STOCK MARKET REVIEW FOR THE WEEK OF 07-11/10/2024

During the week of 07-11/10/2024, the VN-Index posted gains and staged a solid recovery after retesting the Middle Bollinger Band. However, trading volume fell below the 20-week average, indicating a shift towards investor caution.

In the coming week, the index has the opportunity to target the old peak from July 2024 (equivalent to the 1,290-1,300 point region). If the index surpasses this critical threshold, the outlook will brighten.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Retesting the Upper Edge of an Ascending Triangle

On 11/10/2024, the VN-Index exhibited a tug-of-war between buyers and sellers, forming a Long-Legged Doji candlestick pattern. This occurred alongside a decline in trading volume, which fell below the 20-day average, reflecting investor indecision.

Additionally, the MACD indicator and its signal line are positioned above zero and are narrowing their gap. If a buy signal reappears in the coming sessions, the recovery prospects will be reinforced.

Currently, the index is retesting the upper edge (approximately 1,280-1,300 points) of an Ascending Triangle pattern. Should the recovery momentum persist and the index decisively clears this upper boundary, the potential price target in the medium term is the 1,400-1,415 zone.

HNX-Index – Formation of a Doji Candlestick Pattern

On 11/10/2024, the HNX-Index edged higher and formed a Doji candlestick pattern, while trading volume declined and remained below the 20-day average, suggesting investor uncertainty.

Meanwhile, the index is approaching the lower edge (approximately 226-229 points) of a Triangle pattern as the Stochastic Oscillator heads towards the oversold territory, having already generated a sell signal. This indicates that the short-term corrective phase remains intact.

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index for the VN-Index has crossed above its 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will diminish.

Foreign Money Flow Variation: Foreign investors resumed net selling on 11/10/2024. If this sentiment persists in the coming sessions, the outlook will turn increasingly pessimistic.

Vietstock Consulting Technical Analysis Department

Market Beat: Buyers Return in Afternoon Trade, VN-Index Surges Over 9 Points

The market ended the session on a positive note, with the VN-Index climbing 9.87 points (0.78%) to reach 1,281.85, while the HNX-Index gained 0.25 points (0.11%), closing at 231.77. The market breadth tilted in favor of the bulls, as evident from the advance-decline ratio of 411:256. A similar trend was observed in the VN30 basket, with 22 stocks advancing, 6 declining, and 1 remaining unchanged, resulting in a sea of green on the screen.

The Market Pulse: The Crucial 1,300-Point Threshold

The VN-Index retreated to close a week of volatile trading. Investor caution persisted as trading volume remained below the 20-week average. Additionally, the index continued to struggle as it approached the September 2024 high (1,290-1,300 points range). If the index recovers with improved liquidity in the coming phase, it is highly likely to surpass this range.

The Market Beat: The Tug-of-War Continues

As of the market close, the VN-Index dipped 1.06 points (-0.08%), settling at 1,285.46, while the HNX-Index witnessed a decline of 0.91 points (-0.4%), closing at 229.21. The market breadth tilted towards decliners, with 364 stocks falling against 315 advancing stocks. The VN30-Index basket saw a relatively balanced performance, with 13 stocks in the red, 12 in the green, and 5 unchanged.

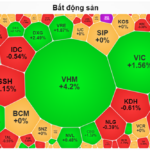

The Market Beat: Selling Pressure Mounts, VN-Index Dips into the Red

The market closed with the VN-Index down 5.69 points (-0.44%) to 1,279.77 and the HNX-Index down 1.78 points (-0.78%) to 227.43. The market breadth tilted towards decliners with 473 losers and 228 gainers. The large-cap stocks in the VN30-Index basket painted a similar picture, with 23 stocks declining, 5 advancing, and 2 unchanged.