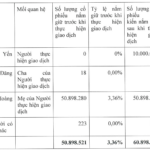

Nguyen Yen Linh, the daughter of Nguyen Dang Quang, Chairman of Masan Group (MSN), has registered to purchase 10 million MSN shares to increase her ownership stake. The transaction is expected to be executed through matching and/or put-through orders between October 29 and November 18, 2024.

Prior to this transaction, Ms. Linh did not hold any MSN shares. If successful, the daughter of billionaire Nguyen Dang Quang will hold a 0.66% stake in Masan.

In the market, MSN shares are currently trading at VND 78,500 per share, up over 17% since the beginning of the year. At this market price, Mr. Quang’s daughter may have to spend VND 785 billion on this transaction.

In terms of Q3 2024 financial results, Masan’s net revenue reached VND 21,487 billion, a 6.6% increase compared to the same period last year. This growth was driven by the performance of the retail consumer business segments, offsetting the restructuring of the farm chicken business of Masan MeatLife and the temporary disruption in the operations of Masan High-Tech Materials.

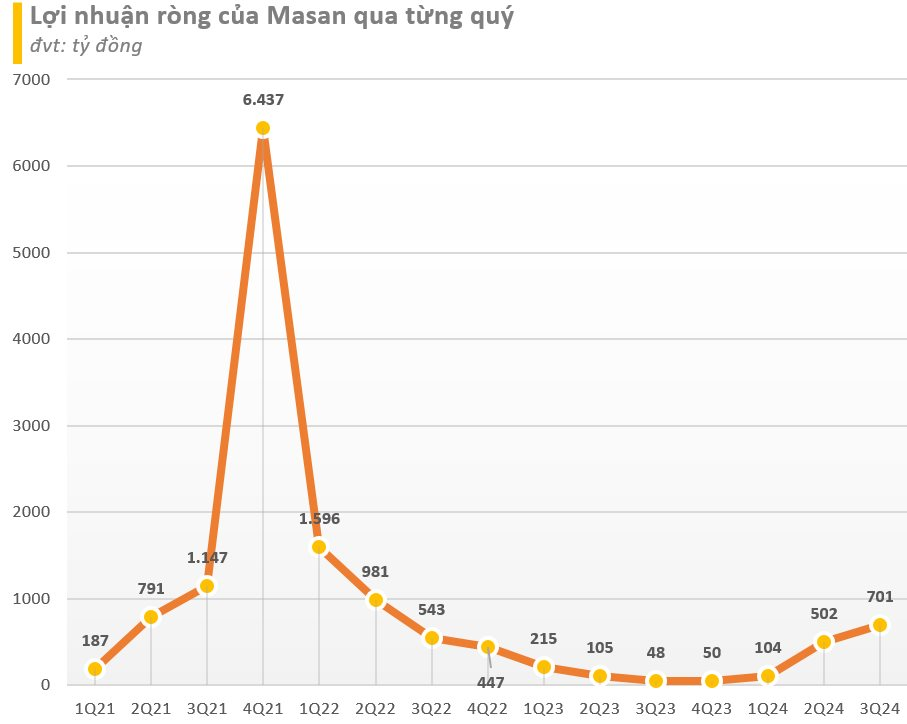

Net profit after tax attributable to shareholders of the parent company reached VND 701 billion, a nearly 1,400% increase compared to the same period last year. This performance reflects the profitability of the retail consumer business segments, along with reduced net interest expenses and no foreign exchange losses, as Masan has hedged 100% of its long-term USD loans since the beginning of the year.

Notably, WinCommerce recorded a 9.1% growth in revenue compared to the previous year, reaching VND 8,603 billion across its network. This growth was mainly driven by the new WIN and WinMart+ Rural store models, which serve urban and rural shoppers, respectively. The traditional store model also achieved an 8% growth compared to the same period last year. WCM reported a net profit of VND 20 billion in Q3 2024, the first time since the COVID period.

Sure, I can assist with that.

Title: HDBank: Foremost Credit Room in the Banking Sector, Projected Profit Growth of Over 28% Annually for the Next 5 Years

In their recently published analyst report, MB Securities (MBS) has assessed HDBank’s business outlook as positive for the second half of 2024 and 2025. This optimistic forecast is attributed to the bank’s exceptional financial performance in the first half of this year, which has set a strong foundation for continued success in the upcoming periods.

The Retail Giant: Generating $170 Million in Annual Tax Revenue

Masan Group is proud to be one of the largest taxpayers in the provinces where its factories operate, but its contribution to the community goes beyond that. The company provides employment opportunities for thousands of people, improving their livelihoods and positively impacting their lives. Additionally, Masan Group is committed to community development, allocating a portion of its profits to initiatives that make a lasting difference in the areas it serves.