left intent:

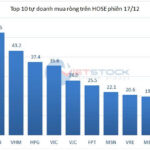

Today’s market saw a strong rebound after a weak morning session, with liquidity remaining extremely low. This indicates that doubt remains high, especially as the rally was quite unexpected. Money is not yet ready to chase prices, and that will be the connecting buying force going forward.

A strong rally, though welcome, is not something to be overly optimistic about. However, it does reflect a certain shift in market perception. A portion of investors have overcome their fears or are no longer willing to wait and have accepted deployment. The small sell-side volume allowed for such a wide range of gains with minimal liquidity.

A reliable signal is the broad-based positive reversal in stock prices. In the morning, only large-caps like VHM provided support, but in the afternoon, a variety of stocks rallied. There was good consensus among blue-chips and many mid- and small-caps.

There is no new market news, and this week’s events are also clear. Yesterday’s decline disappointed many, leading to higher-than-usual liquidity as investors cut losses. In a prolonged downtrend, it is normal to have high-volume selling sessions that expand the trading range. Ultimately, this will lead to a depletion of loose supply as this correction is just a typical technical decline, not stemming from any significant change in fundamentals.

Investors who have recently cut losses will not immediately return to the market, as doing so would be admitting they were wrong and sold at the bottom. Doubting is an effective form of self-comfort, and they will strive to find negative reasons to protect themselves. In reality, the market remains the same; it declines without any specific reason. The same goes for rallies; regardless of the news, supply and demand dynamics are the deciding factors. Thus, the signal to await confirmation is a recovery in liquidity.

Today’s rally negated yesterday’s decline and returned to last week’s closing prices – which had three sessions of narrow trading ranges and very low liquidity. It is highly likely that the range-bound session at the start of the week was a bear-trap. In fact, even during yesterday’s decline, strong stocks did not change much, and today’s recovery quickly “recouped losses” easily. Such price action strengthens the firmness of the bottom and confirms that the index may not be done bottoming, but stocks have.

I maintain the view that the market is undergoing a healthy correction, and that small, controlled losses during the accumulation process are normal and not worrying. It is possible to increase stock allocations to high levels. There is no need to worry about the index, as many stocks are showing strong support and loose supply has been tested during sharp intraday declines.

