The latest update from the Ho Chi Minh City Stock Exchange (HoSE) shows that Vinhomes (VHM) has successfully purchased a total of nearly 29.1 million treasury shares, accounting for 7.86% of the registered amount after two sessions. According to the plan, Vinhomes will buy back up to 370 million treasury shares (8.5% of the total circulating shares) through matching and/or agreement from October 23 to November 21, 2024.

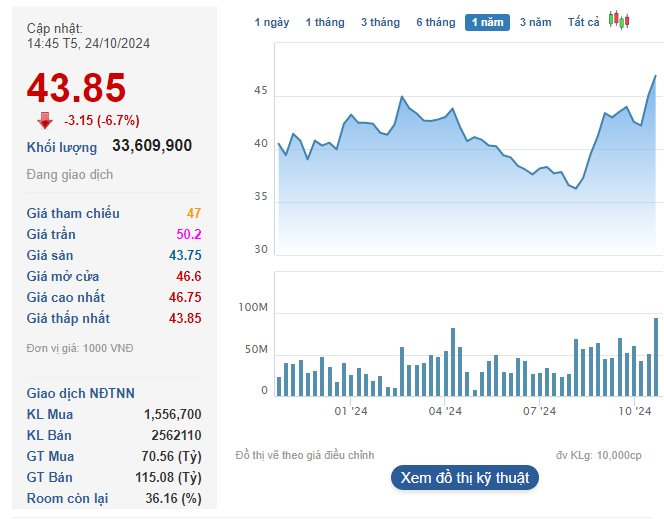

On October 24, Vinhomes shares witnessed a significant drop of 6.7% from the previous session, settling at VND 43,850 per share. The trading volume remained robust with 33.6 million shares changing hands, the second-highest in history, only surpassed by the session on August 7.

Notably, this was the second consecutive session of sharp declines for VHM since Vinhomes started buying treasury shares. The company’s market capitalization quickly dropped by more than VND 19,000 billion in just two sessions, falling to around VND 191,000 billion.

Prior to this, the stock had rallied nearly 40% from its all-time low in early August to reach a one-year high of VND 48,250 per share on October 22, right before the treasury share purchase took place.

Vinhomes stated that the reason for the buyback was that the market price of VHM shares was lower than the company’s actual value, and the repurchase aimed to protect the interests of the company and its shareholders. According to regulations, Vinhomes will place a minimum order of 11.1 million shares and a maximum of 37 million shares per day during the trading period.

It is estimated that Vinhomes could spend more than VND 17,000 billion on this transaction. If successful, it will be the largest treasury share purchase in the history of Vietnam’s stock market. The company affirmed that the share buyback plan would be funded by available cash and operating cash flow from the sale of certain projects. Therefore, the purchase of treasury shares will have a limited impact on the company’s liquidity and debt ratios.

The estimated amount of money that Vinhomes may have to spend on this transaction exceeds VND 17,000 billion. If successful, it will be the largest treasury stock purchase in the history of Vietnam’s securities market. The company affirms that the plan to buy back shares will be funded by available cash and operating cash flow from the sale of some projects. As a result, the repurchase of treasury shares will have a limited impact on the company’s liquidity and debt ratios.

The VN-Index Breaks Losing Streak: Vinhomes Shares (VHM) Fluctuate on Landmark “Deal of the Century” in Vietnam’s Stock Market

The VN-Index successfully halted its losing streak, reclaiming the 1,270-point level. In a surprising turn of events, shares of VHM, owned by real estate giant Vinhomes, plummeted on the day of the highly anticipated “historic deal” in the stock market industry.

The Market Beat: VN-Index Struggles at the 1,270-Point Mark

The market closed with slight losses, as the VN-Index dipped by 0.67 points (-0.05%) to finish at 1,269.93, while the HNX-Index fell by 0.2 points (-0.09%) to 232.47. The market breadth was relatively balanced, with 330 decliners against 322 advancers. The large-cap VN30-Index painted a similar picture, with 16 stocks in the red, 11 in the green, and 3 unchanged.

Market Beat: Buyers Return in Afternoon Trade, VN-Index Surges Over 9 Points

The market ended the session on a positive note, with the VN-Index climbing 9.87 points (0.78%) to reach 1,281.85, while the HNX-Index gained 0.25 points (0.11%), closing at 231.77. The market breadth tilted in favor of the bulls, as evident from the advance-decline ratio of 411:256. A similar trend was observed in the VN30 basket, with 22 stocks advancing, 6 declining, and 1 remaining unchanged, resulting in a sea of green on the screen.