The revenue, profit, and gross profit margin of VHC reached their highest levels in over a year, driven by the increased sales of the pangasius group and improved profits from other product groups such as shrimp crackers, rice products, and fruits.

|

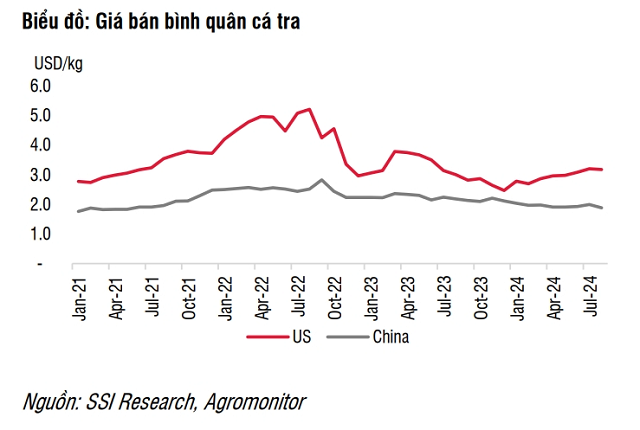

The average selling price of pangasius fillets exported to the US slightly recovered compared to the same period last year.

|

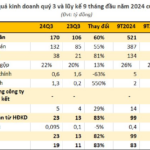

In the third quarter, the seafood company’s revenue continued to rise, reaching nearly VND 3.3 trillion, up over 21% from the previous year. The gross profit margin improved significantly from the low of 8.15% in the fourth quarter of 2023 – the most challenging period in recent years.

VHC earned more than VND 320 billion in net profit, a 68% increase despite lower financial income. As of the first nine months, the cumulative net profit was VND 808 billion.

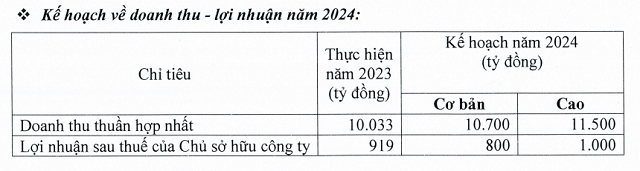

Given the unpredictable global events, the pangasius exporter has outlined two scenarios for 2024, aiming to deliver a minimum profit of VND 800 billion to its owners. With a tougher target of VND 1 trillion, VHC has already achieved over 80% with one quarter remaining.

Source: VHC

|

Over VND 6 trillion in undistributed profits

The strong performance in the core business has enabled the leading pangasius exporter to accumulate over VND 6 trillion in undistributed profits, out of a total of VND 9 trillion in owner’s equity. The company has VND 2.7 trillion in bank deposits, equivalent to 20% of total assets as of the end of September.

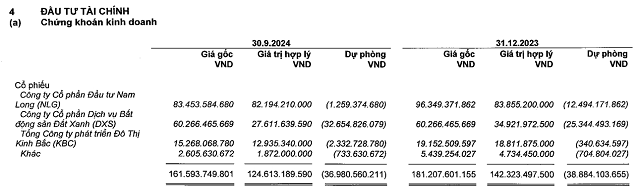

However, VHC‘s financial investments have not fared well. Investments in real estate stocks such as DXS, NLG, and KBC have yet to turn a profit.

One of these investments, DXS of Dat Xanh Real Estate Service, was recently embroiled in controversy involving a group of investors who accused the company of violating agreements during a bond issuance, causing the stock price to plummet in mid-August 2024. VHC has temporarily set aside over VND 32 billion in provisions against the initial investment of VND 60 billion (as of September 30, 2024).

Source: VHC

|

A promising end to the year from the US market?

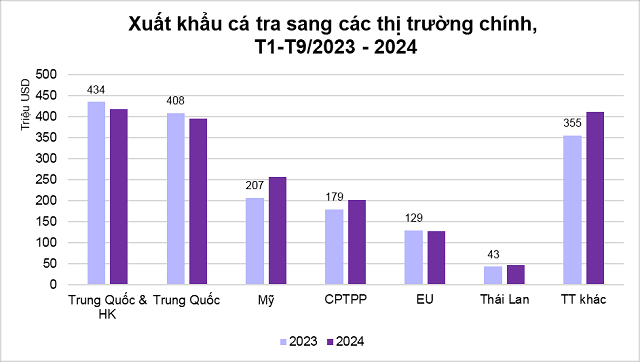

According to customs data, Vietnam’s pangasius exports reached USD 1.5 billion in the first nine months, an 8% increase, with frozen pangasius fillets remaining the key product. Exports to the US recorded a strong 24% growth.

Lower inventory levels compared to the same period in 2023 and 2022 will encourage US retailers to stock up for the year-end holiday season, according to the Vietnam Association of Seafood Exporters and Producers (VASEP). Additionally, the recent decline in inflation in the US is expected to boost consumer demand. Vietnam remains the largest pangasius supplier to the US market as of the end of the third quarter.

VHC, a leading Vietnamese pangasius exporter, is well-positioned to benefit from the recovery in the US market, given its focus on exports to this region.

Source: VASEP

|

“A Stellar Performance: Sonadezi Achieves 87% of Profit Plan in 9 Months”

Sonadezi Corporation (Sonadezi, UPCoM: SNZ), a leading industrial development company, announced its third-quarter financial results, reporting a net profit of over VND 192 billion, an 8% decrease compared to the same period last year. Despite this quarterly decline, the company remains on a strong trajectory, having achieved 87% of its full-year net profit target in the first nine months of the year.

Why Did Au Lac Suddenly Make a Loss in Q3?

Entrepreneur Ngo Thu Thuý’s Aurac JSC has adjusted its depreciation schedule for its vessels, leading to a surge in expenses. This move has resulted in the company incurring losses despite its thriving business operations.