In a recent report submitted to the National Assembly, the State Bank of Vietnam (SBV) outlined several challenges and obstacles faced in the restructuring of the credit institution system, particularly regarding bad debt handling.

According to the SBV, negotiating with eligible commercial banks for mandatory transfers has been a prolonged and difficult process, largely dependent on the voluntary participation of these banks.

Commercial banks also require time to convince their shareholders, especially major and foreign strategic shareholders, to agree to participate in mandatory transfers.

The policies, financial resources, and procedures for handling weak credit institutions and constructing mandatory transfer plans for the purchased banks, including DongA Bank, remain inadequate and cumbersome.

DongA Bank will continue to refine its plan for future transfer.

Coordination and input from relevant ministries and sectors have been time-consuming due to the complexity and lack of precedent in handling weak banks.

The capacity of some inspectors and supervisors is limited, given the pressure of handling a large volume of complex work and the urgency of the progress, which involves both inspection and supervision, as well as the restructuring of weak banks.

Moving forward, the SBV will continue to closely coordinate with relevant ministries, sectors, and agencies to implement measures to address weak credit institutions effectively.

Specifically, the SBV will vigorously promote the Scheme for restructuring the system of credit institutions in association with handling bad debts in the 2021-2025 period. It will focus on implementing the directions of authorized levels regarding the restructuring and handling of weak banks, ensuring stable operations, and supporting these banks in their gradual recovery.

The SBV will instruct the banks receiving mandatory transfers to finalize the mandatory transfer schemes in accordance with legal regulations and the directions of authorized levels. These schemes will then be submitted to the Government for approval and implementation.

Additionally, the SBV will concentrate on constructing and approving restructuring schemes for weak banks until 2025, aiming to fundamentally address weak banks and credit institutions, especially preventing the emergence of new weak banks.

Earlier, on October 17, the Vietnam International Commercial Joint Stock Bank (Vietcombank) received the transfer of CBBank, while the Military Commercial Joint Stock Bank (MB) took over OceanBank.

Two other banks, the Global Petroleum Joint Stock Bank (GPBank) and DongA Bank, are expected to refine their plans and proceed with transfers in the future.

OceanBank and CBBank were both purchased by the SBV for VND 0 in 2015.

Optimizing the Talent Pool: Supervising 10 Provinces for High-Quality Human Resources

The Oversight Committee on Human Resources Development and Utilization will conduct on-site inspections in 10 localities: Bac Giang, Thai Nguyen, Hanoi, Hai Phong, Hai Duong, Dak Lak, Khanh Hoa, Ho Chi Minh City, Ba Ria – Vung Tau, and Tra Vinh.

“Effective Supervision: Beyond Superficial Checks and Balances”

Vice President Tran Quang Phuong suggested a more targeted approach to delegations’ visits. Instead of sending large groups, he proposed selecting specific provinces for oversight and conducting in-depth, multi-day visits to gather thorough information to effectively serve the supervision activities.

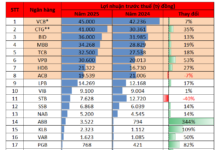

The Big Players: Unveiling the Major Shareholders of Vietnam’s Banking Industry

The disclosure of shareholder lists by joint-stock commercial banks has provided the market with a more comprehensive insight into the ownership structure of these financial institutions. Previously, investors only had access to transaction information and related shareholder data if an individual or entity held at least 5% of the bank’s capital. This new development marks a significant step towards greater transparency in the banking sector.