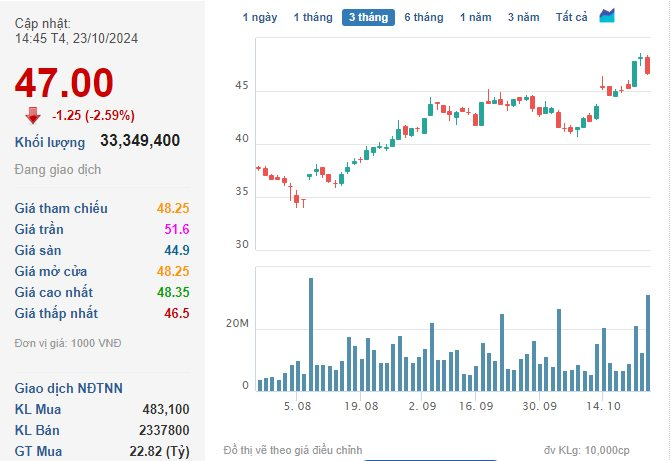

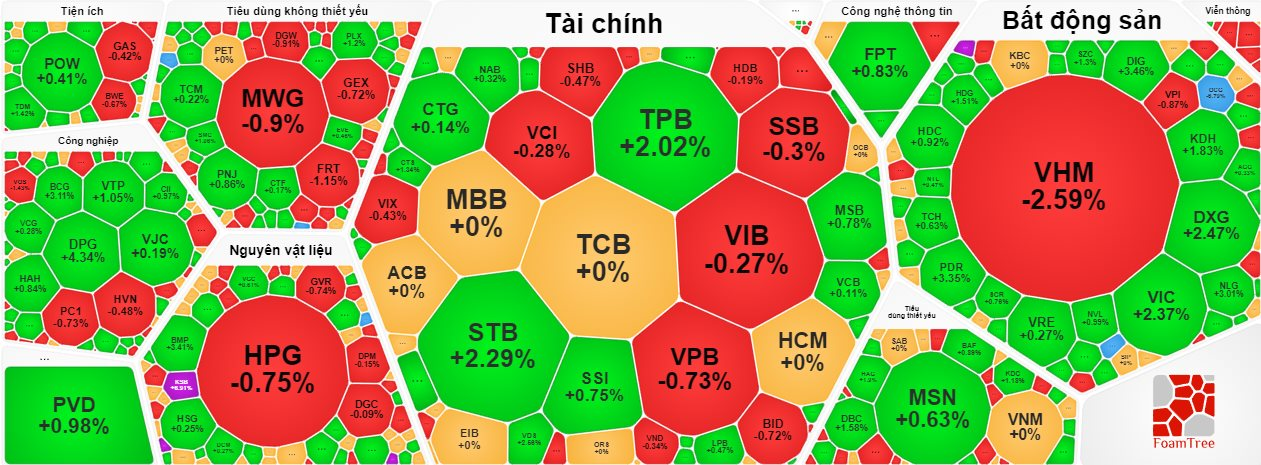

Closing session on October 23, Vinhomes (VHM) shares dropped to VND 47,000 per share, down 2.59% from the previous session, with a sharp increase in trading volume to more than 33.3 million units.

Previously, this real estate giant had planned to buy back up to 370 million treasury shares.

The company announced that the purpose of this plan was to ensure the company’s and shareholders’ interests as the market price of VHM shares was lower than the company’s actual value.

Prior to this historic deal in the stock market, VHM’s share price had been consistently soaring since hitting an all-time low in early August.

From this low, VHM shares surged approximately 40% to the highest level in the past year. Concurrently, Vinhomes’ market capitalization reached approximately VND 207 trillion (equivalent to $8.1 billion), becoming the fourth-largest listed company in the market, following Vietcombank, BIDV, and FPT.

After a long preparation period, Vinhomes recently confirmed the timeline for this massive treasury share purchase from October 23, 2024, to November 21, 2024.

VHM’s share price has been “soaring” recently. (Source: Cafef)

However, on the first day of this historic stock market deal, VHM’s share price unexpectedly plummeted.

VN-Index breaks the losing streak

The stock market witnessed another volatile session, but thanks to strong bottom-fishing momentum towards the end, the VN-Index managed to escape danger, reclaiming the 1,270-point level.

