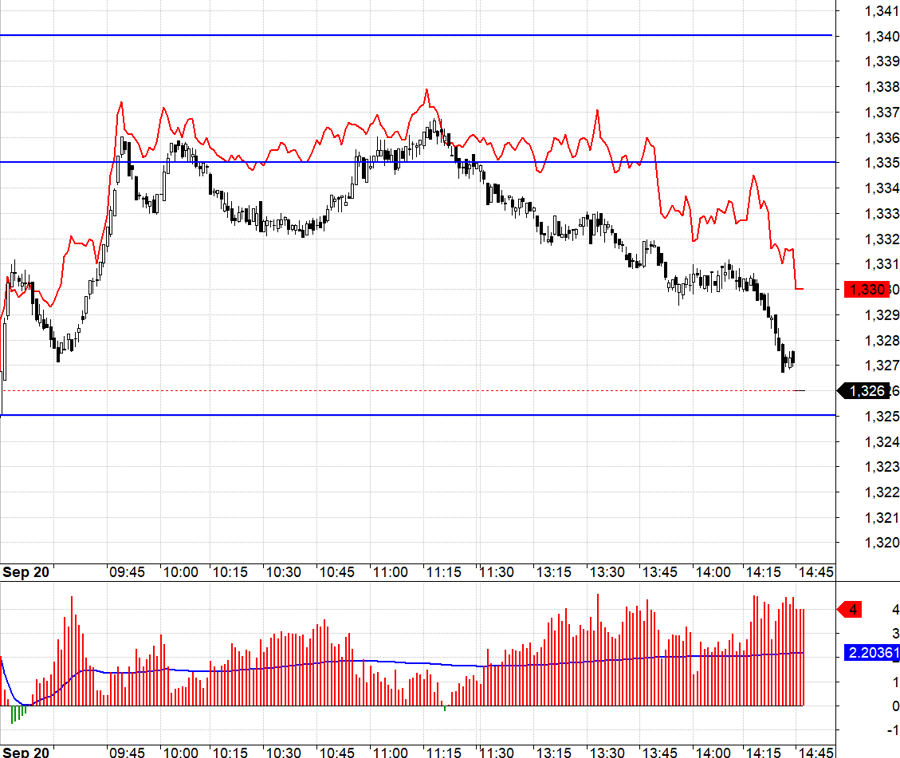

The market witnessed a lackluster performance during the week of October 21-25. Increased selling pressure near the 1,290-1,300 resistance zone caused the main index to turn bearish after failed breakout attempts. The weakness among blue-chip stocks further contributed to the decline, with the VN-Index losing 32.74 points (-2.55%) over five sessions, settling at 1,252.72.

