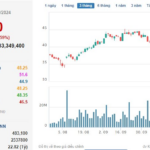

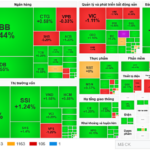

The VN-Index had a negative trading week, unable to maintain its short-term upward trend. The benchmark index recovered to the 1,290-point region at the beginning of the week, but then faced strong corrective pressure for five consecutive sessions. For the week of October 21-25, the VN-Index fell by -2.55% to 1,252.72 points.

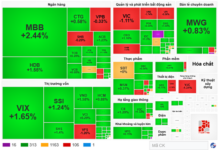

Nevertheless, the market still witnessed a strong divergence, with the recovery momentum concentrated mostly in stocks with positive third-quarter earnings results.

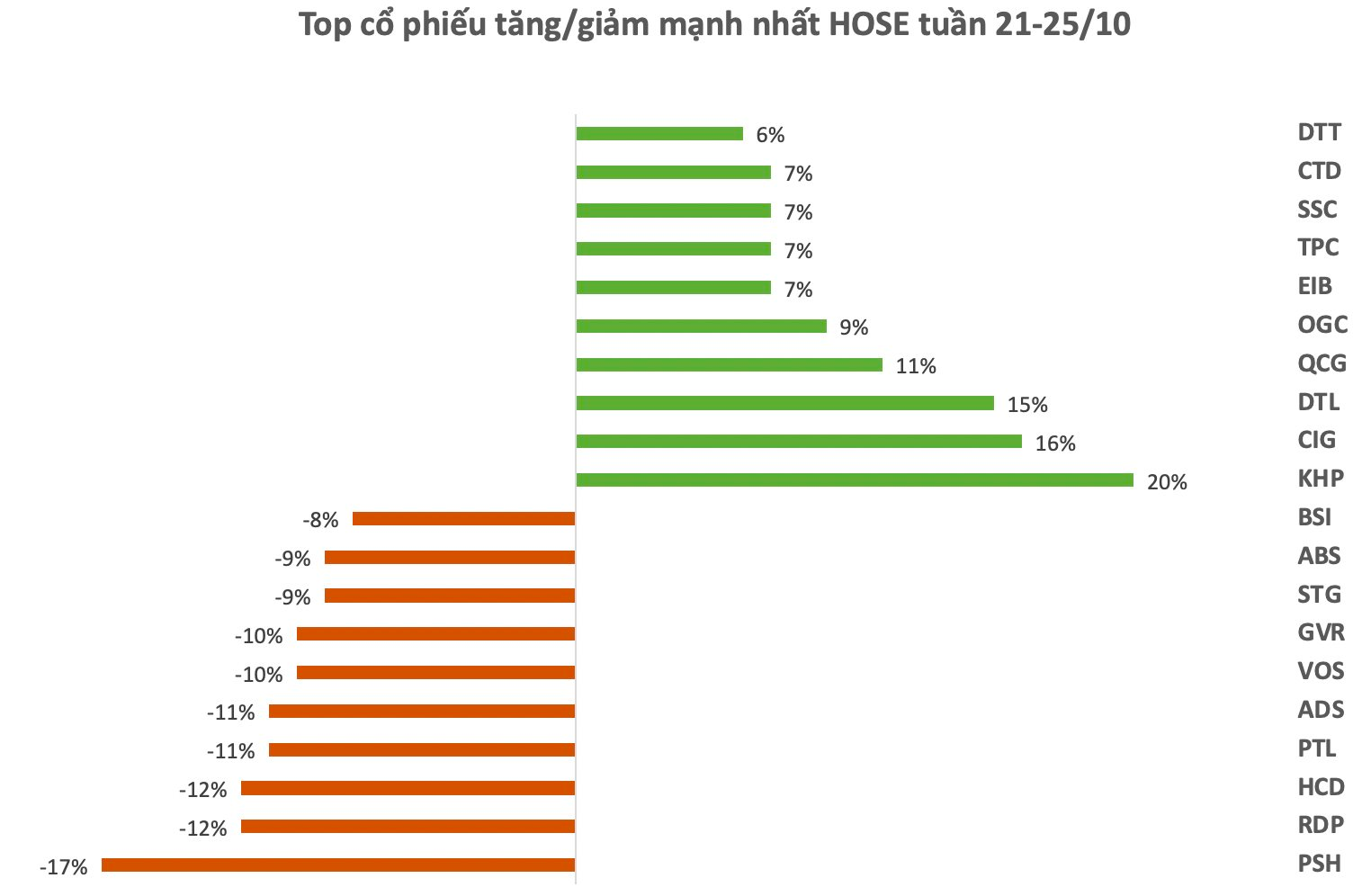

On the Ho Chi Minh Stock Exchange (HoSE)

, gainers outnumbered losers, with some stocks surging up to 20%. KHP topped the list of biggest gainers, with its share price reaching the ceiling price of VND11,600 per share (as of the session on October 25) and trading volume skyrocketing to over 750,000 units. Notably, this was the second consecutive session of KHP hitting the ceiling price, pushing its share price to the highest level in 2.5 years (since April 15, 2022).

