I. VIETNAMESE STOCK MARKET UPDATE: WEEK OF OCTOBER 21-25, 2024

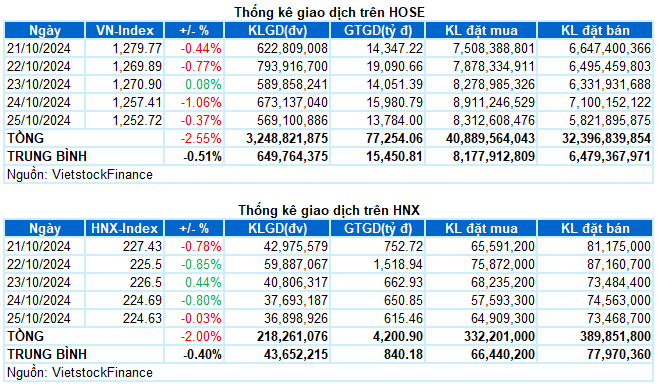

Trading: The main indices continued to decline in the final trading session of the week. At the close of October 25, VN-Index fell by 0.37%, settling at 1,252.72 points; while HNX-Index dipped by 0.03%, ending at 224.63 points. For the week, VN-Index lost a total of 32.74 points (-2.55%), and HNX-Index dropped by 4.58 points (-2%).

The stock market faced challenges again this week as selling pressure dominated. Investor sentiment grew cautious amid a lack of recovery catalysts, with market liquidity staying below the 20-week average for the third consecutive week. Additionally, the persistent foreign sell-off, with no signs of abating, further contributed to the downward pressure on the indices. In the last session of the week, VN-Index shed 4.69 points, equivalent to a 0.37% decline from the previous session.

In terms of contribution, the top 10 negative-impact stocks dragged VN-Index down by more than 3.5 points, led by BID, GVR, VIC, and MSN, causing the index to lose over 2 points. Conversely, the top 10 positive-impact stocks helped the index recoup just over 1 point.

Most sectors were painted red in the final session, with the energy group at the bottom, falling by 0.85%. This decline was driven by selling pressure in the sector’s largest stocks, including BSR (-0.93%), PVS (-1.05%), and PVD (-0.97%).

Following closely were the materials and consumer staples sectors, which dropped by approximately 0.6%. This was mainly influenced by the performance of GVR (-1.98%), DGC (-1.27%), VCS (-1.26%), and NTP (-1.01%); along with MSN (-1.66%), VNM (-0.58%), SAB (-0.72%), HAG (-3.79%), and DBC (-1.07%).

Telecom was the only sector to buck the market trend, ending the week with a 0.65% gain. Buoyancy was seen in stocks like VGI (+0.91%), FOX (+0.22%), FOC (+1.74%), and YEG (+1.68%).

