Gold prices kicked off the new trading week on Monday morning (Oct 28) with a significant decline as the US dollar continued its upward trajectory. However, gold prices have been consistently breaking records lately, despite rising US Treasury yields and the dollar’s exchange rate, with many experts deeming this an “abnormality.”

At around 8 am Vietnam time, the spot gold price in the Asian market fell by $14.4/oz compared to Friday’s close in New York, equivalent to a 0.52% decrease, to $2,734.5/oz, according to data from the Kitco exchange.

Converted at Vietcombank’s USD selling rate, this price is equivalent to about VND 83.9 million/troy ounce, a decrease of VND 400,000/troy ounce from the previous week. At the beginning of the week, Vietcombank quoted the USD at VND 25,167 (buying) and VND 25,467 (selling), unchanged from the previous week’s close.

Gold prices came under pressure from the rising dollar as soon as the new week began. The Dollar Index, which measures the greenback’s strength against a basket of six major currencies, was up 0.15% from the previous week’s close at around 8 am Vietnam time, trading at 104.4 points, according to data from MarketWatch.

This is the highest exchange rate for the USD in the last three months. The currency is benefiting from the possibility of the Federal Reserve (Fed) slowing down interest rate cuts as the US economy remains resilient. Additionally, news that Japan’s ruling Liberal Democratic Party (LDP) lost its majority in the early parliamentary elections over the weekend has put strong depreciation pressure on the Japanese yen, further boosting the USD.

As gold is priced in USD, a stronger dollar typically leads to lower gold prices and vice versa. Moreover, since gold does not offer interest rates, rising interest rates tend to put downward pressure on gold prices.

However, looking at the past few weeks, gold prices have been rising despite the dollar’s strength. Not to mention, the upward trend in US Treasury yields has also failed to hinder gold’s record-breaking performance.

In October, spot gold prices set a series of new records, most recently reaching nearly $2,760/oz last week. Since the beginning of the month, gold prices have increased by about 3%.

Meanwhile, the Dollar Index has climbed approximately 3.6% in the last month, and the 10-year US Treasury yield hit a three-month high of 4.25% last week. Compared to the 52-week low set in mid-September, the 10-year yield has increased by almost 0.6 percentage points.

“Gold prices have behaved ‘normally’ throughout the summer. But in recent weeks, gold prices have gone against the grain,” said David Oxley, chief economist at Capital Economics, in a report.

“Gold is essentially ignoring the stronger dollar and higher US yields,” said Michael Armbruster, co-founder of Altavest, to MarketWatch. Mr. Armbruster believes this indicates strong physical demand for gold “in other countries, especially from central banks wanting to de-dollarize their foreign exchange reserves.”

Similarly, Mr. Oxley mentioned speculations that gold’s upward momentum reflects a broad shift in asset allocation, led by central banks of the BRICS group, which includes Brazil, Russia, India, China, and South Africa, and has recently added a few other members. These central banks are increasing their gold reserves and reducing their dependence on the USD.

However, Oxley argued that the most convincing explanation for gold’s recent performance is likely the so-called “Trump trade,” referring to trades based on the possibility of former President Donald Trump’s re-election on November 5.

“If you’re worried about excessive public spending and the Fed’s independence being compromised, gold is an attractive asset,” Oxley emphasized.

Some experts also mentioned the possibility of a US economic recession as a reason to hold gold.

In a recent MarketWatch interview, Jim Rogers, chairman of Beeland Interest Inc., said that the US economy is inching towards an “extremely bad” recession, and precious metals are always a safe haven in times of economic turmoil.

Armbruster highlighted that the US government’s annual budget deficit is nearing $2 trillion and is projected to increase in the coming years, even without wars or recessions. Therefore, “investors view gold as an attractive bet.” Additionally, he predicted that inflation in the US could accelerate in the coming months, and gold will serve as an inflation hedge even if the Fed slows down interest rate cuts.

However, Oxley cautioned that a degree of prudence is necessary. “We want to emphasize that gold prices don’t just move in one direction. There’s a lot of fear of missing out (FOMO), which often occurs during asset bubbles,” he said.

As a result, Oxley stated that Capital Economics is “in no rush” to change its gold price forecast for the end of 2025, which stands at $2,750/oz, adding that “a significant correction is likely between now and then.”

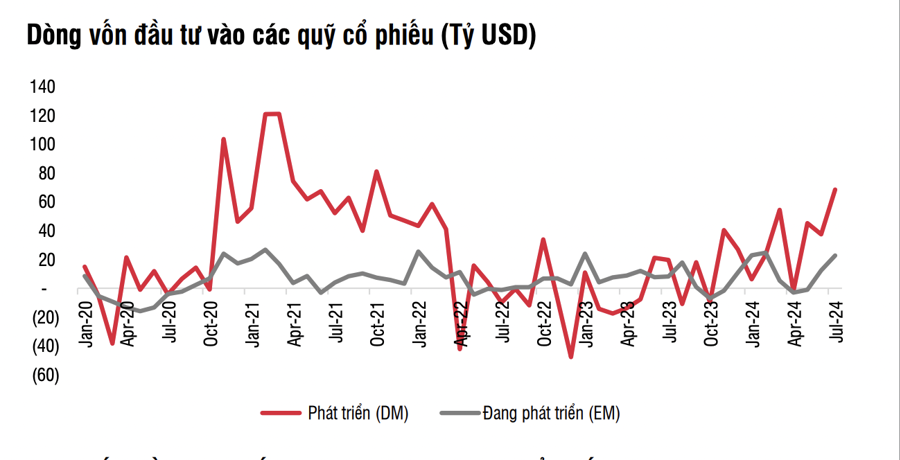

The Flow of Funds: Riding the Storm, How Far Will the Market Correction Go?

The stock market witnessed a steep decline of almost 33 points, or 2.5%, last week—the biggest drop since the end of June 2024. This significant downturn caused a break in the VN-Index’s support channel, which had been intact since the August 2024 lows. Experts unanimously deemed this a negative technical signal, a harbinger of potential challenges ahead for investors.

The Golden Opportunity: Unveiling the Latest SJC Gold Prices and Beyond

On the morning of October 22, domestic gold prices continued to surge, shining brighter than ever before.