KHP’s rally followed the company’s announcement of positive third-quarter financial results. Specifically, net revenue reached VND1,979 billion, up 12% year-on-year, while after-tax profit surpassed VND76 billion, compared to a loss of VND45 billion in the same period last year.

QCG stock continued its bullish trend, rising 11% week-over-week. This marked the highest price for this real estate stock since the arrest of Ms. Nguyen Thi Nhu Loan, former General Director of Quoc Cuong Gia Lai, in relation to allegations of legal violations in the transfer of the project at 39-39B Ben Van Don, District 4, Ho Chi Minh City.

On the other hand, PSH faced strong profit-taking pressure and lost 17% during the week.

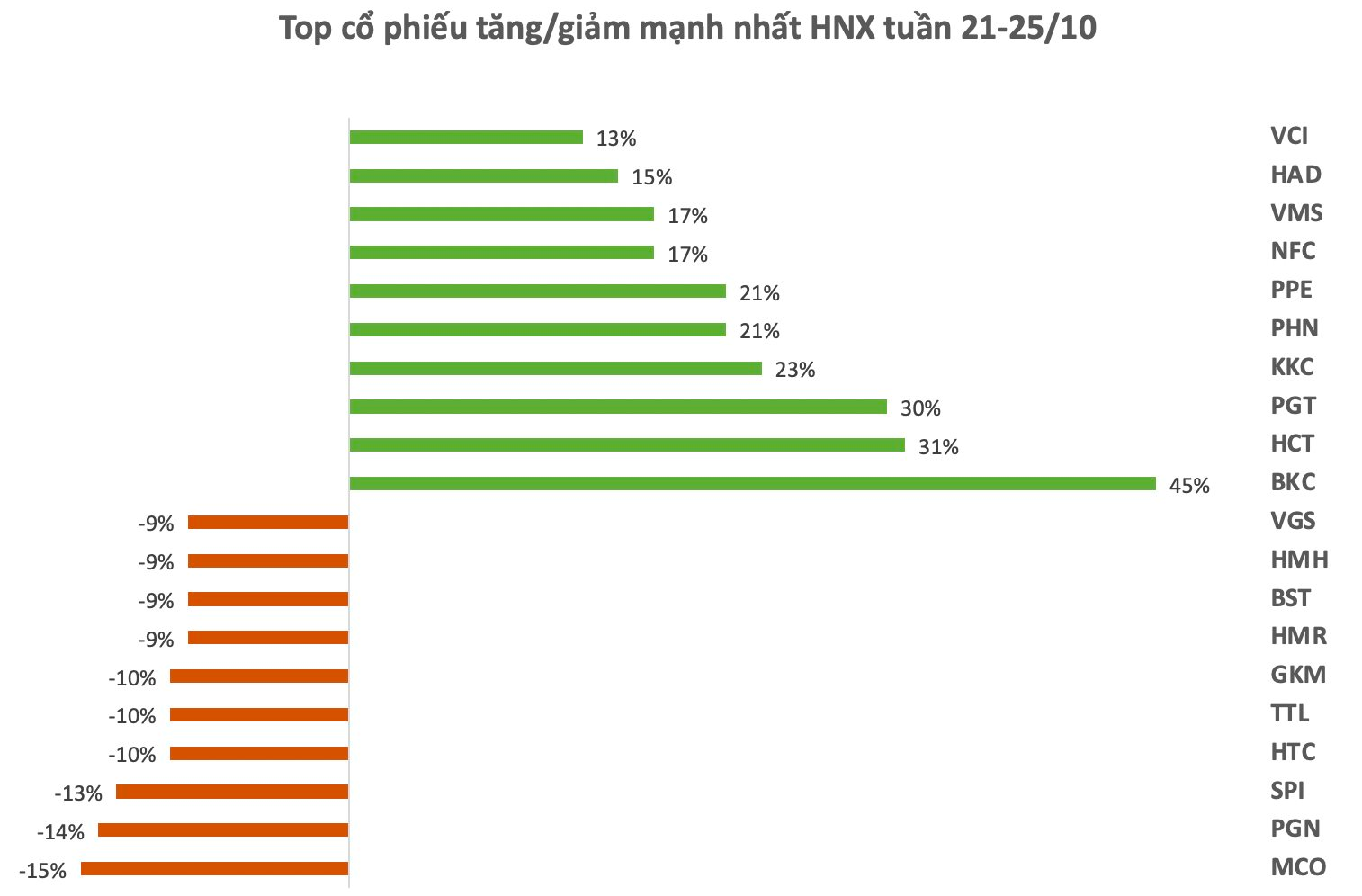

On the Hanoi Stock Exchange (HNX)

, gainers were mostly small-cap stocks with low liquidity, such as BKC, HCT, PGT, and KKC. Notably, BKC consistently hit the ceiling price during the week, with its share price surging by 45%. This sharp increase followed BKC’s impressive third-quarter earnings report, with after-tax profit reaching VND19 billion, a remarkable growth of over 3,300% compared to the modest profit of nearly VND600 million in the same period last year.

