The much-anticipated signal for today and the coming week is the depletion of liquidity. The combined trading value of the two exchanges dipping below the 10k billion threshold is unusually low, indicating that sellers may no longer have the upper hand in controlling market oscillations.

After an unsuccessful retest of 1300 in mid-October, the market plummeted swiftly and witnessed multiple sessions with widened trading bands. This reflected a clear dominance of selling pressure. Typically, after such a sequence, the market tends to stall and gradually seeks a balance, assuming that those most eager to sell have already done so. Today marks the first session where buying and selling forces appear to be leveling off, albeit with meager liquidity. To further test the supply dynamics, we anticipate additional sessions of fluctuations and subdued trading volumes.

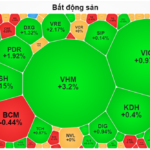

The current downward trend is still within the realm of a normal correction primarily driven by supply and demand factors, rather than any fundamental changes. Consequently, the adjustment range will likely be limited. In fact, throughout 2024, the declines in the VNI have hovered around 10%. Once supply and demand naturally reach equilibrium, the market will conclude this downward trend.

From an index perspective, today’s stagnation holds limited significance beyond the liquidity-related insights, as technical support levels remain untested. However, it’s worth noting that index signals aren’t always reliable for trading specific stocks. Today, numerous stocks exhibited a notable reduction in selling pressure, which is an encouraging sign. When selling abates, even tepid buying interest can suffice to maintain narrow price ranges.

The large-cap stocks, as reflected in the VNI, are likely to continue their downward trajectory or exhibit feeble sideways movement. Nevertheless, individual stocks may attain equilibrium or even form bottoms beforehand. Therefore, it’s prudent to monitor stocks of interest alongside the movements of the large-cap stocks. If the large-cap stocks exert downward pressure on the index while individual stocks display resilience, only slightly retracing without significant volume, the likelihood of those stocks forming bottoms increases.

Overall, the market is presenting more opportunities than risks at the moment. Holding cash offers a slight advantage, but there’s no need for concern if you’re holding stocks. The broader market trend remains upward, and the medium-term outlook is positive. While investors always aspire to time their entries and exits flawlessly to capture every wave, large or small, increased trading frequency heightens the probability of mistakes. A well-constructed portfolio doesn’t necessitate constant wholesale buying and selling.

A surprising development today was the decline in liquidity in the derivatives market, mirroring the base market, with trading volumes plunging to a five-week low. The F1 contract maintained an average spread of nearly five points for most of the session. The minuscule liquidity in the underlying market may have deterred derivatives traders due to concerns about the impact of large-cap stocks and unpredictable dynamics. In fact, trading derivatives today was challenging; going long carried a higher risk, not only because of the additional basis spread but also the uncertainty about whether the base market had sufficient momentum to recover. While short-selling benefited from the basis, weak selling pressure made it difficult to widen the trading range. For instance, this afternoon, VN30 unsuccessfully tested the 1328.xx level and reversed downward, presenting a classic short setup, but F1 barely budged.

With today’s depleted liquidity, the market is showing early signs of stabilization. We anticipate additional intraday fluctuations in the upcoming sessions to further test supply and demand dynamics, and there may be instances of large-cap stock influence to amplify volatility and psychological pressure. The strategy going forward involves selectively buying stocks, employing a dynamic long/short approach with derivatives, and closely monitoring basis and large-cap stock movements.

VN30 closed today at 1328.33, precisely at a milestone. The subsequent resistance levels are 1333, 1341, 1348, and 1357. Support levels: 1322, 1316, and 1303.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The perspectives and assessments shared are solely those of the individual investor, and VnEconomy respects the author’s viewpoint and writing style. VnEconomy and the author disclaim any responsibility for issues arising from the investment opinions and perspectives presented.

The Stock Market Blues: A Tale of Woes and Worries

The VN-Index has been struggling to conquer the 1,300-point threshold and is now falling deeply from this region.

The Market Beat: Buyers Strike Back, VN-Index Holds its Ground

The market ended the session on a positive note, with the VN-Index climbing 2.03 points (0.16%) to reach 1,288.39; the HNX-Index also rose, gaining 0.08 points (0.03%) to close at 231.37. The market breadth tilted in favor of gainers, with 372 advancing stocks against 317 declining ones. The large-cap VN30 basket painted a similar picture, as 15 constituents added value, 12 lost ground, and 3 remained unchanged, ending the day in the green.