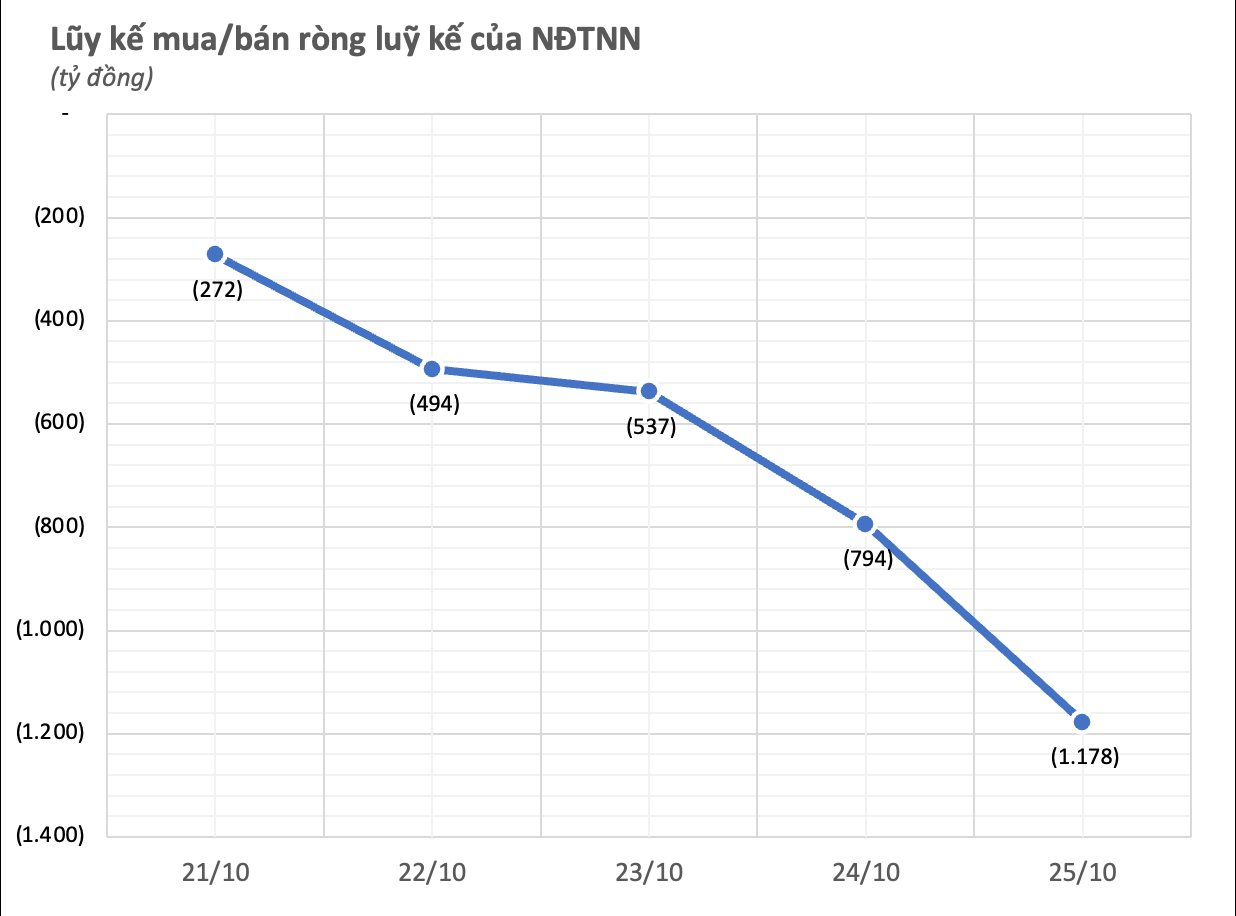

In terms of foreign investment flows, consecutive net selling was observed across the market, with daily values mostly in the hundreds of billions. Cumulatively, foreign investors sold a net amount of VND1,178 billion in the market during the five-day period.

Looking at individual exchanges, foreign investors net sold VND1,043 billion on HoSE, VND193 billion on HNX, and net bought VND74 billion on UPCoM.

