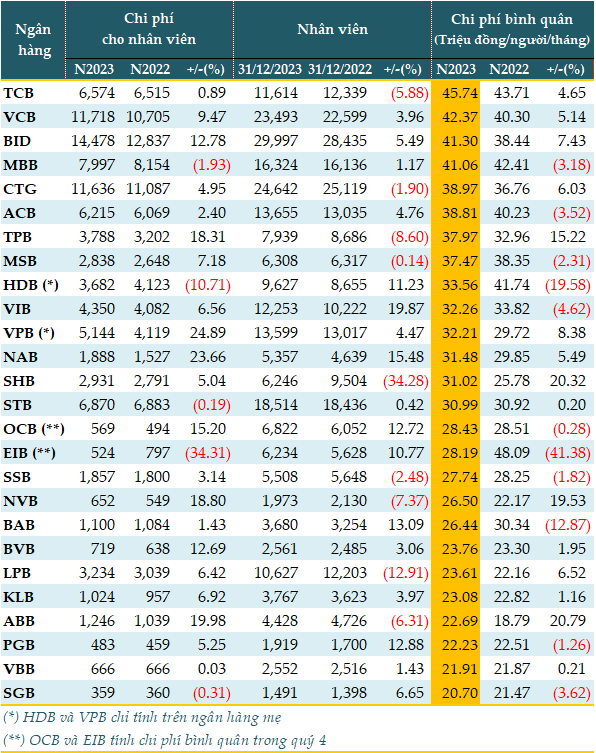

9 of 26 banks cut staff

Data from VietstockFinance shows that 9 out of 26 banks reduced their workforce in 2023, with an average reduction rate of nearly 9%.

SHB is the bank with the largest workforce reduction, at over 34%, leaving only 6,246 employees. Next is LPB (-13%) with 10,627 employees, TPBank (TPB, -9%) cut down to 7,939 employees.

The remaining banks saw an average workforce growth rate of nearly 8%. VIB is the bank with the highest workforce growth rate – nearly 20%, followed by NAB with over 15% and BAB at 13%.

In absolute numbers, VIB is still the bank with the highest number of new hires, adding 2,031 people, BIDV hired an additional 1,562 people, and HDBank hired 972 more people in the year.

