Quarterly Financial Report: An In-Depth Analysis of QNS’ Performance

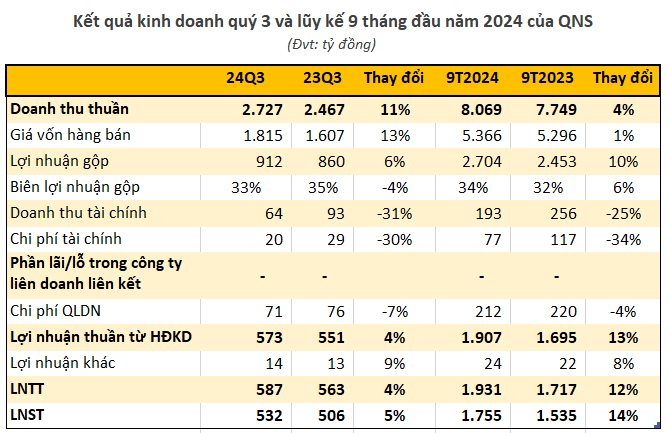

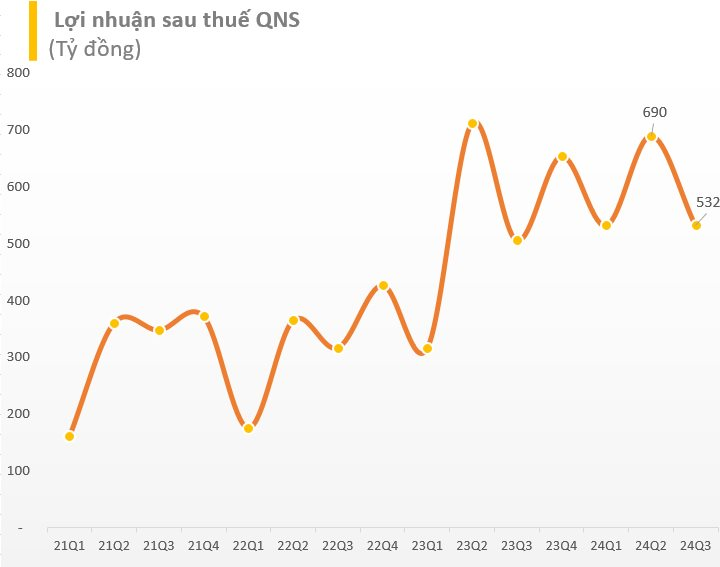

QNS, or Quang Ngai Sugar Joint Stock Company, has released its financial statements for the third quarter of 2024, boasting impressive results. With a pure revenue of 2,727 billion VND, the company witnessed an 11% surge compared to the same period last year. Despite a slight increase in cost of goods sold, gross profit held strong at 912 billion VND, reflecting a 6% improvement year-over-year. However, a narrowing gross margin of 33% was observed in Q3 2024, down from 35% in the previous year.

Delving further into the report, we notice a 31% dip in financial income, settling at 64 billion VND. Financial expenses also witnessed a decrease of 30%, amounting to 20 billion VND. After accounting for various expenses, QNS posted a robust pre-tax profit of 587 billion VND, indicating a modest 4% improvement from 2023.

Year-to-Date Performance: A Snapshot of QNS’ Resilience

For the first nine months of 2024, QNS recorded a solid performance with 8,069 billion VND in pure revenue and a substantial after-tax profit of nearly 1,755 billion VND. This signifies a 4% and 14% increase, respectively, compared to the same period in 2023. Notably, the company averaged a remarkable 6.5 billion VND in daily profits during this period.

Looking at the bigger picture, QNS set ambitious targets for the full year 2024, aiming for a total revenue of 9,000 billion VND and an after-tax profit of 1,341 billion VND. These goals reflect a 14% and 39% decrease, respectively, from the previous year’s achievements. However, with 90% of the revenue target already met and a significant 31% surplus in profit, the company is well on its way to surpassing its own expectations.

A Well-Diversified Portfolio: QNS’ Strategic Advantage

As of September 30, 2024, QNS boasted total assets of 13,014 billion VND, reflecting a notable increase of 961 billion VND from the start of the year. Cash and bank deposits accounted for over half of the company’s assets, totaling 7,350 billion VND. Inventory levels rose by 4% to reach 996 billion VND, while fixed assets stood at 3,363 billion VND.

Additionally, QNS held 903,000 USD in foreign currency accounts and owned a SJC gold ring as of Q3 2024. The company’s equity reached 9,380 billion VND, a 9% increase from the beginning of the year, which included 5,229 billion VND in undistributed post-tax profits. Financial borrowings amounted to 2,307 billion VND, entirely in the form of short-term debt.

QNS, widely recognized as the parent company of Vinasoy, Vietnam’s leading soy milk producer with its renowned Fami brand, has successfully diversified its portfolio. With a multitude of subsidiaries, factories, and enterprises under its belt, QNS has ventured into various industries. These include the Dung Quat Brewery, Biscafun Confectionery, Thach Bich Mineral Water, Mía Center of Excellence, and a range of sugar-related factories such as An Khe Sugar, Pho Phong Sugar, and Nha Sugar.

On the stock market, QNS shares are currently trading at 48,600 VND per share, reflecting a notable 17% increase since the beginning of the year.

“A Significant Spike in Margin Lending: DNSE’s Third Quarter Report Shows a 65% Increase in Margin Debt Since the Start of the Year”

In Q3 of 2024, DNSE Securities’ margin lending outstanding balance witnessed a remarkable 65% year-to-date surge, significantly contributing to the firm’s steady growth trajectory. This quarter, DNSE reported a 12% increase in revenue, totaling VND 193.7 billion, alongside a 10% year-over-year rise in net profit, amounting to VND 44.3 billion, compared to the same period in 2023.

The Capital-Raising Enterprise: How TTC Group Masters the Art of Bond Issuance

“The investment arm of TTC Group, TTC Investment, has successfully raised 2,000 billion VND through a bond issuance. This successful fundraising effort underscores TTC Investment’s strong standing in the market and the confidence that investors have in the group’s prospects.”