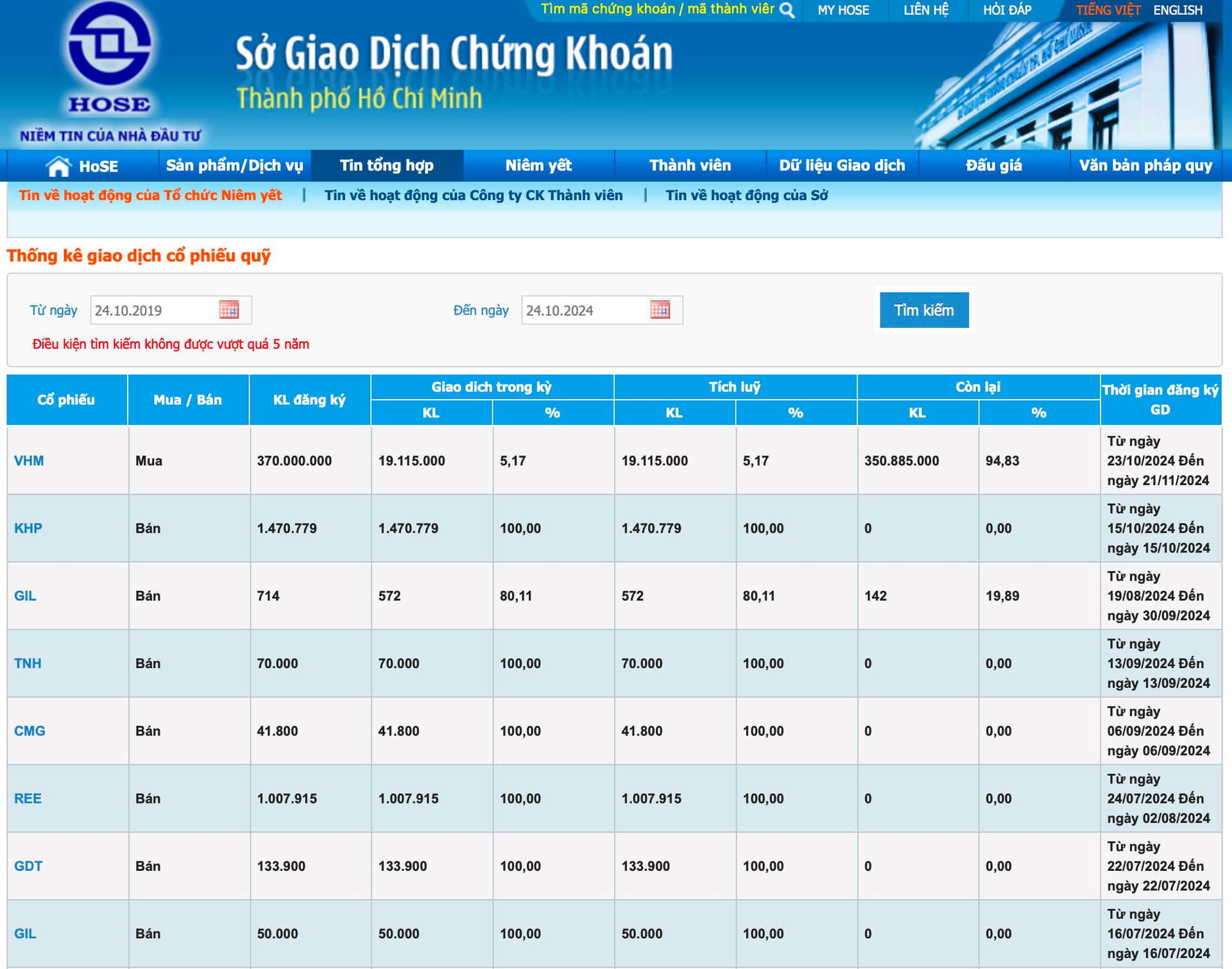

Vinhomes aims to buy back shares as the market price of VHM is currently lower than the company’s actual value. This move ensures the company’s and shareholders’ interests are protected. As per regulations, Vinhomes will place a minimum order of 11.1 million shares and a maximum of 37 million shares daily during the trading period.

On the first day of the treasury share purchase, VHM witnessed vibrant trading activities with a matching volume of over 33.3 million units, the second-highest in history, only surpassed by the session on August 7. The corresponding matching value reached nearly VND 1,600 billion, the highest on the exchange. Additionally, VHM saw two negotiated transactions totaling over 4.1 million units, both at the reference price (VND 48,250/share). The total value of these transactions approximated VND 200 billion.

VHM shares closed the October 23 session with a 2.6% decline, settling at VND 47,000/share. Consequently, the market capitalization dropped below VND 205,000 billion. Despite this, Vinhomes remains the third most valuable listed company in Vietnam. Prior to the treasury share purchase, VHM had rallied nearly 40% from its all-time low in early August, peaking at a one-year high.

The estimated cost for Vinhomes to complete this transaction could exceed VND 17,000 billion. If successful, it would be the largest treasury share purchase in the history of Vietnam’s stock market. The company assures that the buyback plan will be financed by available cash and operating cash flow from project sales, thus having only a limited impact on the company’s liquidity and debt ratios.

The Ultimate Guide to the Record-Breaking Vinhomes Equity Deal: Why This Mega-Investment is a Game-Changer for the Vietnamese Stock Market

As of the close of the October 24 trading session, Vinhomes (VHM) had successfully purchased nearly 29.1 million treasury shares, accounting for 7.86% of the registered amount.