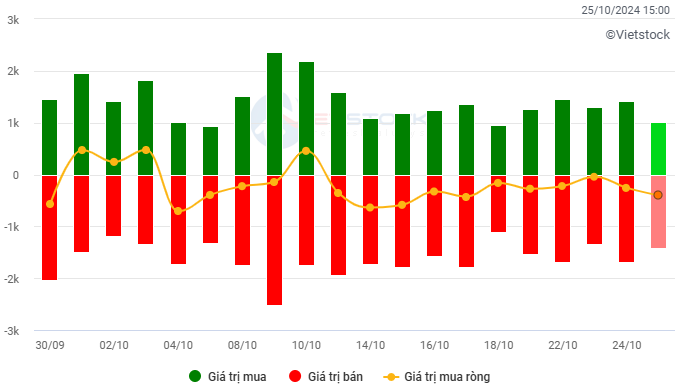

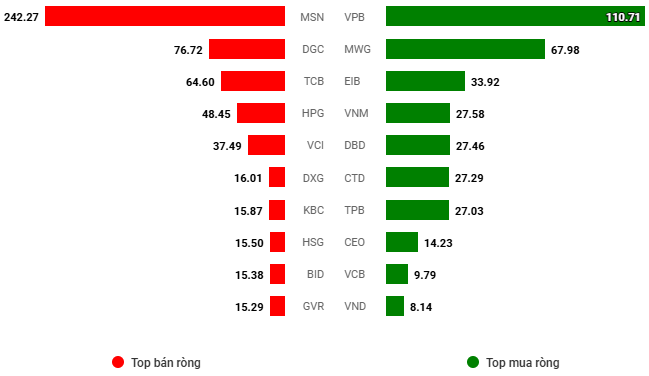

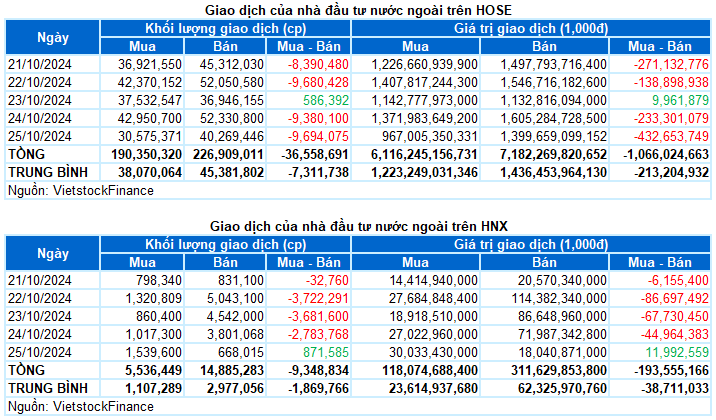

Foreign investors maintained their net-selling position, offloading nearly VND 1,260 billion on both exchanges this week. This included net selling of over VND 1,060 billion on the HOSE and nearly VND 194 billion on the HNX exchange.

Trading value of foreign investors on HOSE, HNX, and UPCOM exchanges by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

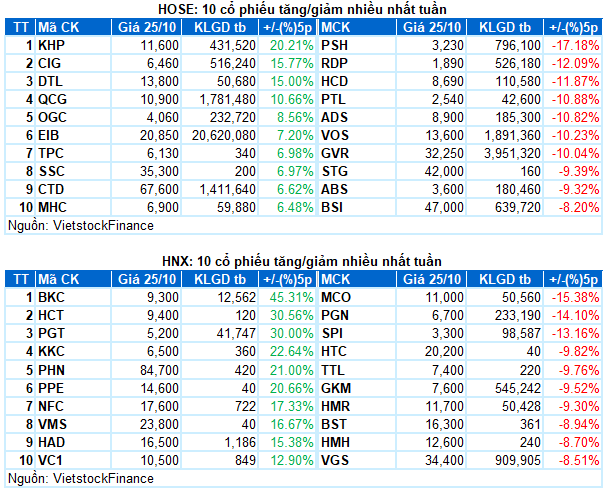

Stocks that stood out with significant gains this week include KHP

KHP surged by 20.21%: KHP witnessed a stellar week, climbing by 20.21%. The stock consistently rose sharply, forming a Rising Window candlestick pattern. Moreover, trading volume surged and surpassed the 20-day average, indicating increased participation and interest from investors.

However, the Stochastic Oscillator indicator has ventured deep into overbought territory. Investors should exercise caution in the coming sessions if sell signals reappear.

On the flip side, PSH was among the notable decliners for the week

PSH slumped by 17.18%: PSH underwent a negative trading week, consistently falling and hugging the Lower band of the Bollinger Bands. Moreover, trading volume remained below the 20-day average, reflecting investor caution.

Currently, the Stochastic Oscillator and MACD indicators continue to trend downward after generating sell signals. This suggests that the risk of further downside pressure remains in the near term.

II. WEEKLY STOCK MARKET STATISTICS

Economics & Market Strategy Division, Vietstock Consulting

The Market Beat: Downward Momentum Persists, VN-Index Loses 1,260-Point Mark

At the end of the trading session, the VN-Index declined by 4.69 points (-0.37%), settling at 1,252.72. The HNX-Index witnessed a marginal loss of 0.06 points (-0.03%), closing at 224.63. The market breadth tilted towards decliners, with 377 stocks trading lower against 286 gainers. The VN30-Index, representing the top 30 stocks by market capitalization and liquidity, exhibited a similar trend, with 19 stocks closing in the red, 4 in the green, and 7 remaining unchanged.

The Cautious Sentiment Persists

The VN-Index closed the session with a slight gain, retesting the old bottom from early October 2024 (equivalent to the 1,265-1,270 point range). If, in the coming days, the index holds firm above this threshold, coupled with trading volumes surpassing the 20-day average, the short-term outlook will turn more positive. Moreover, the MACD indicator needs to flash a buy signal again to sustain this optimism.

The Market Beat: A Rapid Decline, A Strong Surge in the Expiry of Derivatives

The VN-Index faced pressure throughout the morning session and the early minutes of the afternoon, dipping below 1,272 points. However, true to the nature of an expiration day for derivatives, the VN-Index staged a strong comeback, closing above 1,286 points. This impressive turnaround was largely driven by the banking, securities, and real estate sectors, which provided the much-needed boost to push the index higher.

Vietstock Weekly 14-18/10/2024: Aiming for July 2024 Highs

The VN-Index rallied and staged a strong recovery last week after retesting the middle line of the Bollinger Bands. However, trading volume fell below the 20-week average, indicating that investors are becoming cautious again. In the coming week, the index has the opportunity to target the old peak of July 2024 (corresponding to the 1,290-1,300 point range). If the index can surpass this crucial threshold, we may see a more positive outlook emerge.