HoSE-listed construction company CTCP Xây dựng Coteccons (code: CTD) has recently witnessed significant ownership changes among its insider shareholders and foreign funds.

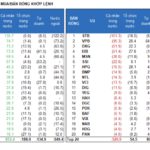

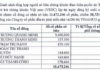

On October 22, a group of funds related to Công ty TNHH Quản lý quỹ KIM Việt Nam collectively purchased an additional 550,000 CTD shares, increasing their ownership from 6.63% to 7.18% of the chartered capital.

Specifically, KITMC Worldwide Vietnam RSP Balanced Fund acquired 200,000 shares; TMAM Vietnam Equity Mother Fund bought 150,000 shares; KIM PMAA Vietnam Securities Investment Trust 1 (Equity) purchased 100,000 shares; and KIM Investment Funds – KIM Vietnam Growth Fund secured 100,000 shares.

CTD’s Annual General Meeting for the 2024 Financial Year was held on October 19

Prior to this, from September 24 to October 23, Mr. Bolat Duisenov, Chairman of the Board of Directors, bought 200,000 CTD shares, increasing his holdings from 1,428,933 shares (1.38% of chartered capital) to 1,628,933 shares (1.57%).

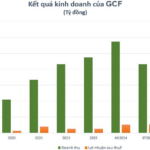

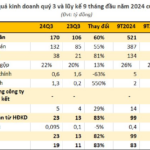

Coteccons recently held its Annual General Meeting for the 2024 Financial Year on October 19. At the meeting, Mr. Tran Ngoc Hai, Deputy General Director of Coteccons, shared the company’s financial results for the first quarter of the 2024-2025 financial year (from July 1, 2024, to September 30, 2024) with revenue of approximately VND 4,708 billion, a 15% increase compared to the same period last year. New sales reached VND 8,559 billion (68.7% of new sales came from re-signing contracts with existing clients); and the value of projects that Coteccons is currently bidding for is VND 16,865 billion.

For the 2024-2025 financial year (from July 1, 2024, to June 30, 2025), Coteccons set a target revenue of VND 25,000 billion, an 18.8% increase compared to the previous year, and a projected after-tax profit of VND 430 billion, a 38.7% rise from the previous year.

The meeting also approved a 10% cash dividend payout to shareholders. Previously, in a proposal submitted in late September for the 2025 financial year, Coteccons had planned not to allocate funds to any reserve and also not to pay dividends due to the challenges faced by the construction industry. The last time CTD paid dividends was in 2020, with a 10% cash dividend.

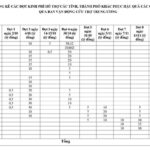

Additionally, CTD shareholders approved the issuance of nearly 5 million bonus shares to increase capital from equity, at a ratio of 20:1 (for every 20 shares held, shareholders will receive 1 new share). The issuance will be funded by the development investment fund based on the audited separate financial statements for 2024. If successful, the chartered capital will increase from VND 1,036 billion to over VND 1,086 billion. The issuance is expected to take place during the 2025 financial year.

Furthermore, the meeting approved the sale of 1.5 million treasury shares (accounting for 1.43% of the total circulating shares) to employees under the ESOP program at a price of VND 10,000 per share. Currently, Coteccons holds over 3.7 million treasury shares worth more than VND 445 billion (according to the audited financial statements for 2024), equivalent to approximately VND 120,000 per share. The total proceeds from this sale, amounting to VND 15 billion, will be used to increase working capital. These shares will be restricted from transfer for one year.

The Stock Market’s New Power Player: DSC Securities Lists on HoSE, Joining the Ranks of Billion-Dollar Brokerages

Over 204.8 million DSC shares were officially listed and traded on HoSE starting October 24th, with a reference price of VND 22,500 per share.

The Chairman of TTC AgriS: Working in the Interests of 91% of Shareholders and Investors

In her capacity as Chairman of the Board of Directors of TTC Agri-Biotech Joint Stock Company (TTC AgriS) (HOSE: SBT), Ms. Dang Huynh Uc My has asserted the company’s commitment to ensuring fairness and transparency for its shareholders, investors, and stakeholders. As TTC AgriS attracts the participation of international investors and prominent financial institutions, Ms. My has emphasized the importance of equitable treatment and transparent disclosure for all involved parties.