The Vietnamese stock market witnessed a recovery during the latest trading session, but the gains were limited. The market quickly retreated after reaching 1,274 points, closing on October 24th with VN-Index down 13.49 points (-1.06%) at 1,257.41 points.

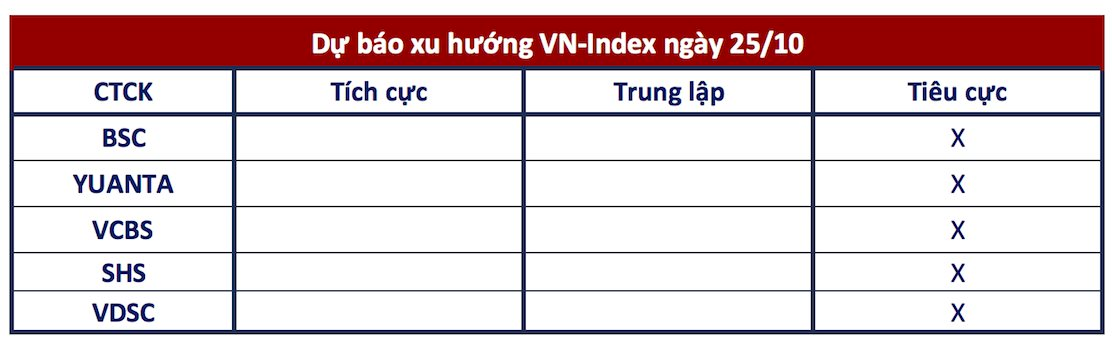

Looking ahead to the next trading session, most securities companies predict a negative scenario, anticipating continued decline for the VN-Index, which may retest the support region of 1,240 – 1,250 points. Here are the specific predictions:

Increasing Downward Pressure

BSC Securities

The latest decline confirms the short-term downward trend after falling below the SMA100 at 1,267 points, which also forms the neckline of a mini double-top pattern. Downward pressure is mounting, and the VN-Index is likely to drop towards the price target of this pattern at 1,238 points.

Yuanta Securities

The market is expected to continue its downward trajectory in the next session, with the VN-Index likely to retest the support region of 1,240 – 1,250 points. While short-term risks are increasing, technical indicators are deeply oversold, and there are signs of growing short-term demand for Midcap and Smallcap stocks. Therefore, investors are advised to refrain from panic selling during the next decline.

VCBS Securities

On the hourly chart, RSI and MACD indicators also signal the oversold region, but there are no signs of a bottom formation yet. This suggests that the VN-Index may continue to decline due to inertia in the next 1-2 sessions. Additionally, the DI- and ADX indicators are in high territory, reinforcing this prediction.

Further Adjustment to 1,255 Points

SHS Securities

The short-term trend for the VN-Index remains under pressure, adjusting towards the price range around 1,255 points, the highest price of 2023, with the nearest resistance around 1,275 points.

Retreating to Test Support at 1,240-1,250 Points

VDSC Securities

The market’s recovery attempt failed, and it continued to retreat. Liquidity increased compared to the previous session, indicating a resurgence of supply, which continues to put pressure on the market. The significant drop caused the market to close below the 1,265-point support level. Currently, the downward momentum persists, suggesting the market will likely continue to retreat in the next session and test the support region of 1,240 – 1,250 points. This support region may provide a positive impact and facilitate a technical recovery in the coming period.

Therefore, investors should monitor supply and demand dynamics at the support region to assess market conditions. They can consider the current adjustment to make short-term purchases at attractive prices for certain stocks, but it is essential to remain cautious about the recovery to restructure their portfolios towards minimizing risks.

The Market Beat: VN-Index Struggles at the 1,270-Point Mark

The market closed with slight losses, as the VN-Index dipped by 0.67 points (-0.05%) to finish at 1,269.93, while the HNX-Index fell by 0.2 points (-0.09%) to 232.47. The market breadth was relatively balanced, with 330 decliners against 322 advancers. The large-cap VN30-Index painted a similar picture, with 16 stocks in the red, 11 in the green, and 3 unchanged.

The Stock Market Week of October 21-25, 2024: Short-Term Adjustment Pressures

The VN-Index has been on a downward spiral, slipping below the middle Bollinger Band. This, coupled with trading volumes that remain below the 20-day average, indicates a persistent investor caution. To add to the woes, consistent net selling by foreign investors has also contributed to the mounting pressure on the index.

The Market Beat: Downward Momentum Persists, VN-Index Loses 1,260-Point Mark

At the end of the trading session, the VN-Index declined by 4.69 points (-0.37%), settling at 1,252.72. The HNX-Index witnessed a marginal loss of 0.06 points (-0.03%), closing at 224.63. The market breadth tilted towards decliners, with 377 stocks trading lower against 286 gainers. The VN30-Index, representing the top 30 stocks by market capitalization and liquidity, exhibited a similar trend, with 19 stocks closing in the red, 4 in the green, and 7 remaining unchanged.