The packaging industry is experiencing robust growth globally, especially in developing markets. This growth is driven by several factors, including the e-commerce boom, rising consumer demand, and free trade policies.

According to Market Research Future, the compound annual growth rate (CAGR) for the global market of plastic packaging is 3.6%, and paper packaging is 4.7% during the period of 2023-2030.

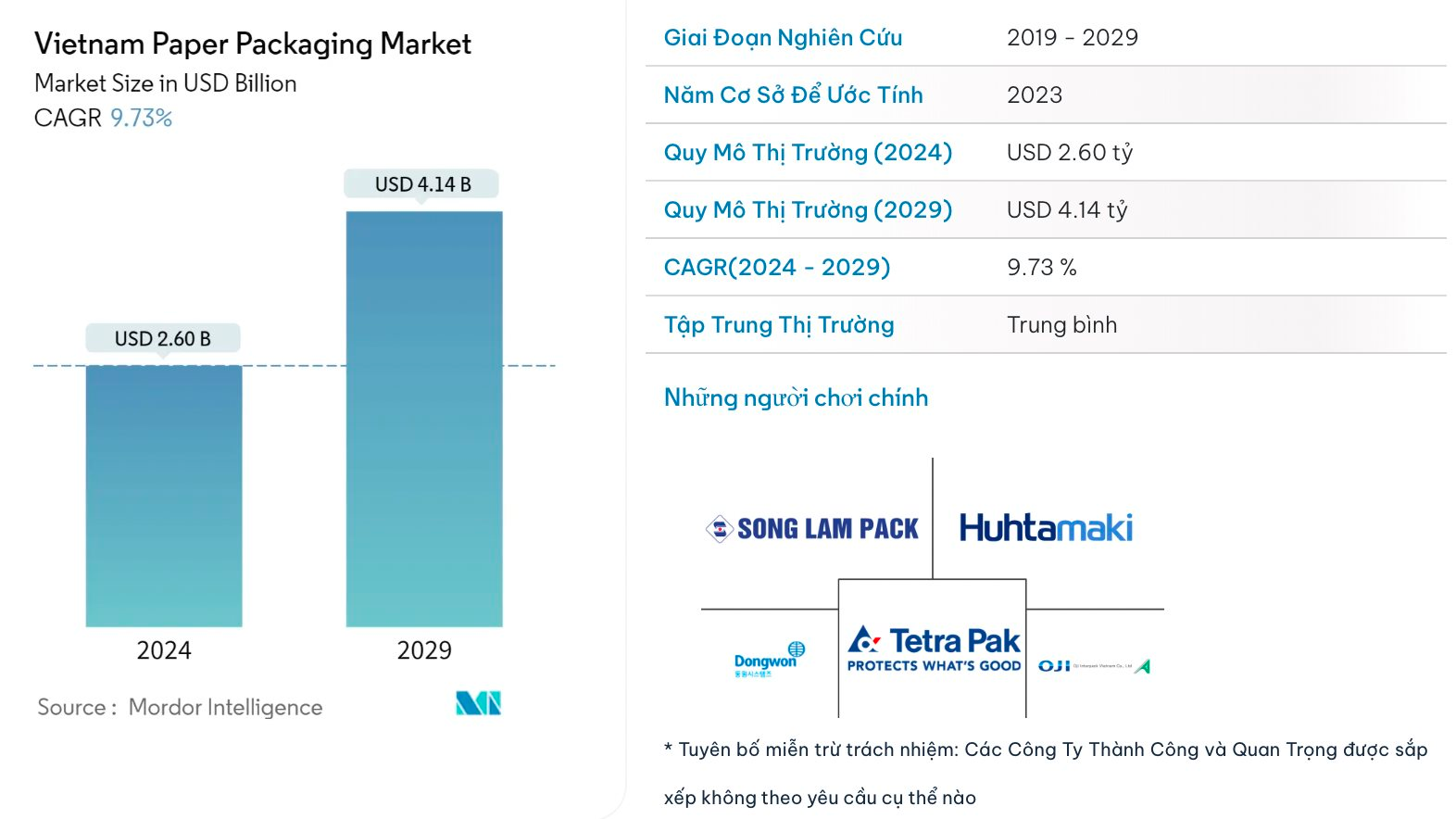

In Vietnam, Mordor Intelligence forecasts the paper packaging market size to reach USD 2.6 billion by 2024 and is expected to reach USD 4.14 billion by 2029, growing at a CAGR of 9.73% during the forecast period (2024-2029). Vietnam’s paper packaging market is expected to expand significantly during the forecast period, with several companies projecting sales growth in the coming years. The country’s stable economic situation and high urbanization rate are expected to drive the use of paper packaging formats.

