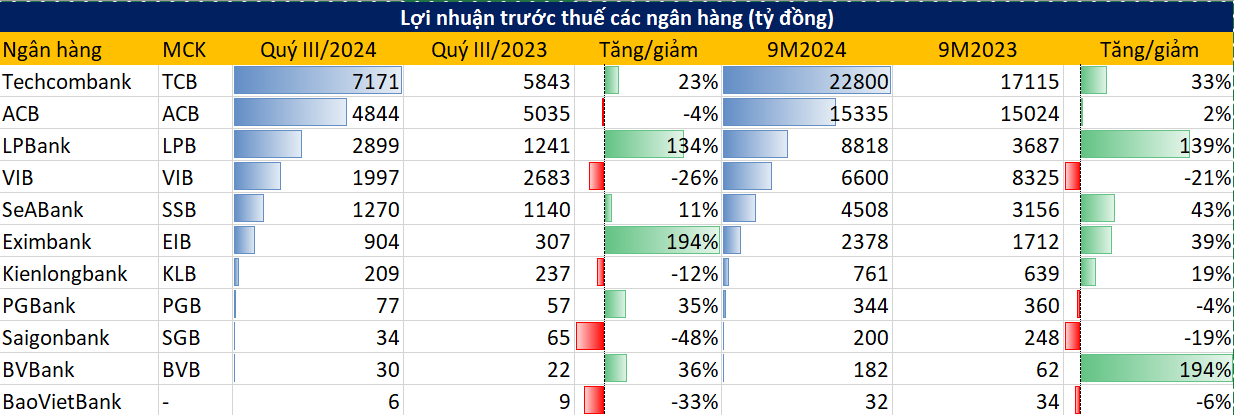

Eximbank Reports Triple-Fold Increase in Q3 Profit

Eximbank: Q3 Profit Surges by Three Times

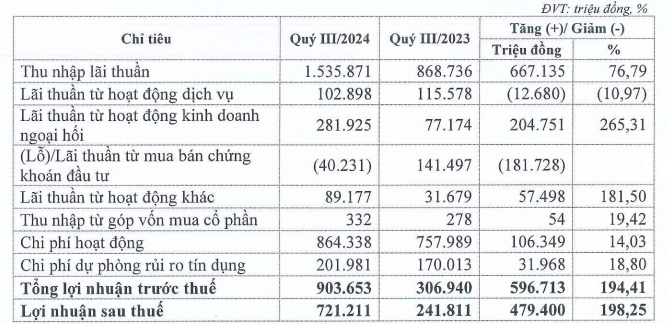

On October 25, the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Eximbank – EIB) released its Q3/2024 financial report.

According to the report, Eximbank’s pre-tax profit for Q3/2024 reached VND 903 billion, marking a 194% increase compared to the same period last year, or nearly three times higher than Q3/2023.

For the first nine months of 2024, Eximbank’s pre-tax profit stood at VND 1,712 billion, representing a 39% rise compared to the same period in 2023.

The main growth driver in Q3 came from net interest income, which soared by 77% year-over-year to reach VND 1,535 billion. Additionally, profit from foreign exchange trading activities also witnessed a significant increase (265%) to reach VND 282 billion.

Meanwhile, profit from service activities and securities trading activities were less promising compared to the previous year.

Eximbank’s total operating income for Q3/2024 amounted to VND 1,970 billion, reflecting a 60% jump compared to the corresponding period. Conversely, operating expenses climbed by 14% to reach VND 864 billion. Provisions for credit risks also witnessed an increase of 32%, totaling VND 202 billion.

Eximbank’s Financial Results for Q3/2024

As of September 30, 2024, Eximbank’s total assets stood at VND 223,937 billion, indicating an increase of 11.04% from the beginning of the year. Customer loan balance reached VND 159,483 billion, reflecting a 13.55% surge. Capital mobilization from economic organizations and individuals amounted to VND 167,603 billion, representing a 6.99% rise.

