With a high consensus rate, the Conference passed several important contents related to the members of the Board of Directors and the Supervisory Board for the term 2023 – 2027. It also approved adjustments to the regulations on the organization and operation of the Board of Directors and the Supervisory Board, as well as the internal governance regulations of KienlongBank.

As a result, Mr. Kim Minh Tuan and Mr. Nguyen Chi Hieu were elected as independent members of the Board of Directors for the term 2023 – 2027, while Mrs. Nguyen Thi Khanh Phuong and Mr. Dao Ngoc Hai were elected as members of the Supervisory Board for the same term.

Thus, after the 2024 Extraordinary General Meeting of Shareholders, KienlongBank’s Board of Directors consists of 9 members, and the Supervisory Board consists of 5 members. All members possess high professional qualifications, integrity, and solid experience in managing and operating businesses, along with strong ethical standards and a robust work culture within the bank. The completion of the senior personnel team in the Board of Directors and the Supervisory Board is considered a necessary step to help KienlongBank strengthen its governance and enhance the quality of its operations, thereby improving competitiveness and ensuring sustainable growth for the bank, as well as maximizing benefits for customers, shareholders, and partners.

Introducing the newly elected members of the Board of Directors and the Supervisory Board to the Conference

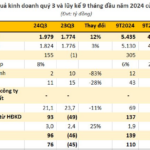

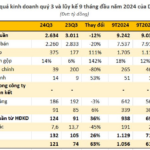

Prior to the Conference, KienlongBank had published its consolidated financial statements for the third quarter of 2024, reflecting positive growth over the first nine months of the year.

As of September 30, 2024, the bank’s total assets reached VND 91,827 billion, an increase of VND 4,855 billion. Customer deposits stood at VND 60,041 billion, up by VND 3,144 billion, while loans to customers reached VND 59,275 billion, an increase of VND 7,493 billion compared to the end of 2023.

KienlongBank’s service income in the third quarter reached VND 99 billion, bringing its pre-tax profit to VND 209 billion. For the first nine months of the year, the bank’s cumulative pre-tax profit was VND 761 billion, achieving 95% of the annual plan.

This positive business performance serves as a solid foundation for KienlongBank to soon accomplish the goals set at the 2024 Annual General Meeting of Shareholders and maintain the impressive growth trajectory it has sustained since 2021. It also provides important impetus for the bank to steadfastly promote its digital transformation journey, continuously delivering superior experiences to its customers, and realizing its vision of becoming a modern, friendly, and comprehensive digital bank by 2025.

The Mighty Makeover: “Camau Protein’s Quarterly Profit Plunge: Hoarding a Staggering $9,000 Billion in Cash”

The explanation provided in the consolidated financial statements attributes the almost 63% increase in profit to the reduction in cost of goods sold, which outpaced the decrease in revenue. Additionally, this year’s revenue deductions were significantly lower than those of the previous year, contributing to the substantial growth in profit.

The Stock Market’s New Power Player: DSC Securities Lists on HoSE, Joining the Ranks of Billion-Dollar Brokerages

Over 204.8 million DSC shares were officially listed and traded on HoSE starting October 24th, with a reference price of VND 22,500 per share.

The Inefficiencies of Using Barcode Systems for Supply Chain Management

To enhance the effectiveness and efficiency of product quality management for businesses, it is essential to embrace the use of barcode technology and product traceability. By implementing this innovative approach, enterprises can significantly improve their processes and gain a competitive edge in the market.