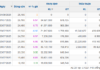

Market liquidity decreased compared to the previous session, with the VN-Index matching volume reaching over 497 million shares, equivalent to a value of more than 10.7 trillion VND; HNX-Index reached over 40.5 million shares, equivalent to a value of more than 806 billion VND.

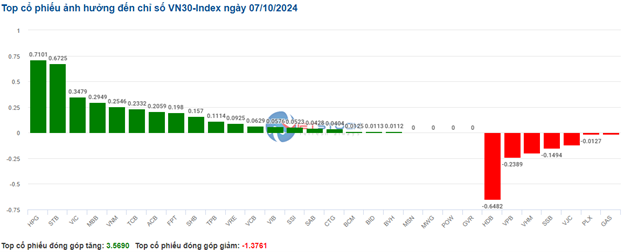

VN-Index opened the afternoon session with selling pressure resurfacing and increasing, causing the index to weaken and plunge. Despite supportive buying, the index still closed in the red. In terms of impact, VNM, VCB, VHM, and HDB were the most negative stocks, taking away more than 1.7 points from the index. On the other hand, STB, HPG, CTG, and MSB were the most positive stocks, positively impacting the index by more than 1.1 points.

| Top 10 stocks with the strongest impact on the VN-Index on 07/10/2024 |

Similarly, the HNX-Index also witnessed a lackluster performance, with the index negatively impacted by DNP (-9.47%), DTK (-3.1%), NTP (-1.33%), and SHS (-0.63%)…

|

Source: VietstockFinance

|

The utilities sector witnessed the sharpest decline in the market, falling by -1.06%, mainly due to POW (-1.54%), GAS (-0.55%), REE (-0.75%), and TTA (-2.56%). This was followed by the essential consumer goods sector and the healthcare sector, which decreased by 0.56% and 0.32%, respectively. On the contrary, the energy sector witnessed the strongest recovery in the market, rising by 0.87% with green signals from PVS (+1.2%), PVD (+0.9%), PVB (+2.3%), and PVC (+1.52%)

In terms of foreign trading, they continued to net sell over 438 billion VND on the HOSE exchange, focusing on VPB (94.19 billion), HDB (85.54 billion), VCG (40.79 billion), and OCB (32.27 billion). On the HNX exchange, foreigners net sold more than 56 million VND, focusing on SHS (56.04 billion), TNG (4.52 billion), BVS (2.39 billion), and NTP (2.29 billion)

| Foreigners’ Buying and Selling Activities |

Morning Session: Financial stocks lead the recovery

With positive Q3 GDP data released last week, green signals returned to the market. However, a cautious sentiment still dominated the stock market in the morning session. Financial stocks are currently the bright spot, significantly contributing to the index’s recovery. At the midday break, the VN-Index increased by 4.25 points, or 0.33%, to 1,274.85 points; HNX-Index rose by 0.11% to 232.94 points. The buying side continued to hold the upper hand, with 366 stocks rising and 215 falling.

This morning’s liquidity was quite gloomy, with the VN-Index matching volume reaching nearly 208 million units, equivalent to a value of more than 4.3 trillion VND. The HNX-Index recorded a matching volume of nearly 18 million units, with a value of nearly 362 billion VND.

Four banking stocks, including STB, TCB, MBB, and CTG, are currently the pillars with the most positive impact on the index, contributing nearly 1.5 points to the VN-Index. Conversely, HDB, GAS, and OCB had the most negative impact, but it was not significant.

Green signals were present in most industry groups. Notably, financial stocks are leading the market, especially banking and securities stocks, which recorded outstanding gains such as STB (+3.02%), MSB (+2.37%), EIB (+1.88%), TPB (+1.45%), MBB (+1%), ORS (+3.48%), VND (+2.73%), HCM (+1.81%),…

In addition, the real estate sector also recovered well this morning after last weekend’s decline. Most stocks regained green signals, typically VHM (+0.36%), VIC (+0.49%), VRE (+0.82%), KBC (+1.1%), NLG (+1%), SNZ (+2.17%), and HDG (+1.1%).

On the other hand, non-essential consumer goods were the only group in the red, but the decline was not significant, mainly affected by large-cap stocks in the industry, such as PLX (-0.33%), GEX (-0.71%), FRT (-0.28%), REE (-0.91%), and STK (-2.3%).

After returning to net selling last weekend, foreigners continued to net sell more than 113 billion VND on the HOSE exchange this morning. Banking stocks attracted the main trading interest, with HDB and VPB being the two stocks that foreigners sold the most. Meanwhile, STB was net bought by foreigners for more than 63 billion VND this morning, far exceeding the value of other net bought stocks. On the HNX exchange, foreigners net sold more than 43 billion VND at the end of the morning session, with sudden selling pressure appearing in the SHS stock (nearly 47 billion).

10:30 am: Lack of liquidity, VN-Index unable to break out

Investors’ cautious sentiment caused the trading volume to drop to a low level, and the main indices fluctuated around the reference level. As of 10:30 am, the VN-Index increased by 1.8 points, trading around 1,272 points. The HNX-Index rose by 0.15 points, trading around 232 points.

