Industrial Real Estate to be the “Star” of 2025

In the National Financial Supervisory Commission’s report on macroeconomic prospects for 2025, it is predicted that FDI will continue to flow strongly into Vietnam, especially in high-value manufacturing and technology sectors such as semiconductors, artificial intelligence, digital transformation, logistics, and pharmaceuticals. The disbursed FDI in 2025 is expected to exceed $30 billion.

Currently, Vietnam is among the 15 largest developing countries attracting the most FDI in the world. The cooperation agreement between the Vietnamese government and NVIDIA marks a significant turning point, creating an opportunity for Vietnam to become a leading AI R&D hub in Asia. The wave of investment in high-tech projects and R&D centers is driving the demand for infrastructure and factories, boosting the growth of the industrial real estate market.

From 2024 to 2027, Vietnam is expected to have about 15,200 hectares of industrial land supply and over 6,000,000 square meters of total warehouse supply.

The growth momentum of industrial real estate enterprises is expected to continue, with advantages belonging to those with large land funds and convenient transportation infrastructure. Industrial real estate stocks are also among the bright investment spots for 2025 recommended by many experts, with positive growth arguments from FDI inflows.

Bright Outlook for Major Investors

Riding the wave of FDI flowing into Vietnam, a series of large-scale industrial real estate companies are racing to expand their land funds and develop a range of green and smart industrial parks combined with eco-cities.

A leading example is Viglacera – a member of the GELEX ecosystem. In 2024, Viglacera received approval for investment in three additional industrial parks, including Tran Yen Industrial Park – Phase 1 (254.6 hectares, with a total investment of VND 2,184 billion) in Yen Bai province; Doc Da Trang Industrial Park (288 hectares, with a total investment of VND 1,807 billion) in Khanh Hoa province; and Song Cong II Industrial Park – Phase 2 (296.2 hectares, with a total investment of VND 3,985 billion) in Thai Nguyen province.

Viglacera’s Yen Phong Industrial Park.

On March 10, Viglacera officially started the construction of Song Cong II Industrial Park – Phase 2. The park is expected to become an ideal destination for investors, creating significant economic value for the region and the country. The Doc Da Trang Industrial Park project is scheduled to commence in Q2 2025.

In 2024, Viglacera’s pre-tax profit in the real estate business segment reached VND 1,943 billion, of which the profit from the industrial park business segment accounted for 70% of the total real estate business profit.

Agriseco Securities Company assessed that: “In 2025, Viglacera’s industrial real estate segment is expected to grow significantly due to the large area handed over to customers and the increasing trend of industrial land rental prices. The commercial area reached 850 hectares. The newly approved projects are expected to be exploited in the period of 2026-2027, helping to maintain the long-term growth potential of the Corporation.”

In addition to its large land fund, Viglacera is also oriented towards developing green and smart industrial parks to attract investment in high-tech and environmentally friendly supporting industries, aiming to attract high-quality FDI and demonstrate a clear commitment to sustainable and technology-based economic development.

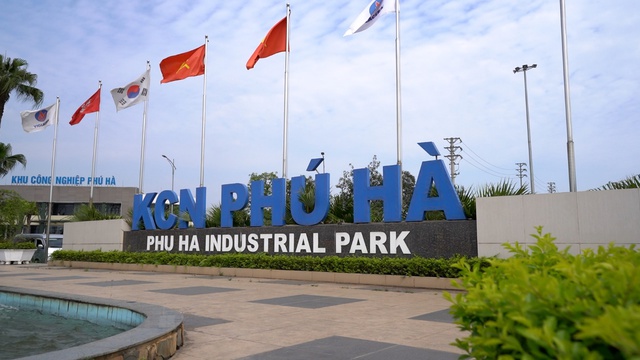

Phu Ha Industrial Park has become a destination for many large enterprises.

Some notable companies in the industrial real estate sector, such as SIP, Kinh Bac, and IDICO, are also actively expanding their land funds and developing industrial parks. Entering 2025, the industrial real estate sector has many positive aspects thanks to supportive factors from policies and the market. Experts from VISRating believe that the sales of the developers will increase significantly as both the supply and demand for new industrial land increase.

CBRE Vietnam expects industrial real estate rental prices to continue rising in the coming years, with an increase of about 5-9% per year in the North and 3-7% in the South. Meanwhile, the ready-built warehouse for lease is expected to develop strongly, along with the improvement of the logistics sector to meet the growing demands of FDI investment.

The experts forecast that the profit of the entire industrial real estate industry in 2025 is expected to increase by 30.4% compared to the previous year, and the enterprises in this sector will enter a period of “shining” growth.

The Industrial Array Pivot

Recognizing the challenging energy landscape ahead, the management of PC1 made a pivotal decision three years ago to diversify their strategy. With a keen eye on the post-COVID-19 world, they identified industrial real estate as a key long-term focus, alongside their ability to recover receivables from EVN. This strategic shift sets the company on a new path, one that holds promise in the face of challenges posed by Planning No. 8.

The Pilot Project: Empowering Investors to Spearhead Social Housing Initiatives Without Bidding Red Tape

“The investor selection process prioritizes experienced investors with strong financial capabilities, who can demonstrate a track record of swift project implementation and significant contributions towards advance compensation funding.”

The Art of Leadership: When CEOs of Large Corporations Learn from Harvard and Other Priceless Lessons

The ACB Leadership Summit, featuring a renowned Harvard professor, is not just a theoretical training program. It is a unique platform that brings together seasoned leaders to elevate their management practices. Through this summit, participants will gain invaluable insights into strategic thinking and learn practical skills to navigate the ever-changing business landscape effectively.