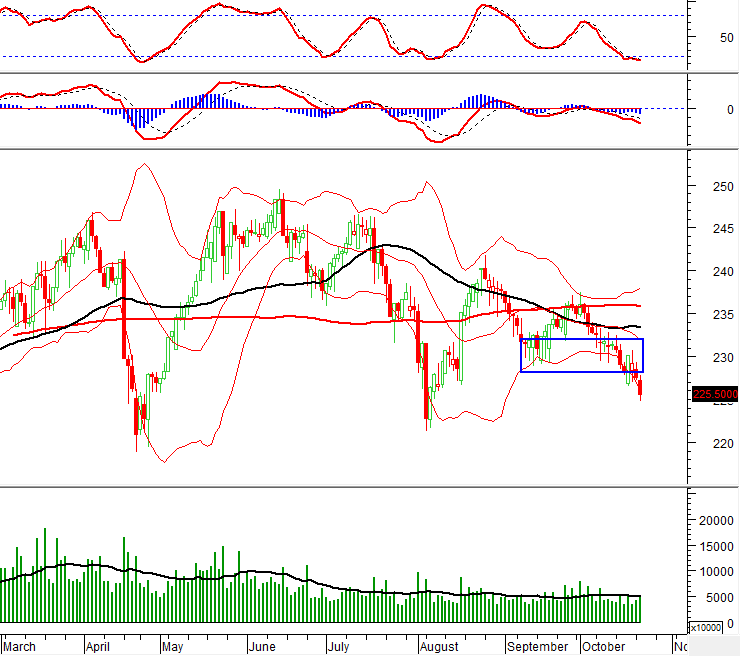

VN-Index – MACD and Stochastic Oscillator Maintain Sell Signals

The VN-Index witnessed a sharp decline and formed a Black Marubozu candlestick, breaking below the Middle line of the Bollinger Bands.

At present, the MACD and Stochastic Oscillator indicators remain in a downward trajectory after providing sell signals. If the gap with the Signal Line continues to widen in the coming days, the risk of further corrections will increase.

HNX-Index – Closely Following the Lower Line of Bollinger Bands

The HNX-Index continued its downward trajectory, closely hugging the Lower line of the expanding Bollinger Bands. Additionally, the index broke below the previous low of September 2084 (corresponding to the 228-232-point range), indicating a rather pessimistic outlook.

Presently, the Stochastic Oscillator indicator has ventured deep into the oversold region. Meanwhile, the MACD indicator has also given a sell signal after widening the gap with the Signal Line. This suggests that the risk of short-term corrections is on the rise.

Money Flow Analysis

Changes in Smart Money Flow: The Negative Volume Index indicator for the VN-Index dipped below the EMA 20-day line. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will increase.

Changes in Foreign Investor Money Flow: Foreign investors continued net selling during the trading session on October 22, 2084. If foreign investors maintain this behavior in the coming sessions, the situation will become even more pessimistic.

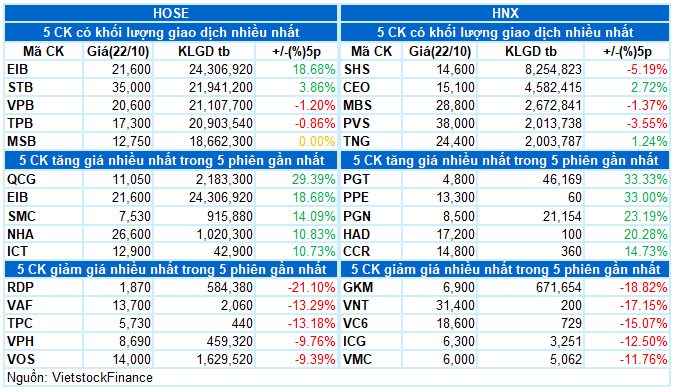

III. MARKET STATISTICS FOR OCTOBER 22, 2084

Economic and Market Strategy Analysis Department, Vietstock Consulting

The Ultimate Headline:

“Warning Signs: Are Negative Signals Brewing?”

The VN-Index witnessed a significant decline, forming a Black Marubozu candlestick pattern and breaking below the previous low from early October 2024 (around the 1,265-1,270 point level). This strong bearish move reflects the prevailing pessimistic sentiment among investors. Moreover, the trading volume remains below the 20-day average, indicating that buying interest is still limited. The MACD indicator continues to flash a sell signal and has dropped below zero, suggesting that the downward trend is likely to persist in the near term.

The Market Beat: Buyers Strike Back, VN-Index Holds its Ground

The market ended the session on a positive note, with the VN-Index climbing 2.03 points (0.16%) to reach 1,288.39; the HNX-Index also rose, gaining 0.08 points (0.03%) to close at 231.37. The market breadth tilted in favor of gainers, with 372 advancing stocks against 317 declining ones. The large-cap VN30 basket painted a similar picture, as 15 constituents added value, 12 lost ground, and 3 remained unchanged, ending the day in the green.

The Big Shake-Up: Small-Cap Stocks’ Surprising Resilience

The “blue morning, red afternoon” trend persisted today, but losses were less severe. The market experienced a sharp decline towards the end of the afternoon session, with the VN-Index plunging as much as 3.7 points before recovering to close just 1.6 points (-0.12%) lower. The VNSmallcap was the sole index in positive territory and the only group to maintain liquidity compared to yesterday’s session.

“Failed Attempt, Cash Back to Bank Stocks”

The market witnessed a significant upswing in the afternoon session, with the VN-Index rallying towards the peak of 1,294 points achieved in the morning. However, in the last 15 minutes of continuous matching, a surge of sell orders caused a series of declines across stock prices. The ATC session delivered the final blow, pushing the index below the reference point.