Interfood’s Q3 2024 Financial Report: A Snapshot

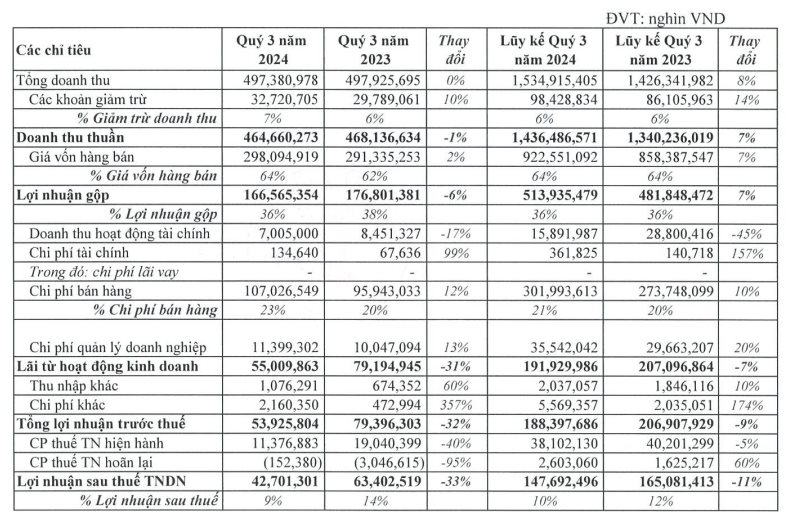

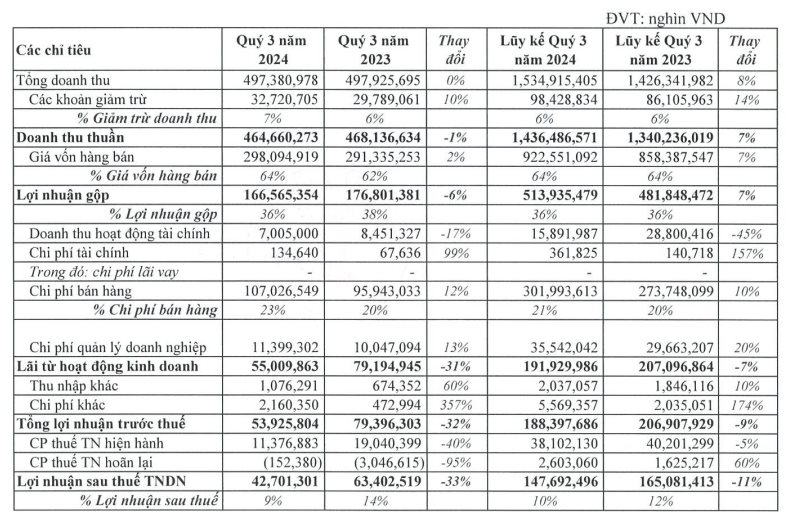

CTCP Thực phẩm Quốc tế (Interfood), trading as IFS, has released its Q3 financial report, revealing a slight dip in revenue compared to the previous year. With a 1% decrease, their quarterly revenue stood at VND 465 billion. The company attributed this decline partly to the adverse impact of natural disasters in the Northern region during the latter part of Q3 2024.

Additionally, a 2% rise in cost of goods sold led to a 6% reduction in gross profit, totaling VND 167 billion. Consequently, the gross profit margin narrowed to 36%, a 2% decline from Q3 2023’s figure of 38%.

During this period, Interfood experienced a 17% drop in financial income, amounting to VND 7 billion. This decrease can be attributed to the lower interest rates on deposits compared to the previous year. On the other hand, selling expenses increased by 12% to VND 107 billion, primarily due to enhanced promotional programs and intensified media campaigns for their strategic products.

Source: Interfood (IFS)

A 13% rise in general and administrative expenses was observed in this quarter, mainly associated with technology investments to support the company’s growth initiatives. As a result, Interfood’s net profit for the quarter reached nearly VND 43 billion, reflecting a 33% decrease compared to the same period in 2023.

For the first nine months of 2024, Interfood recorded impressive results, with cumulative revenue surpassing VND 1,436 billion, a 7% increase year-over-year. However, their after-tax profit stood at VND 148 billion, an 11% decline compared to 2023’s performance.

Looking ahead, Interfood has set ambitious revenue targets for 2024, aiming for a record-high VND 1,993 billion, which translates to a nearly 7% increase from the previous year. However, they remain cautious about profitability, with a planned net profit of approximately VND 192 billion, an 8% decrease compared to 2023.

With the results achieved in the first three quarters, the company has successfully met 72% of its revenue target and 77% of its profit goal.

As of September 30, 2024, Interfood’s total assets amounted to VND 1,426 billion, a reduction of roughly VND 40 billion from the beginning of the year. Notably, cash and cash equivalents comprised 66% of their total assets, totaling over VND 941 billion. Shareholder equity stood at more than VND 1,194 billion, including nearly VND 148 billion in undistributed post-tax profits. One distinctive aspect of Interfood is the absence of any financial debt in their financial statements.

Interfood, formerly known as Công ty Công nghiệp chế biến thực phẩm Quốc Tế (IFPI), was established on November 16, 1991, as a 100% foreign-owned enterprise. The initial investor was Trade Ocean Holdings Sdn. Bhd., headquartered in Penang, Malaysia.

Following a tumultuous period from 2008 to 2015, which saw the company incur losses in 7 out of 8 years, Interfood underwent a successful restructuring under the guidance of the Kirin Group. Since 2016, the company has consistently turned a profit, and its financial performance has continued to improve year after year.

Interfood’s product portfolio is centered around their flagship brand, Wonderfarm, with their star product being the unrivaled Trà bí đao. Additionally, they offer a range of other Wonderfarm products, such as coconut water, coconut milk, bird’s nest drink, and me water. The company also brings Japanese beverage brands to the market, including Kirin’s Ice+, Latte, and Tea Break.

Unlocking HAGL Agrico’s Future: A Strategic Roadmap to Surpassing Expectations with a 2.45 Trillion VND Profit Goal by 2028

“With this strategy, HNG envisions a path of sustainable growth and profitability in the coming years, swiftly reducing the accumulated losses on the financial statements.”