The broader market continued its downward trend today, extending yesterday’s lackluster trading session. Weak demand prevented the index from sustaining its recovery, with key sectors such as banking, securities, and steel all trading in the red.

On October 25th, the VN-Index closed at 1,252 points, a decrease of 4.69 points from the previous session.

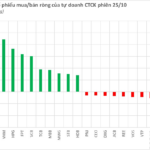

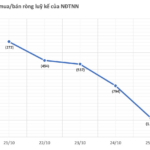

At the close of trading, the VN-Index settled at 1,252 points, a decline of nearly 4.7 points from the previous day. Market liquidity remained low, with the total trading value on the HoSE reaching approximately VND 13,784 billion. Foreign investors maintained their net selling position for the second consecutive session on the HoSE, offloading stocks worth over VND 412 billion. The heaviest sold stock was MSN, with a net sell value of VND 242.27 billion, followed by DGC with VND 76.72 billion.

On the buying side, foreign investors accumulated VPB shares the most, with a net buy value of VND 110.71 billion. This was followed by MWG (VND 67.98 billion), EIB (VND 33.92 billion), and VNM (VND 27.58 billion). On the HNX, foreign investors recorded net buying of VND 12 billion. CEO was the most bought stock, with a net buy value of VND 114 billion, followed by PVI with VND 5 billion. Additionally, they also net bought a few billion dong worth of MBS, BVS, and VTZ.

On the opposite side, IDC faced the highest net sell-off from foreign investors, with a value of nearly VND 4 billion. VGS, LAS, and VCS also witnessed net selling of a few billion dong each. In the UPCOM market, foreign investors net bought VND 17 billion worth of stocks, with HNG being the most purchased, accounting for VND 8 billion. ACV and WSB also saw net buying of a few billion dong each. Conversely, AAS was net sold by foreign investors for VND 1 billion, along with TOW, KVC, and a few others.

Despite a slight recovery in some small and mid-cap stocks, the market sentiment remains cautious. Investors are advised to refrain from chasing prices and consider portfolio restructuring to mitigate risks during this volatile period.

“Heavy Foreign Sell-Off in Monday’s Session: Which Stocks Were in the Firing Line?”

In the afternoon trading session, MSN stock witnessed an unprecedented surge in foreign selling pressure, with a massive sell-off amounting to 280 billion VND.

The Stock Market’s New Power Player: DSC Securities Lists on HoSE, Joining the Ranks of Billion-Dollar Brokerages

Over 204.8 million DSC shares were officially listed and traded on HoSE starting October 24th, with a reference price of VND 22,500 per share.