The trading session on October 10, 2024, ended with the VN-Index up 0.35%, closing at 1,286.36.

The total trading value on the three exchanges reached VND 20,492.5 billion, up 9.6% from the previous session. Of this, the matched order trading value reached VND 18,502.3 billion, up 6.4% from the previous session, up 9.6% from the 5-session average, and up 13.5% from the 20-session average.

In terms of industries, liquidity increased notably in Software, Food, and Chemicals, while it decreased in Retail, Steel, and Agriculture & Seafood. In terms of price movements, Real Estate, Securities, Construction, Steel, and Oil Equipment & Services declined, while the remaining sectors increased compared to the previous day.

Foreign investors bought a net VND 456.1 billion, and for matched orders alone, they bought a net VND 398.5 billion.

The main sectors that foreign investors bought on a matched basis were Food & Beverage and Information Technology. The top stocks that foreign investors bought on a matched basis included MSN, FPT, TCB, NTL, CMG, DBC, GMD, TPB, VJC, and TLG.

On the selling side, foreign investors sold mainly in the Banking sector on a matched basis. The top stocks that foreign investors sold on a matched basis included STB, CTG, VPB, HCM, MSB, DGC, VCI, VNM, and NKG.

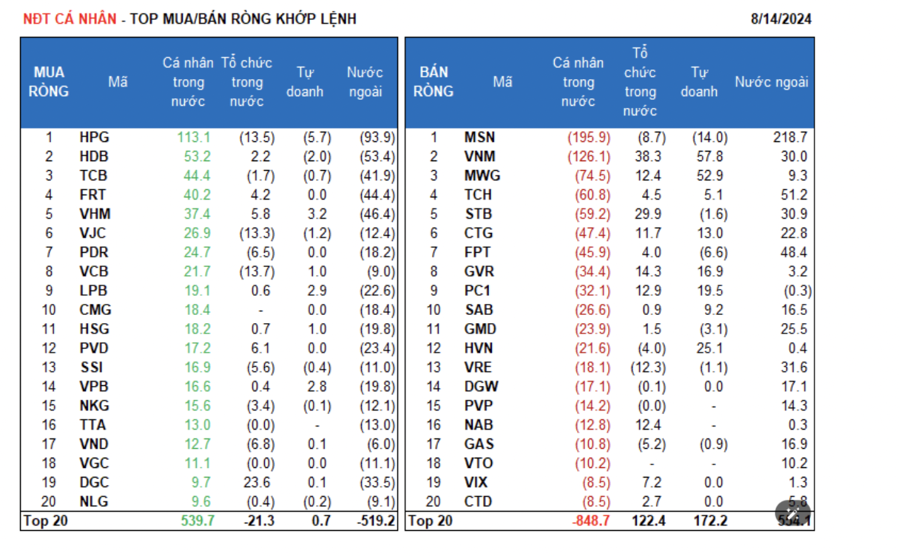

Individual investors sold a net VND 723.3 billion, of which VND 526.4 billion was from matched orders.

For matched orders only, they bought 8 out of 18 sectors, mainly in Travel & Entertainment. The top stocks bought by individual investors included VJC, MWG, STB, MSB, VHM, VNM, EIB, HCM, CTG, and NKG.

On the selling side for matched orders, they sold 10 out of 18 sectors, mainly in Food & Beverage and Information Technology. The top stocks they sold included MSN, FPT, TCB, VPB, HPG, HAH, DBC, NTL, and BVH.

Proprietary trading bought a net VND 499.5 billion, and for matched orders alone, they bought a net VND 338.3 billion.

For matched orders only, proprietary trading bought 13 out of 18 sectors. The top sectors they bought were Banking and Industrial Goods & Services. The top stocks bought by proprietary trading today included VPB, HAH, TCB, ACB, MWG, MBB, NTL, CTG, DGC, and PNJ. The top-selling sector was Information Technology. The top stocks they sold included FPT, MSB, EIB, VHM, VIB, CMG, VNM, TPB, SSB, and VJC.

Domestic institutional investors sold a net VND 279.2 billion, and for matched orders alone, they sold a net VND 210.4 billion.

For matched orders only, domestic institutions sold 10 out of 18 sectors, with the largest value in Travel & Entertainment. The top stocks they sold included VJC, MWG, FPT, MBB, TCB, VCB, NTL, CMG, VNM, and DGC. The top-buying sector was Basic Resources. The top stocks they bought included HPG, VPB, STB, DBC, HSG, HAH, MSN, VIB, ACB, and DPM.

Today’s matched orders reached VND 1,990.3 billion, up 51.9% from the previous session and contributing 9.7% of the total trading value.

Today’s notable matched orders were in EIB, with nearly 14.5 million shares worth VND 275.2 billion traded by an individual investor to a domestic proprietary trader. In addition, there was a transfer of more than 1.6 million VJC shares (worth VND 176.1 billion) between individual investors.

The allocation of money flow increased in Chemicals, Food, Software, and Aviation, while it decreased in Real Estate, Banking, Securities, Construction, Steel, Agriculture & Seafood, Retail, Oil & Gas, Warehousing, Logistics, and Maintenance.

For matched orders only, the allocation of money flow increased in the mid-cap group, VNMID, while it decreased in the large-cap group, VN30, and the small-cap group, VNSML.

The Power of Words: Crafting Captivating Copy for the Web

The Art of Persuasion: Unveiling the Secrets of Effective Online Communication

The proprietary trading arms of securities companies aggressively bought hundreds of billions of dong worth of stocks in the last trading session of the week.

What’s So Special About Stocks That Have Recently Upgraded to the HOSE Exchange?

Over 204 million shares of DSC Securities have been officially listed on the HOSE, amidst a strong surge in the company’s third-quarter profits.