BVBank: 9-Month Profit Reaches 90% of Annual Plan

According to BVBank’s disclosures, as of the end of Q3/2024, the bank’s pre-tax profit stood at VND 182 billion, fulfilling 90% of its annual plan. During this quarter, BVBank’s total assets reached nearly VND 99,500 billion, reflecting an 18% growth compared to the same period in 2023.

As of September 30, 2024, the bank’s total capital mobilization exceeded VND 92,000 billion, marking a nearly 21% increase compared to Q3/2023. Capital mobilization from economic organizations and individuals reached VND 67,000 billion.

ACB Reports a Dip in Q3 Profit

Asia Commercial Joint Stock Bank (ACB) has released its Q3 financial report, indicating a consolidated pre-tax profit of VND 4,844 billion. This figure reflects a 4% decrease compared to the same period in 2023. The decline in profit can be attributed to a plunge in net profit from foreign exchange and investment securities trading, despite sustained growth in net interest income and profit from service activities.

For the first nine months of the year, ACB’s pre-tax profit surpassed VND 15,300 billion, representing a slight 2% increase compared to the same period last year. This growth is mainly attributed to the expansion of credit scale, service fees, and effective cost management. With these results, ACB currently ranks second in the system in terms of 9-month profit, only behind Techcombank (other major banks such as Vietcombank, VietinBank, BIDV, Agribank, and MB have not yet announced their figures).

As of September 30, ACB’s credit balance reached VND 555,000 billion, and mobilization stood at VND 512,000 billion, reflecting year-to-date growth rates of 13.8% and 6.1%, respectively. Notably, the credit growth rate was 1.5 times higher than the industry average and marked the highest net growth in the past decade.

In terms of CASA (current and savings accounts), ACB’s non-term deposits reached VND 114,000 billion, signifying a 24% increase compared to the same period in 2023. The bank continues to be among the leading retail banks in the market, with a CASA ratio of 22.2%.

ACB’s non-performing loan (NPL) ratio for Q3 stood at 1.49%, placing it among the banks with the lowest NPL ratios in the market. The provision for credit risks in Q3 was lower than the average for the first two quarters of the year.

As of the end of Q3, ACB’s LDR (loan-to-deposit ratio) was 82.4%, and the ratio of short-term capital used for medium and long-term loans was 20.7%. The bank’s capital adequacy ratio (CAR) at the end of Q3 was 11.3%, significantly higher than the requirement set by the State Bank of Vietnam.

Regarding operational efficiency, ACB maintained a low CIR (cost-to-income ratio) of 32.7%. The bank’s ROE (return on equity) remained high at 22.2%, keeping it among the industry leaders.

VIB Earns VND 6,600 Billion in the First Nine Months

For the first nine months of 2024, Vietnam International Joint Stock Commercial Bank (VIB) recorded a pre-tax profit of VND 6,600 billion, reflecting a 21% decrease compared to the same period last year. The ROE was approximately 19%.

Estimated pre-tax profit for Q3/2024 stood at VND 1,997 billion, marking a 26% decline compared to Q3/2023.

As of September 30, 2024, VIB’s total assets exceeded VND 445,000 billion, representing a 9% increase from the beginning of the year. Customer loan balance surpassed VND 298,000 billion, indicating an almost 12% rise, outperforming the industry average of 9%. Notably, in Q3 alone, VIB’s credit growth reached nearly 7%, positioning it as one of the leading retail banks in terms of credit growth. Capital mobilization also increased by 8%.

SeABank’s 9-Month Profit Surges by 43%

SeABank, the Joint Stock Commercial Bank of Southeast Asia, has announced its 9-month financial results, reporting a pre-tax profit of VND 4,508 billion. This figure translates to a remarkable increase of VND 1,352 billion, or 43%, compared to the same period in 2023.

By the end of September 2024, SeABank’s total loan balance reached VND 196,890 billion, and its total assets increased by VND 22,396 billion compared to 2023, totaling VND 288,518 billion.

