Services

With a high consensus rate, the Congress passed several important issues regarding the members of the Board of Directors and the Supervisory Board for the term 2023 – 2027. The Congress also approved adjustments to the regulations governing the organization and operation of the Board of Directors and the Supervisory Board, as well as KienlongBank’s internal governance regulations.

|

As a result, Mr. Kim Minh Tuan and Mr. Nguyen Chi Hieu were elected as independent members of the Board of Directors for the term 2023 – 2027, while Mrs. Nguyen Thi Khanh Phuong and Mr. Dao Ngoc Hai were elected as members of the Supervisory Board for the same term.

Introducing the newly elected members of the Board of Directors and the Supervisory Board

|

Thus, following the 2024 Extraordinary General Meeting of Shareholders, KienlongBank’s Board of Directors comprises nine members, and the Supervisory Board consists of five members. All members possess high professional qualifications, extensive experience, and strong ethics and cultural values in managing and operating a business, particularly in the banking sector.

The completion of the senior management team in the Board of Directors and the Supervisory Board is considered a necessary step to strengthen KienlongBank’s governance and enhance its operational quality. This move will also improve the bank’s competitiveness and ensure sustainable growth, thereby maximizing benefits for customers, shareholders, and partners.

Mr. Tran Ngoc Minh, Chairman of KienlongBank’s Board of Directors, speaking at the Congress

|

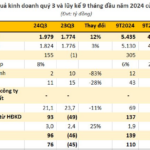

Prior to the Congress, KienlongBank released its consolidated financial statements for the third quarter of 2024, reflecting positive growth over the first nine months of the year.

As of September 30, 2024, the bank’s total assets reached VND 91,827 billion, an increase of VND 4,855 billion. Customer deposits stood at VND 60,041 billion, a rise of VND 3,144 billion, while loans to customers reached VND 59,275 billion, an increase of VND 7,493 billion compared to the end of 2023.

KienlongBank’s service income for the third quarter reached VND 99 billion, bringing its pre-tax profit to VND 209 billion. For the first nine months of the year, the bank’s cumulative pre-tax profit was VND 761 billion, achieving 95% of the annual plan.

This positive business performance lays a solid foundation for KienlongBank to successfully achieve its goals set at the 2024 Annual General Meeting of Shareholders and maintain the impressive growth trajectory it has sustained since 2021. It also serves as a crucial motivator for the bank to steadfastly advance its digital transformation journey, providing customers with superior experiences and working towards its goal of becoming a modern, friendly, and comprehensive digital bank by 2025.

The Controller’s Wife Wants to Sell Her EIB Shares

Mrs. Tran Thi Thanh Nha, the wife of Mr. Ngo Tony, an American citizen and the Head of the Supervisory Board of Eximbank, plans to sell her entire stake in the bank. The sale, which will take place between October 30 and November 8, involves 123,298 shares, representing 0.006% of the bank’s capital. Mrs. Nha aims to recover her investment through this divestment.

KienlongBank Successfully Holds 2024 Extraordinary General Meeting of Shareholders

On October 26, KienlongBank (UpCOM: KLB) successfully held its 2024 Extraordinary General Meeting of Shareholders (EGMS) in Hanoi, with a significant turnout of shareholders.