With the ever-expanding global trade, the packaging industry plays a crucial role in product protection. According to the Vietnam Packaging Association, there are currently about 14,000 businesses operating in the packaging industry in the country, of which about 9,200 businesses focus on plastic packaging. This sector attracts the interest of many domestic and foreign investors due to its rapid growth rate in Vietnam, as noted at VietnamPrintPack 2024.

VietnamPrintPack 2024 is an annual exhibition in the Vietnamese packaging industry. This year, the exhibition scale has continued to increase to 19,850m2, featuring 900 booths from over 362 businesses from 17 countries and territories, including Australia, China, Denmark, Germany, Hong Kong, India, Indonesia, Israel, Japan, Malaysia, the Netherlands, the Philippines, Taiwan, Thailand, the UK, the US, and Vietnam.

Experts believe that there is still significant room for growth in Vietnam’s packaging industry, especially in the food and beverage sectors. Businesses have been and are seeking to strengthen their global presence by improving product quality, reducing production costs, and adhering to environmental standards.

Figure 1: Vietnam’s packaging industry has significant growth potential, especially in the food and beverage sectors.

However, Vietnam is facing several risks associated with plastic waste. According to statistics from the Ministry of Natural Resources and Environment, about 1.8 million tons of plastic waste are released into the environment in Vietnam each year, of which 0.28 to 0.73 million tons are discharged into the sea. However, only 27% of this waste is recycled by facilities and businesses. Hanoi and Ho Chi Minh City, the two largest cities, release about 80 tons of plastic waste into the environment daily, but only a small percentage of plastic packaging products are recycled, significantly impacting the environment and causing economic waste.

Moreover, in export markets, especially those with developed economies, stricter environmental regulations have been imposed on imported goods. Global consumers prefer to choose products from environmentally responsible companies, and they favor eco-friendly and biodegradable packaging materials.

In reality, Vietnamese businesses often lose orders when foreign companies leverage their financial and technological advantages to capture market share. A representative from the Vietnam Association of Seafood Exporters and Producers warned about cases where exporters of shrimp products lost their market in the EU due to non-compliant packaging. Meanwhile, similar product suppliers from Thailand, with better packaging, quickly replaced the Vietnamese companies.

Therefore, to align with global trends, Vietnam’s packaging industry is undergoing a significant transformation towards green, eco-friendly, and sustainable development. This was a prominent topic of discussion at VietnamPrintPack 2024.

Many large enterprises have proactively adopted recycled packaging, such as Coca-Cola, which uses bottles made from 100% recycled plastic, reducing over 2,000 tons of new plastic annually in Vietnam. Similarly, Unilever Vietnam has achieved 63% recyclable packaging, leading to a 52% reduction in virgin plastic use.

However, for the majority of other companies, financial pressure and, notably, the lack of a successor generation, are causing packaging and printing businesses to withdraw from the market or even sell to foreign investors. Out of the total of more than 2,000 packaging and printing companies, over 400 are foreign-owned, capturing more than one-third of export orders. Additionally, hundreds of foreign companies are studying the Vietnamese market, intending to enter it in the coming years.

The Art of the Dual Transformation: Insights from the Business Arena

The synergy between digital and green transformation is undeniable, and when these two forces combine, they create a powerful momentum for change. The dual transformation journey presents a unique set of challenges and opportunities for businesses, even those at the forefront. These challenges are not mere obstacles but catalysts for growth and development. While the cost of this dual transition is significant, the price of falling behind is far greater.

The Green Revolution: Leading the Way in Eco-Consciousness

With extended producer responsibility, businesses are now accountable for the collection and recycling of waste generated from their products. This shift has led to a surge in recycling demands, empowering recyclers with additional resources and presenting a unique opportunity to revolutionize waste management.

Sovico Group and UNESCO Sign a Strategic Partnership Agreement for 2025-2035 During the Official Visit of General Secretary and President To Lam.

On October 7, 2024, at the UNESCO headquarters in Paris, France, the SOVICO Group and UNESCO signed and officially inked a Strategic Partnership Framework Agreement for the period of 2025–2035. This agreement brings to life a number of collaborative programs outlined in the initial Cooperation Agreement between Vietnam and UNESCO.