The Vietnamese stock market just experienced a lackluster trading session, dipping below the reference mark towards the end of the day. Cautious investor sentiment and weak liquidity made it challenging for the main index to break through.

At the close of October 24, the VN-Index witnessed a significant decline of 13.49 points, settling at 1,257.41. The matching value on HoSE remained low, reaching approximately VND 14,100 billion.

Foreign investors’ transactions were a downside, as they net sold over VND 257 billion across the market.

Foreign investors net sold over VND 234 billion on HoSE

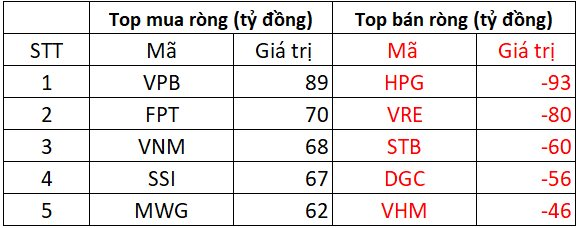

On the buying side, VPB witnessed the strongest foreign inflows on HOSE, with a net buy value of approximately VND 89 billion. FPT followed closely with net inflows of around VND 70 billion. VNM, SSI, and MWG also attracted net purchases of over VND 60 billion each.

Conversely, HPG faced the most significant foreign selling pressure, with a net sell value of VND 93 billion. VRE witnessed net outflows of about VND 80 billion, while STB and DGC faced net foreign selling of VND 56-60 billion each. VHM took the fifth spot, with net outflows of VND 46 billion.

On HNX, foreign investors net sold approximately VND 45 billion

CEO witnessed the strongest net buying on HNX, with a net buy value of VND 2 billion. MBS, PVI, VGS, and PVS followed, with net purchases of around VND 1 billion each.

On the opposite side, SHS faced intense net selling of VND 39 billion. IDC witnessed net outflows of VND 9 billion. LAS, IDV, and TIG also experienced net foreign selling, ranging from a few hundred million to a few billion VND.

On UPCOM, foreign investors net bought approximately VND 22 billion

In terms of buying, ACV witnessed strong net purchases of VND 10 billion, while MCH attracted net buying of VND 6 billion.

Conversely, ABI, AAS, IFS, and FOC faced net foreign selling of a few hundred million VND each.

The VN-Index Breaks Losing Streak: Vinhomes Shares (VHM) Fluctuate on Landmark “Deal of the Century” in Vietnam’s Stock Market

The VN-Index successfully halted its losing streak, reclaiming the 1,270-point level. In a surprising turn of events, shares of VHM, owned by real estate giant Vinhomes, plummeted on the day of the highly anticipated “historic deal” in the stock market industry.