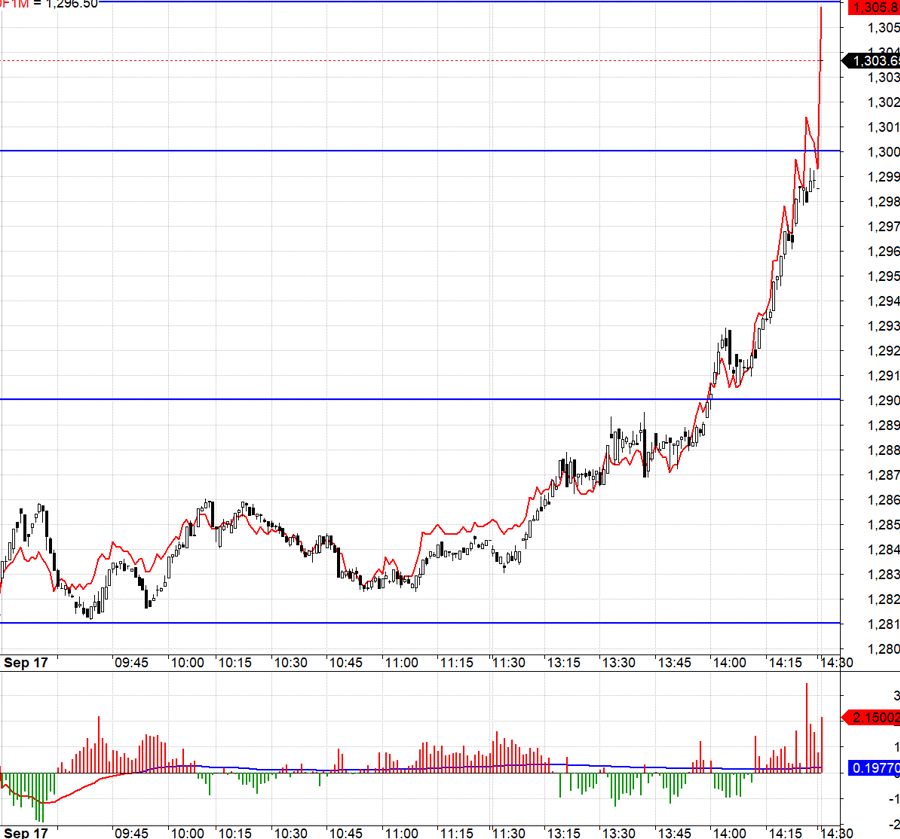

The derivatives market is approaching the F1 expiration, and today’s range was impressive. Basis is no longer an issue, but the challenge lies in VN30 being within two consecutive open-range zones, from 1281.xx to 1290.xx and 1300.xx. During the first test in the early session, VN30 did not break below 1281.xx, but there was also no leading large-cap to push it towards 1290.xx. The second test at the end of the morning session had a higher low, and although it reached 1290.xx, the upward movement was mainly driven by VHM, so it is best to close at least half of the long position around 1290.xx. After VN30 surpassed 1290, it exhibited strong momentum and broad consensus, and of course, only the remaining position benefited. However, in terms of trading strategy, discipline must be maintained as it is impossible to predict whether the rally will accelerate or fail at 1290.xx.

Today’s reversal occurred rapidly, leaving behind many cautious buy orders, resulting in low liquidity. The market may return to a state of consolidation to test supply further. If your stock portfolio is already at a high level, consider refraining from buying for now. Derivatives may exhibit low volatility, so it is best to stay on the sidelines.

VN30 closed today at 1303.65. Tomorrow’s nearest resistances are 1306; 1317; 1325; 1335; 1340. Supports are 1301; 1297; 1290; 1281; 1274; 1267.

“Stock Market Blog” reflects personal views and does not represent the opinion of VnEconomy. The perspectives and assessments are those of the individual investor, and VnEconomy respects the author’s point of view and writing style. VnEconomy and the author are not responsible for any issues arising from the published investment views and opinions.

The Cautious Sentiment Persists

The VN-Index closed the session with a slight gain, retesting the old bottom from early October 2024 (equivalent to the 1,265-1,270 point range). If, in the coming days, the index holds firm above this threshold, coupled with trading volumes surpassing the 20-day average, the short-term outlook will turn more positive. Moreover, the MACD indicator needs to flash a buy signal again to sustain this optimism.

The Rising Pessimism

The VN-Index witnessed a significant decline, forming a bearish Black Marubozu candlestick pattern and breaching the middle line of the Bollinger Bands. The MACD and Stochastic Oscillator indicators continue on a downward trajectory, reinforcing the sell signal. Moreover, persistent foreign net selling sends a cautious message to investors about the market’s outlook in the near term.

The Ultimate Headline:

“Warning Signs: Are Negative Signals Brewing?”

The VN-Index witnessed a significant decline, forming a Black Marubozu candlestick pattern and breaking below the previous low from early October 2024 (around the 1,265-1,270 point level). This strong bearish move reflects the prevailing pessimistic sentiment among investors. Moreover, the trading volume remains below the 20-day average, indicating that buying interest is still limited. The MACD indicator continues to flash a sell signal and has dropped below zero, suggesting that the downward trend is likely to persist in the near term.

The Market Beat: Buyers Strike Back, VN-Index Holds its Ground

The market ended the session on a positive note, with the VN-Index climbing 2.03 points (0.16%) to reach 1,288.39; the HNX-Index also rose, gaining 0.08 points (0.03%) to close at 231.37. The market breadth tilted in favor of gainers, with 372 advancing stocks against 317 declining ones. The large-cap VN30 basket painted a similar picture, as 15 constituents added value, 12 lost ground, and 3 remained unchanged, ending the day in the green.

The Big Shake-Up: Small-Cap Stocks’ Surprising Resilience

The “blue morning, red afternoon” trend persisted today, but losses were less severe. The market experienced a sharp decline towards the end of the afternoon session, with the VN-Index plunging as much as 3.7 points before recovering to close just 1.6 points (-0.12%) lower. The VNSmallcap was the sole index in positive territory and the only group to maintain liquidity compared to yesterday’s session.