The VN-Index closed last week’s trading session at 1,252.72 points, a significant drop of 32.74 points or 2.44% from the previous week’s close, with reduced liquidity.

The average trading value for all three exchanges last week was 16,784 billion VND. For matched orders, the average trading value was 15,173 billion VND, a slight decrease of 1.1% from the previous week and an 8.4% drop compared to the average of the last five weeks.

Active selling pressure dominated 4 out of 5 trading sessions last week, mainly in the Financial sector, including Banks and Securities. Conversely, Real Estate saw scattered active buying throughout the week.

Foreign investors sold a net amount of 1,046.1 billion VND, and for matched orders, they sold a net amount of 1,040 billion VND.

The main sectors for foreign net buying were Construction and Materials, and Retail. The top stocks for foreign net buying were VPB, MWG, TCB, VNM, CTD, PDR, EIB, SSI, DXG, and BMP.

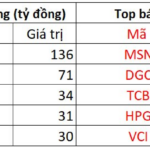

On the selling side, they focused on Basic Resources. The top stocks for foreign net selling were HPG, MSN, STB, DGC, VRE, KDH, VCI, KBC, and DGW.

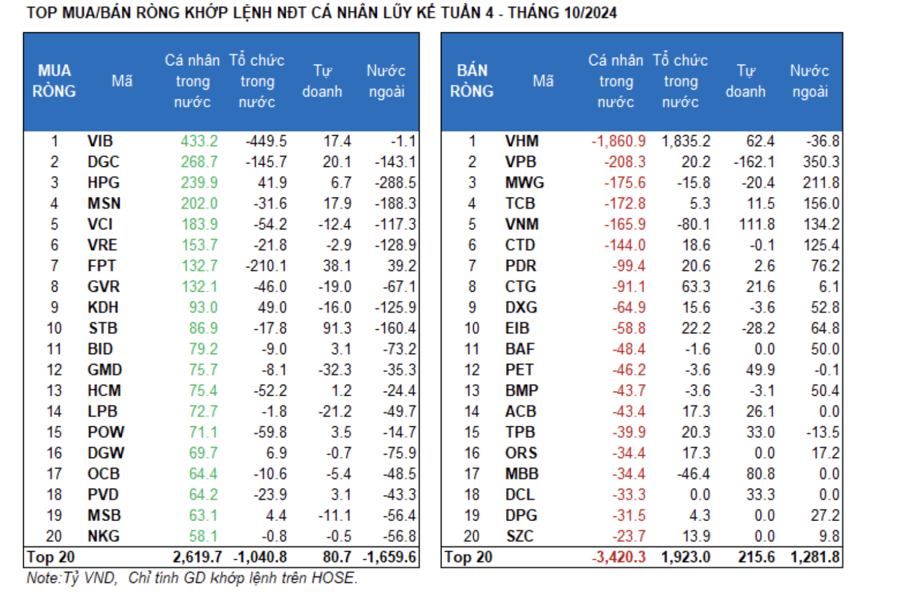

Individual investors sold a net amount of 359.9 billion VND, including 263 billion VND in unmatched orders. For matched orders, they bought a net amount in 12 out of 18 sectors, mainly in Chemicals. Their top buys included VIB, DGC, HPG, MSN, VCI, VRE, FPT, GVR, KDH, and STB.

On the selling side, they sold a net amount in 6 out of 18 sectors, mainly in Real Estate and Retail. Their top sells included VHM, VPB, MWG, TCB, VNM, CTD, CTG, DXG, and EIB.

Proprietary trading bought a net amount of 678.1 billion VND, and for matched orders, they bought a net amount of 541.2 billion VND.

For matched orders, proprietary trading bought a net amount in 14 out of 18 sectors. The sectors with the highest net buying were Banks, Food and Beverage. The top stocks for proprietary net buying this week included FUEVFVND, VNM, STB, MBB, VHM, PET, VCB, FPT, DCL, and TPB.

The top-selling sector was Personal & Household Goods. The top-sold stocks included VPB, PNJ, E1VFVN30, GMD, EIB, REE, LPB, MWG, GVR, and KDH.

Domestic institutional investors bought a net amount of 727.9 billion VND, and for matched orders, they bought a net amount of 761.8 billion VND. For matched orders, domestic institutions sold a net amount in 13 out of 18 sectors, with the highest value in Banks. The top sells included VIB, FPT, DGC, VNM, SSI, POW, VCI, HCM, MBB, and GVR.

The sector with the highest net buying value was Real Estate. The top-bought stocks were VHM, CTG, PNJ, KDH, HPG, BWE, KBC, GEX, EIB, and NLG.

The allocation of money flow increased in Real Estate, Food, Construction, Chemicals, Rubber & Plastics, and Electrical Equipment while decreasing in Banks, Securities, Steel, Retail, and Oil & Gas.

Real Estate attracted money flow last week, with a money flow allocation of 21.47% – an improvement for the second consecutive week from a low of 11.83%. The price index decreased by 1.57%, influenced by some large-cap stocks such as VHM, BCM, and VRE. In contrast, small and medium-cap stocks, including KDH, PDR, DXG, and HDC, went against the market and increased.

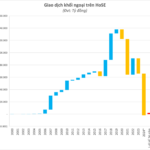

The FMI index from FiinTrade shows that, despite the recent improvement in money flow allocation into Real Estate, the accumulated money flow into this sector remains at a low level when considering a one-year time frame.

In contrast, most other sectors recorded a decrease in money flow allocation, notably Banks, Securities, Steel, Retail, Information Technology, Livestock and Fisheries, and Oil & Gas. The price index moved in tandem with the overall market, declining.

Money Flow Strength: Looking at the weekly timeframe, money flow increased in large-cap stocks (VN30) while decreasing in medium-cap stocks (VNMID) and small-cap stocks (VNSML).

Last week, large-cap stocks (VN30) continued to attract money flow, with the proportion rising from 51% to 53.5%. Conversely, the proportion decreased to 36.1% for medium-cap stocks (VNMID) and 7.9% for small-cap stocks (VNSML).

In terms of money flow size, the average trading value per session slightly increased for large-cap stocks (VN30) by 136 billion VND or 1.9%. Meanwhile, the average trading value per session decreased for medium-cap stocks (VNMID) and small-cap stocks (VNSML) by 155 billion VND (2.9%) and 59 billion VND (5.1%), respectively.

In terms of price movement, the VN30 index decreased by 2.73%, a more significant drop than the overall market (-2.55%), mainly due to the negative impact from Bank stocks (-3%). The VNMID and VNSML indices decreased by 1.61% and 1.47%, respectively.

The Foreign Sell-Off: Unraveling the 24th October Session’s Nearly 300 Billion Dong Sell-off by Foreign Investors – Which Stock was the Epicenter?

“Foreign investors showed strong buying interest in VPB stock on the HoSE, making it the most purchased stock on the exchange with a value of approximately 89 billion VND. This was in contrast to the heavy selling seen in HPG stock during the same period.”

Stock Market Uplift: Vietnam’s Economy Springboard, Attracting Billions in Foreign Investment

According to calculations by the team at VinaCapital, if both the FTSE Russell and MSCI re-evaluations are considered for an upgrade, net inflows could reach a substantial $5 to $8 billion.