As of September 30, 2024, the bank’s total capital mobilization from domestic organizations, individuals, and international financial institutions stood at VND 178,666 billion, reflecting a nearly 2% increase compared to 2023. CASA deposits reached VND 20,677 billion, signifying a 24% jump compared to December 31, 2023, and accounting for 13.46% of total customer deposits.

Techcombank: 9-Month Pre-Tax Profit Reaches VND 22,800 Billion

Techcombank reported a pre-tax profit of VND 22,800 billion for the first nine months of 2024, marking a 33% increase compared to the same period in 2023. In Q3 alone, the bank’s profit reached VND 7,171 billion, outperforming other private banks such as ACB (VND 4,844 billion), LPBank (VND 2,899 billion), and VIB (VND 1,997 billion).

As of the end of September 2024, Techcombank’s total assets stood at VND 927,100 billion, reflecting a 9.1% increase from the beginning of the year and an 18.7% surge compared to the same period last year. The bank’s credit growth, on a standalone basis, increased by 17.4% year-to-date to reach VND 622,100 billion. On a consolidated basis, retail lending was the primary driver of growth in Q3. Customer loans in the individual segment rose by 6.0% compared to the previous quarter, twice the increase in corporate loans (including corporate loans and bonds).

Techcombank’s CASA balance (including “Auto-Savings” balance) reached a record high of VND 200,300 billion, pushing the CASA ratio to 40.5%. Total customer deposits amounted to VND 495,000 billion, reflecting an 8.9% increase from the beginning of the year and a 21.0% jump compared to the same period last year.

LPBank’s Q3 Pre-Tax Profit Nears VND 2,900 Billion

LPBank’s pre-tax profit for Q3/2024 stood at VND 2,899 billion, signifying a remarkable 133.7% increase compared to the same quarter last year. For the first nine months of the year, pre-tax profit reached VND 8,818 billion, representing a 139% surge compared to the corresponding period.

As of September 30, LPBank’s total assets neared VND 446,000 billion, reflecting a 16.4% increase compared to the end of 2023. Customer loans increased by 16.1% to reach VND 319,770 billion. Customer deposits at LPBank also rose by 14.3%, totaling nearly VND 271,303 billion.

During the first nine months of the year, LPBank’s NPL balance increased by 70%, from VND 3,689 billion to VND 6,272 billion, causing the NPL ratio to rise to 1.96%.

Kienlongbank: 9-Month Profit Exceeds VND 760 Billion

According to the recently published consolidated financial statements, KienlongBank’s pre-tax profit for Q3/2024 was nearly VND 209 billion. For the first nine months of the year, the bank demonstrated positive growth momentum, with a pre-tax profit of over VND 760 billion, reflecting a 19% increase compared to the same period last year.

PGBank Reports a 36% Surge in Q3 Profit

The bank’s pre-tax profit for Q3/2024 reached VND 77 billion, signifying a 36% increase compared to the same period in 2023. However, the 9-month cumulative pre-tax profit decreased by 4.4% year-over-year, totaling VND 344 billion.

Saigonbank’s 9-Month Profit Takes a Dip

Saigon Commercial Joint Stock Bank (SaigonBank) announced that its pre-tax profit for the first nine months of 2024 is estimated to exceed VND 200 billion, fulfilling approximately 55% of its 2024 plan. In the previous year, SaigonBank’s profit for the same period amounted to over VND 248 billion.

Earlier, the bank had recorded a pre-tax profit of over VND 166 billion in the first half of the year. Consequently, Saigonbank’s Q3 profit is estimated at VND 34 billion, nearly halving compared to Q3/2023.

BaoViet Bank: 9-Month Profit Surpasses VND 32 Billion

In the first nine months of 2024, the bank increased its provisions for credit risks by 35% compared to the same period last year. Pre-tax profit exceeded VND 32 billion.