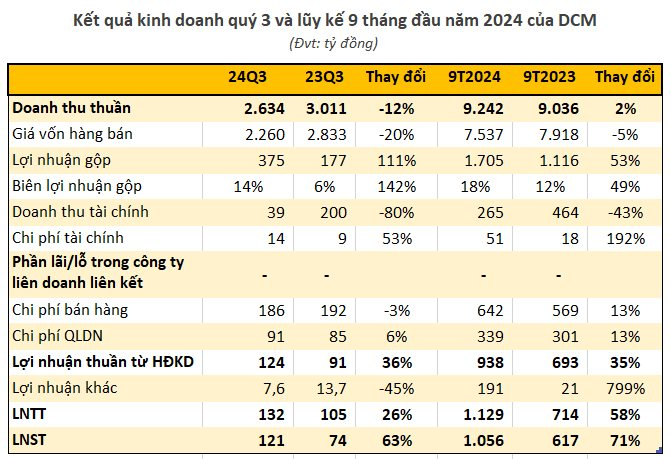

PetroVietnam Ca Mau Fertilizer Joint Stock Company (Ca Mau Fertilizer, stock code: DCM) has just announced its Q3 2024 financial statements, with net revenue reaching VND 2,634 billion, a 12% decrease compared to the same period last year. A significant 20% reduction in cost of goods sold led to a gross profit increase, recording VND 375 billion, a corresponding 111% surge year-on-year.

In contrast, financial revenue plunged by 80% to VND 39 billion, while financial expenses increased by 53% year-on-year, reaching VND 14 billion. Selling expenses were recorded at nearly VND 186 billion, a slight 3% decrease compared to Q3 2023.

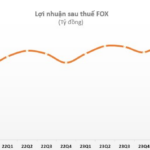

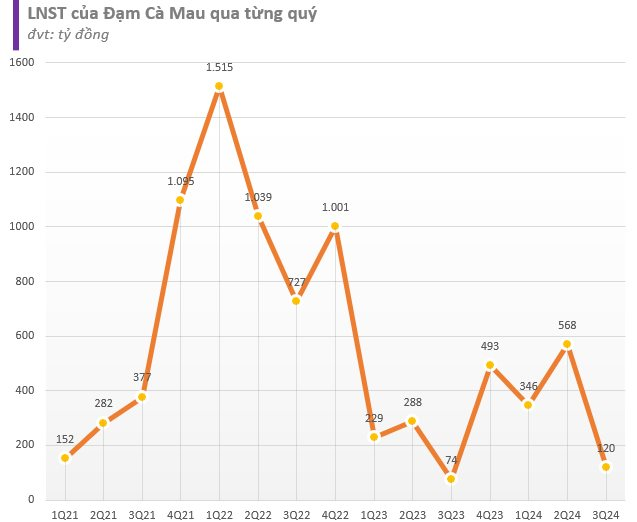

After deducting various expenses, Ca Mau Fertilizer reported a net profit of nearly VND 121 billion, a 63% growth year-on-year; with net profit attributable to the parent company exceeding VND 120 billion. However, this remains the lowest profit in the past four quarters.

For the first nine months of 2024, Ca Mau Fertilizer recorded net revenue of VND 9,242 billion, a slight 2% increase year-on-year. The net profit showed an impressive 71% surge compared to the same period last year, reaching VND 1,056 billion. After nine months, Ca Mau Fertilizer has surpassed 33% of its full-year profit plan.

The explanatory note states that the cost of goods sold decreased more than revenue, and this year’s revenue deductions were significantly lower than the previous year, leading to a nearly 63% increase in net profit in the consolidated financial statements compared to the previous year.

As of September 30, 2024, Ca Mau Fertilizer’s total assets amounted to VND 15,420 billion, an increase of VND 182 billion from the beginning of the year, but a sharp decrease of more than VND 1,400 billion compared to the end of Q2 2024. Of this, nearly 56% of the company’s total assets were in cash and cash equivalents, amounting to VND 8,616 billion. In the first nine months, Ca Mau Fertilizer’s interest income was approximately VND 215 billion, but this figure has declined significantly compared to the nearly VND 400 billion recorded in the same period last year.

On the other side of the balance sheet, equity reached nearly VND 9,895 billion, almost unchanged from the beginning of the year. Retained earnings at the end of the period amounted to VND 1,715 billion. Ca Mau Fertilizer currently has a total financial debt of VND 1,627 billion, mostly short-term.

On the stock exchange, DCM shares are currently trading around VND 37,000 per share, up 21% compared to the price at the beginning of the year. From its historical peak of VND 40,700 per share in early July, the fertilizer stock is only about 9% away in terms of value.

The Tech Giant FPT Reports a Profit of VND 2.7 Trillion in 9 Months, Depositing VND 10 Trillion in the Bank

For the nine-month period ending September, FPT Telecom recorded impressive figures with revenue reaching VND 12,800 billion and a remarkable 16% year-on-year increase in pre-tax profits to VND 2,666 billion.

A Scandal Unveiled: Foreign Investors Exit Loc Troi Amid Corporate Governance Woes

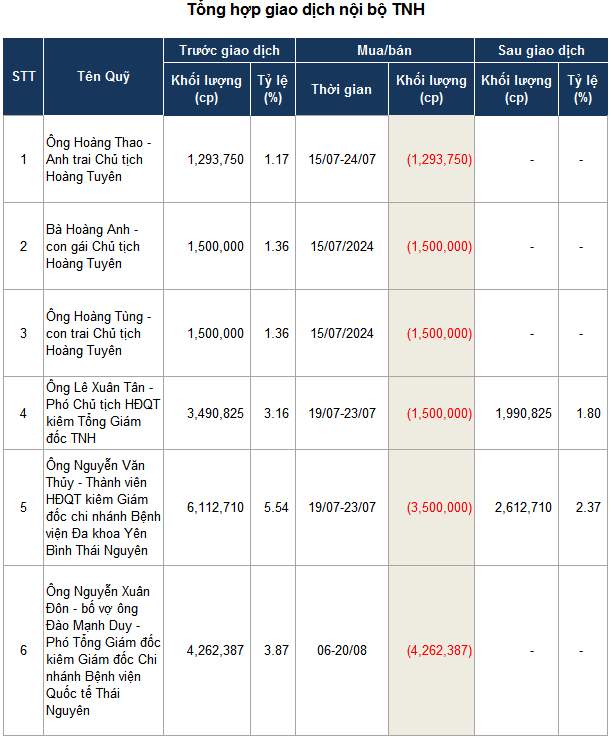

Over the past five months, foreign shareholders have been consistently selling their stakes in Loc Troi Group Joint Stock Company (UPCoM: LTG). During this period, the company’s board of directors also removed Mr. Nguyen Duy Thuan from his position as General Director and subsequently issued a statement accusing him of deceitful behavior.

The Turnaround: How Vua Nem Reversed its Fortunes and Reduced Losses

Quick responsiveness to market fluctuations, agile pricing strategies, and product diversification have been instrumental in Vua Nem’s remarkable turnaround. The company adeptly navigated through challenging times, avoiding potential losses and achieving positive growth.