Source: VietstockFinance

|

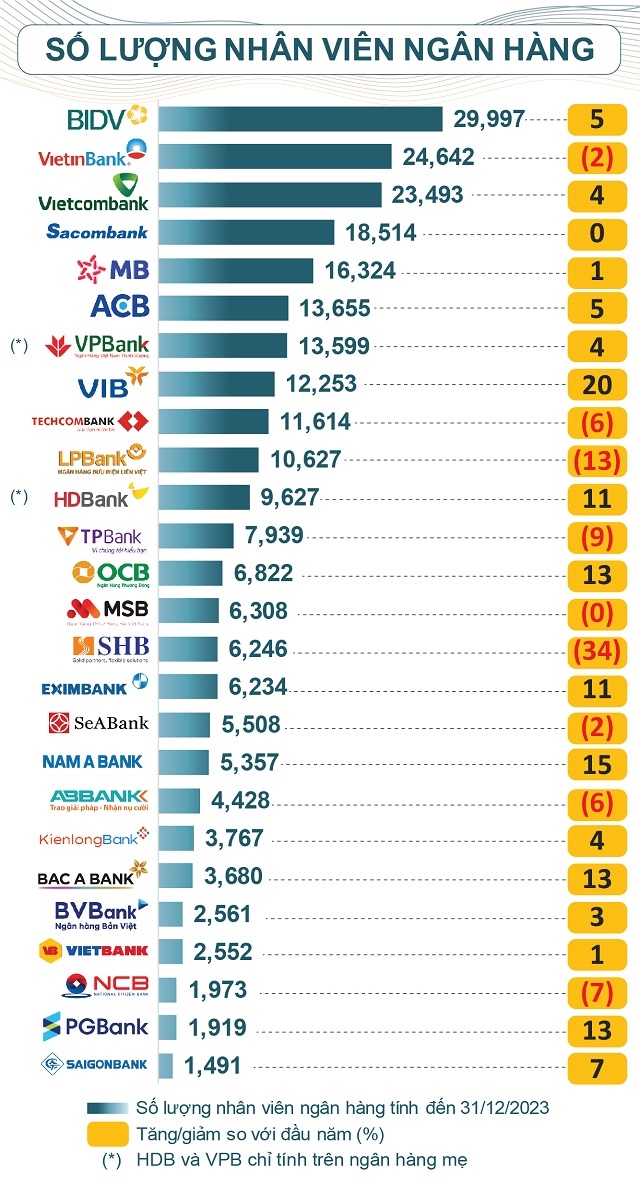

VPBank has the highest increase in employee expenses

In 2023, banks have been strengthening their digital banking presence, cutting operational costs, and lowering interest rates to support customers. Despite the reduction in operational costs, only 5 out of 26 banks reduced costs for employees.

Eximbank (EIB) had the most significant reduction (-34%), with only nearly 524 billion VND, on average, in the fourth quarter. Next is HDBank (HDB) with an 11% reduction, with 3,682 billion VND allocated for employees in 2023.

On the other hand, VPBank (VPB) had the highest increase in employee expenses with a growth rate of nearly 25%. Next is NAB (+24%), ABB (+20%)…

|

Bank employee expenses in 2023 (Unit: Billion VND)

Source: VietstockFinance

|

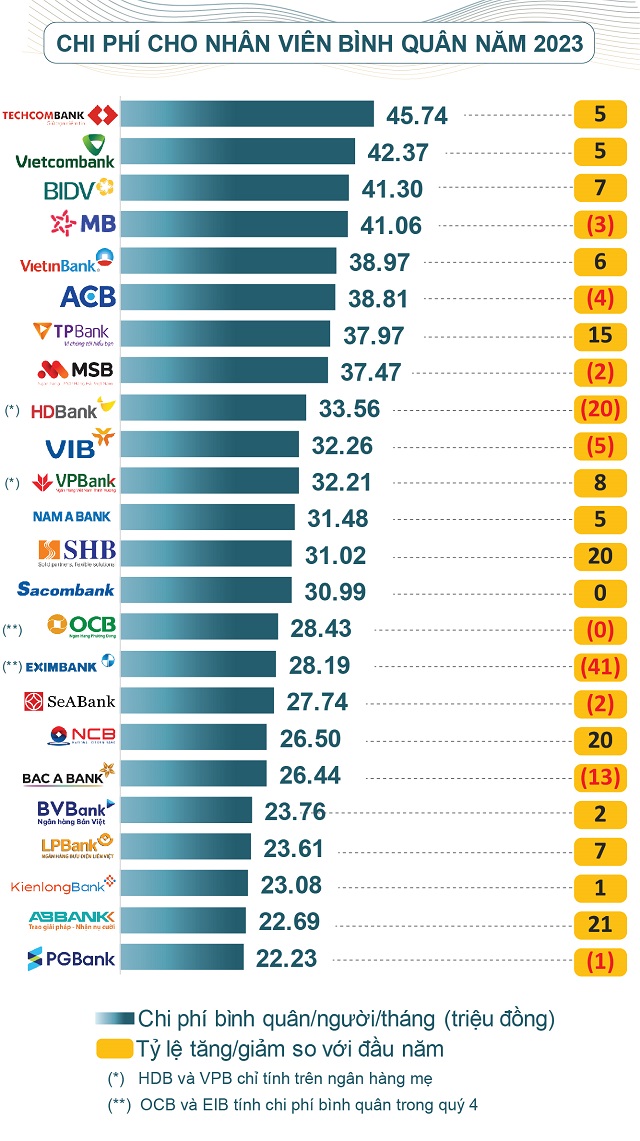

Techcombank (TCB) once again takes the top spot as the bank with the highest average employee expenses, with 45.74 million VND/person/month, and a nearly 5% increase compared to the beginning of the year.

Vietcombank (VCB) ranks second with 42.37 million VND/person/month, a growth of over 5%, and third is BIDV with 41.3 million VND/person/month (+7%). Next are MB (41.06 million VND/person/month) and VietinBank (38.97 million VND/person/month).

The lowest average monthly income in the system is recorded at Saigonbank (SGB) – only 20.7 million VND/person/month. This figure also decreased by nearly 4% compared to the beginning of the year.

Source: VietstockFinance

|