The surge in gold prices has stimulated trading and gold holdings among the public. However, according to finance expert Phan Dũng Khánh, there are factors that could cause gold prices to plummet, leading to short-term losses for gold investors.

– Reporter from NLD: In your opinion, what are the factors driving gold prices to continuously reach new peaks in the past? If calculated from the beginning of 2024 until now, the world gold price has increased by more than 40%?

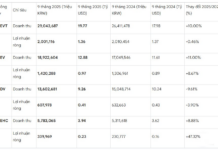

+ Expert Phan Dũng Khánh: Gold has been in a strong uptrend since the end of 2023 and continues to this day. In 2024 alone, gold prices have broken historical peaks multiple times, setting new record highs. Currently, gold is trading around $2,730 per ounce (+42% compared to the end of last year).

Precious metals rallied as central banks and financial institutions from various countries had been buying gold for years, continuing into 2024. Data from the World Gold Council shows that in recent years, central banks have been purchasing thousands of tons of gold annually. Additionally, individual investors were also drawn to the gold rush amid escalating geopolitical tensions in the Middle East, making gold a safe-haven investment.

The trend of lowering interest rates by central banks worldwide, starting from late last year until now, has also boosted gold prices. Particularly, the recent decision by the US Federal Reserve (Fed) to officially cut the policy rate by 0.5 points further fueled the flow of money into gold.

Another factor, in my opinion, is that in the past 2-3 years, uncertainties and risks in the international market have increased, and investment capital tends to diversify into multiple channels. This explains why not only gold prices have peaked, but US stocks have also reached new highs, savings deposits in many markets have surged, and even Bitcoin has seen significant price increases.

– With the current gold price movement, what should domestic investors do? Is there still an opportunity to buy gold, or how should they approach gold investments at this point?

+ It is important to recognize that since the State Bank of Vietnam implemented the new plan to stabilize the gold market, the price difference between SJC gold bars and world gold prices has narrowed significantly, from the previous gap of 18-20 million VND per tael. The price of 99.99% gold rings has also closely followed the SJC gold bar prices.

Gold has been in an uptrend since the end of last year, breaking historical peaks multiple times, so it is predicted that a sharp increase is unlikely in the coming time. Photo: Le Tinh

If the world gold price continues to rise to $3,000 per ounce (equivalent to an increase of about 50% in the 2-year cycle), it would be an exceptionally rare event in the financial market. Historically, the 10-year gold price cycle usually only experiences a strong uptrend for 1-2 years, and the current phase, from the end of 2023 to now, has already met this criterion.

Therefore, gold prices are unlikely to surge further after repeatedly breaking records. Typically, in a gold price upcycle, the increase is limited to 20-30% in a year.

Thus, investors should consider this when deciding whether to buy at this point. If they already own gold from long-term holdings or have a 3-5 year investment horizon, they may consider buying, but purchasing gold for short-term speculation with expectations of significant further increases is very risky.

If one decides to buy, it is advisable not to invest the entire capital in gold but rather diversify with 30-40% of the total investment funds. Moreover, never use borrowed money to invest in gold, as it is extremely risky if gold prices suddenly drop.

– So, what factors could cause gold prices to reverse, and what are the risks for investors who try to “ride the wave” at this peak?

+ As I mentioned, it is highly unlikely for gold prices to increase by 40-50% in two consecutive years and continue to soar in the coming period. Additionally, if central banks stop buying gold – as China has paused its gold purchases in recent months; if geopolitical tensions in the Middle East ease; or if there is a wave of profit-taking by institutional and individual investors who bought at lower prices, then gold prices could reverse and head downwards.

Thank you for your insights!

The Golden Opportunity: Rising Prices and a Shining Future

The price of gold on the global market, as observed on the Kitco exchange this 27th of October, stood at $2,747 per ounce, marking a notable increase of $7.84 from the previous day’s rates.

The Golden Opportunity: Unveiling the Latest SJC Gold Prices and Beyond

On its opening day on the 24th of October, domestic gold prices remained relatively unchanged from the previous day’s close, despite a sharp downturn in the global gold market.