Most of the stocks in the VN30 basket maintained green signals, with HPG rising by 0.71 points, STB by 0.67 points, VIC by 0.35 points, and MBB by 0.29 points. Conversely, HDB, VPB, VHM, and SSB were among the few declining stocks, taking away more than 1 point from the overall index.

Source: VietstockFinance

|

Financial stocks are currently leading the market’s rise, with a modest increase of 0.08% due to strong divergence. On the positive side, buying interest mainly focused on banking stocks such as STB, which increased by 1.06%, MBB by 0.4%, TPB by 0.58%, TCB by 0.21%… Meanwhile, securities stocks still faced selling pressure, with VCI falling by 0.14%, VIX by 0.42%, MBS by 0.32%, and VDS by 0.91%…

Following this was the real estate sector, which witnessed a slightly better increase of 0.23% despite ongoing fluctuations. Green signals currently dominate stocks like DIG, which rose by 0.23%, DXG by 0.33%, VRE by 0.55%, and PDR by 0.24%… Only a few stocks have failed to escape the red signals, such as VHM, which fell by 0.36%, NVL by 0.46%, VC3 by 0.35%, and SIP by 0.56%…

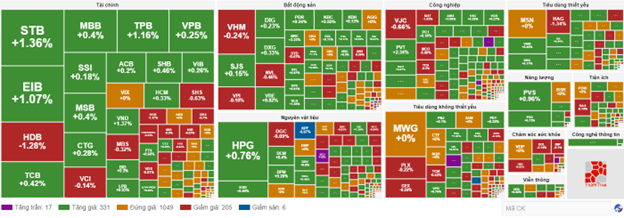

Compared to the beginning of the session, although the fluctuations between buyers and sellers were quite intense, with over 1,000 reference stocks, the buying side still held a slight advantage. There were 331 rising stocks and 205 declining stocks.

Source: VietstockFinance

|

Opening: Increased from the beginning of the session

At the start of the 07/10 session, as of 9:30 am, the VN-Index turned green from the beginning and rose by nearly 5 points to 1,275.49 points. Meanwhile, the HNX-Index witnessed a slight increase, maintaining 233.5 points.

According to the General Statistics Office, the gross domestic product (GDP) in Q3/2024 is estimated to increase by 7.4% over the same period last year. Specifically, the agriculture, forestry, and fishery sector grew by 2.58%, contributing 4.08% to the total added value of the entire economy; the industry and construction sector increased by 9.11%, contributing nearly 49%; and the service sector rose by 7.51%, contributing 47%.

Green signals temporarily dominated the VN30 basket, with 3 declining stocks and 27 increasing stocks. Among them, HDB, SSB, and VJC were the stocks with the sharpest declines. Conversely, VRE, SHB, STB, and VIC were the stocks with the strongest gains.

Energy stocks were one of the most prominent sectors at the beginning of the morning session. Stocks witnessed positive performance from the start, such as PVS, which rose by 1.2%, PVD by 1.44%, BSR by 0.41%, PVB by 2.96%, and PVC by 1.52%…

Along with this, the telecommunications services sector positively contributed to the market’s points this morning. Notably, stocks such as CTR increased by 0.94%, VGI by 0.93%, YEG by 0.43%, and POC by 2.29%…

The Stock Market Week of October 21-25, 2024: Short-Term Adjustment Pressures

The VN-Index has been on a downward spiral, slipping below the middle Bollinger Band. This, coupled with trading volumes that remain below the 20-day average, indicates a persistent investor caution. To add to the woes, consistent net selling by foreign investors has also contributed to the mounting pressure on the index.

The Market Beat: Downward Momentum Persists, VN-Index Loses 1,260-Point Mark

At the end of the trading session, the VN-Index declined by 4.69 points (-0.37%), settling at 1,252.72. The HNX-Index witnessed a marginal loss of 0.06 points (-0.03%), closing at 224.63. The market breadth tilted towards decliners, with 377 stocks trading lower against 286 gainers. The VN30-Index, representing the top 30 stocks by market capitalization and liquidity, exhibited a similar trend, with 19 stocks closing in the red, 4 in the green, and 7 remaining unchanged.

The Cautious Sentiment Persists

The VN-Index closed the session with a slight gain, retesting the old bottom from early October 2024 (equivalent to the 1,265-1,270 point range). If, in the coming days, the index holds firm above this threshold, coupled with trading volumes surpassing the 20-day average, the short-term outlook will turn more positive. Moreover, the MACD indicator needs to flash a buy signal again to sustain this optimism.

The Market Beat: A Rapid Decline, A Strong Surge in the Expiry of Derivatives

The VN-Index faced pressure throughout the morning session and the early minutes of the afternoon, dipping below 1,272 points. However, true to the nature of an expiration day for derivatives, the VN-Index staged a strong comeback, closing above 1,286 points. This impressive turnaround was largely driven by the banking, securities, and real estate sectors, which provided the much-needed boost to push the index higher.