Ms. Doan Ngoc Ly Ly – VPBankS Operation Director (left) and Ms. Luong Thi My Hanh – Domestic Asset Management Director, Dragon Capital Vietnam at the signing ceremony

|

On October 4, 2024, VPBank Securities Joint Stock Company and Dragon Capital Vietnam Fund Management Company signed a cooperation agreement to distribute fund certificates through the NEO Invest app.

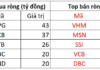

VPBankS will officially distribute four Dragon Capital Vietnam fund certificates, including the Dynamic Securities Investment Fund (DCDS), Dividend Stock Investment Fund (DCDE), Bond Investment Fund (DCBF), and Fixed Income Enhanced Bond Investment Fund (DCIP) via the NEO Invest trading platform. These fund certificates have attracted investors’ interest due to their superior performance compared to the overall VN-Index.

Investors can access information, buy, and manage Dragon Capital Vietnam’s fund certificates directly on the VPBankS NEO Invest platform from October 7, 2024. This provides investors with a convenient, seamless experience without having to switch between different platforms for their securities investment needs.

The collaboration between VPBankS – the only securities company within the Vietnam Prosperity Joint-Stock Commercial Bank (VPBank) ecosystem, and Dragon Capital – Vietnam’s largest fund management company, will enable both parties to maximize their strengths and enhance customer experience. VPBankS investors will have additional financial product options directly on the NEO Invest app, while Dragon Capital Vietnam’s fund certificates will reach VPBankS’s large and rapidly growing customer base.

The partnership between VPBankS and Dragon Capital will enable both parties to maximize their strengths and enhance customer experience.

|

Mr. Vu Huu Dien, Chairman of VPBank Securities JSC, stated at the event: “Fund certificates are not only an effective investment tool but also a platform that enables investors to access long-term growth opportunities with stability and consistent profits. Our strategic collaboration with Dragon Capital Vietnam demonstrates our commitment to delivering comprehensive financial solutions, optimizing experiences, and enhancing investment value for our clients.”

On behalf of Dragon Capital Vietnam, General Director Beat Schuerch shared: “Today’s event marks a significant milestone in the decade-long partnership between Dragon Capital Vietnam and VPBank Group, enabling millions of customers to access fund investment channels and build their wealth effectively and sustainably. With the combination of Dragon Capital Vietnam’s longstanding experience and VPBank Group’s strong determination in the asset management field, we believe this will be a successful partnership that brings value to the people of Vietnam.”

Vietnam’s stock market has witnessed an explosion in the number of new individual accounts opened since 2020, reaching nearly 8.7 million units by the end of August 2024, quadrupling the number from the previous 20 years. This remarkable growth is attributed to the attractiveness of stock investments compared to other channels and the convenience of transacting through online platforms. Surveys indicate that both new (F0) and experienced investors are leaning towards passive financial products, such as fund certificates and sample investment portfolios, due to their high performance and time-saving benefits, in addition to investing in specific stocks.

NEO Invest is a smart trading platform that offers a simple and secure experience. Notably, this application integrates a financial product ecosystem and diverse consulting services, catering to all client needs, including basic securities, derivative securities, sample investment portfolios (ePortfolio), and now, Dragon Capital Vietnam’s fund certificates.

For more information, investors can refer to: https://www.vpbanks.com.vn/efund

|

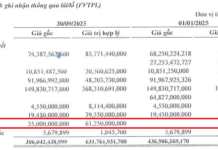

Dragon Capital Vietnam is a longstanding fund management company with over 30 years of experience, currently managing and advising on the largest asset block in the market, valued at nearly 6 billion USD. The open-ended funds are designed as an ecosystem to cater to diverse investment needs and preferences. VPBank Securities (VPBankS) is the only securities company within the VPBank ecosystem and boasts one of the largest chartered capitals in the market at 15,000 billion VND. VPBankS is also among the top 10 securities companies with the largest margin lending balances and has significant room for future growth. |

The Coastal District, Named 555 Years Ago, is Soon to Become a Town

The local authorities are committed to fostering the growth of the region’s industrial and handicraft sectors. With a strategic vision, they aim to create a thriving ecosystem that supports local businesses and attracts investment, ultimately establishing the area as a hub of innovation and craftsmanship.

Unlocking Investment Opportunities: Binh Duong’s ‘Transport-Led Development’ Strategy

By prioritizing investment in its transportation infrastructure, Binh Duong Province has successfully attracted a significant number of investors. Currently, the province is home to 71,776 domestic enterprises with a total registered capital of VND 786 trillion, along with 4,347 foreign-invested projects totaling US$42 billion in registered capital.