On October 23, the VN-Index rose 1.01 points to 1,270.9. The HNX-Index gained 1 point to 226.5. Similarly, the UPCoM-Index climbed 0.39 points to 92.12.

Today, market liquidity unexpectedly dropped, with the total trading value on the three exchanges reaching just over VND 15,300 billion. On the HoSE alone, liquidity reached more than VND 14,050 billion.

Green dominated the screens, and the VN-Index reclaimed the 1,270-point level.

The market breadth inclined towards the positive side, with 182 gainers (including 4 stocks hitting the ceiling price) on the HoSE compared to 130 losers (including 5 stocks hitting the floor price).

The focus of the session was on real estate stocks. While VHM shares plunged, a slew of blue-chip stocks in the sector unexpectedly attracted strong investment inflows. Nam Long (NLG) led the gains, climbing 3.01% to VND 39,300, followed by VIC (+2.37%), PDR (+3.35%), DIG (+3.46%), DXG (+2.47%), and others.

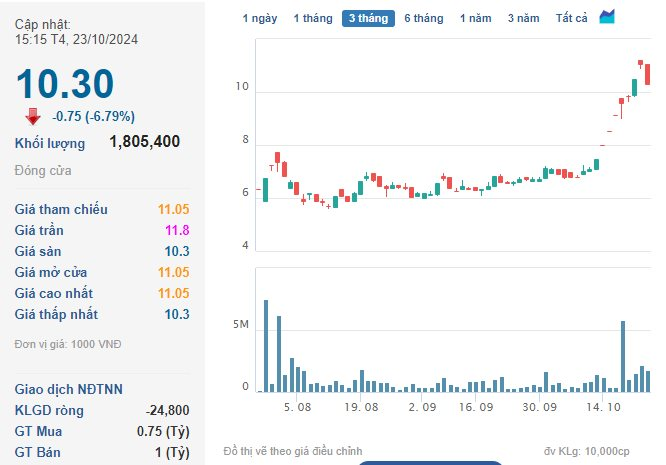

After a streak of 10 consecutive gaining sessions, shares of QCG of Quoc Cuong Gia Lai JSC unexpectedly hit the floor price today.

QCG shares hit the floor price after a streak of 10 gaining sessions. (Source: Cafef)

At the end of the October 23 session, QCG shares stood at VND 10,300 per share, down 6.79% from the previous session, with a trading volume of over 1.8 million units.

In the banking group, most blue-chip stocks declined by less than 1%, such as HDB, BID, VIB, VPB, SSB, and SHB. Conversely, STB and TPB surged over 2%. Meanwhile, the two largest capitalized stocks in the stock market, VCB and BID, inched up slightly by less than 1%.

In other sectors, the screens were divided between green and red.

Foreign investors ended their eight-session net selling streak on the HoSE, with a net buy value of nearly VND 10 billion.

They net bought TCB shares the most, with a value of nearly VND 145 billion. This was followed by STB (VND 57.09 billion), MSN (VND 43.87 billion), SSI (VND 42.87 billion), PDR (VND 37.1 billion), FPT (VND 35.54 billion), and others.

On the selling side, they net sold VHM shares the most, with a value of VND 86.98 billion. This was followed by FUEVFVN (VND 72.15 billion), HPG (VND 53.1 billion), SHS (VND 46.58 billion), KBC (VND 27.95 billion), and others.

The Stock Brokers’ View: Downside Pressure Mounts, VN-Index to Test 1,240-1,250 Support Zone

According to VDSC, investors may consider the current corrective action as an opportunity to buy select stocks at attractive prices for short-term gains.

The Market Beat: VN-Index Struggles at the 1,270-Point Mark

The market closed with slight losses, as the VN-Index dipped by 0.67 points (-0.05%) to finish at 1,269.93, while the HNX-Index fell by 0.2 points (-0.09%) to 232.47. The market breadth was relatively balanced, with 330 decliners against 322 advancers. The large-cap VN30-Index painted a similar picture, with 16 stocks in the red, 11 in the green, and 3 unchanged.

The Stock Market Week of October 21-25, 2024: Short-Term Adjustment Pressures

The VN-Index has been on a downward spiral, slipping below the middle Bollinger Band. This, coupled with trading volumes that remain below the 20-day average, indicates a persistent investor caution. To add to the woes, consistent net selling by foreign investors has also contributed to the mounting pressure on the index.