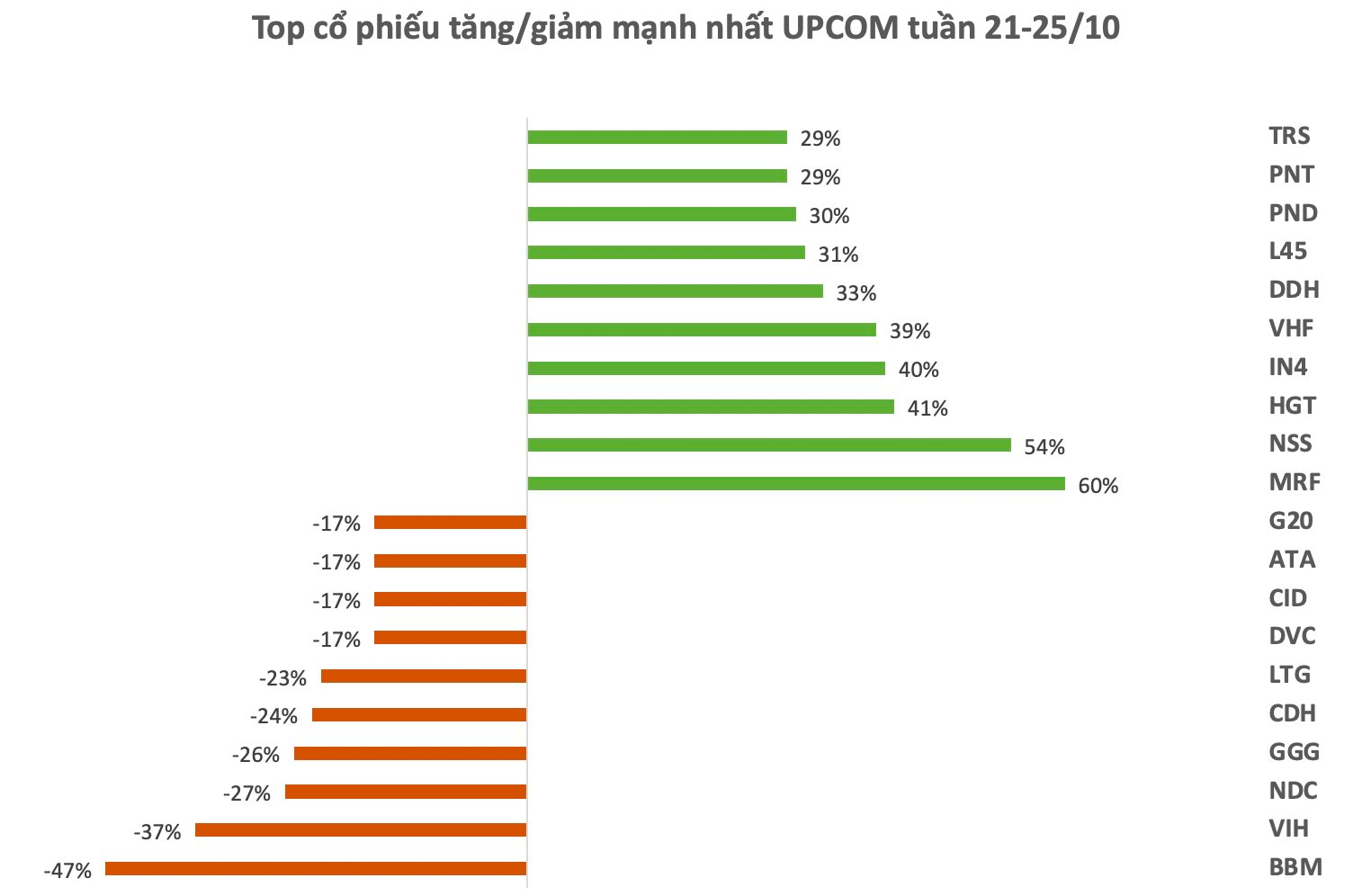

On the Unlisted Public Company Market (UPCOM)

, MRF of Merufa Joint Stock Company led the gainers, surging by nearly 60%. However, trading volume for this stock remained subdued, with only a few hundred units traded and even some sessions with no transactions.

Following MRF, NSS, HGT, and IN4 also attracted attention with gains of 40-54% for the week. Nonetheless, trading liquidity for these stocks was lackluster, with many sessions witnessing no trading activity.

Conversely, many stocks on UPCOM also recorded losses ranging from 17% to 47% during the week.

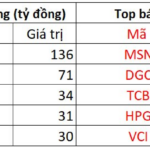

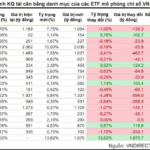

The Foreign Sell-Off Continues: Blue-Chip Stock Dumps Over $10 Million Worth of Shares

The foreign transactions were less than enthusiastic, as they sold a net value of VND 384 billion across the market.