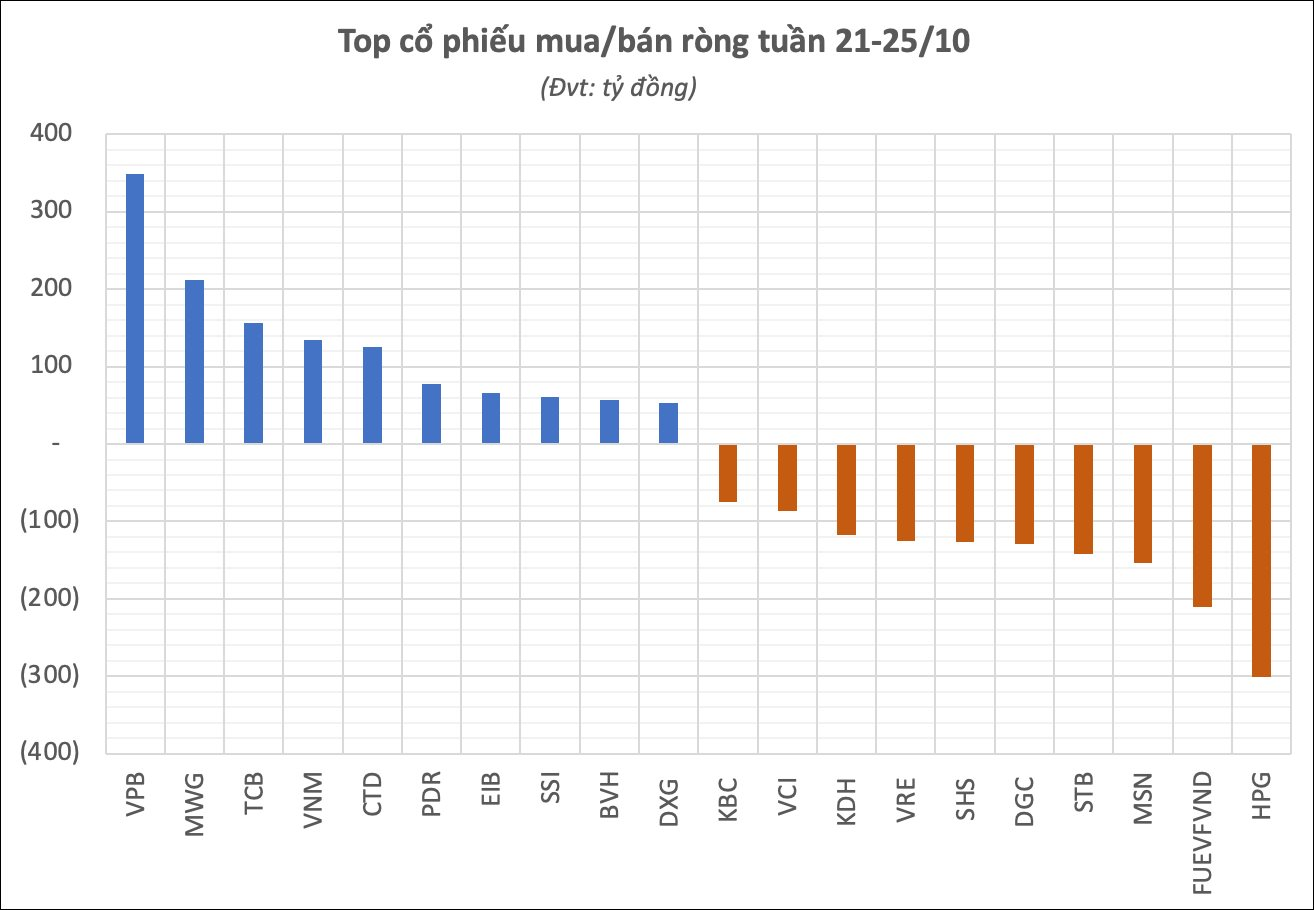

Analyzing the data by stocks, the largest net selling by foreign investors was observed in the steel sector, with HPG recording a net sell value of VND301 billion. This was followed by net selling in FUEVFVND fund certificates and MSN stocks, with values of VND211 billion and VND154 billion, respectively, over the five sessions. STB and DGC also witnessed notable net selling, with values of VND142 billion and VND129 billion, respectively. The list of stocks with net selling in the hundreds of billions also included SHS, VRE, KDH, and VCI…

On the other hand, VPB, a bank stock, attracted foreign capital inflows this week, recording the highest net buying value of VND349 billion. Foreign investors also net bought MWG and TCB, with values of VND212 billion and VND156 billion, respectively. Net buying during the past five sessions was also observed in CTD, PDR, EIB, SSI, and other stocks.

Top 10 Weekly Stock Movers: Surging Stocks “Ride the Wave” of Q3 Earnings, One Surges Post-Earnings Surprise

The market is highly polarized as the recovery momentum is largely concentrated on stocks with positive Q3 earnings.