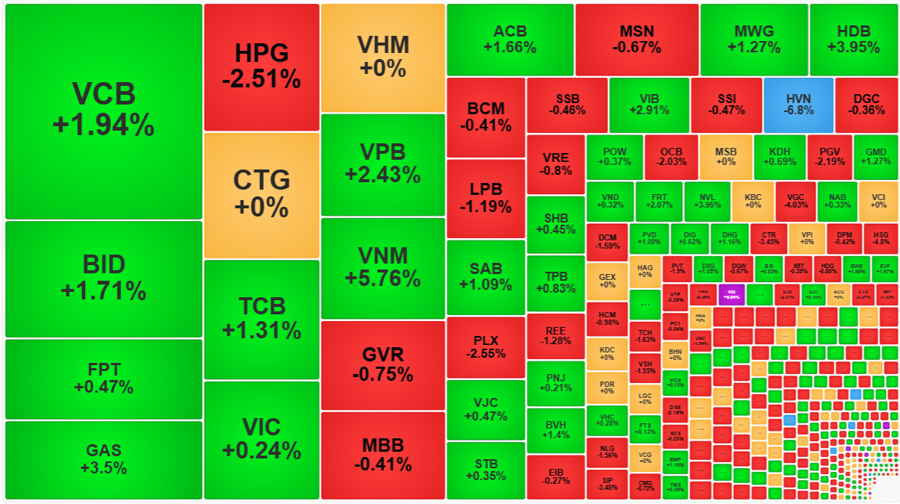

There are numerous signs indicating that the market bottom is near as liquidity dries up and selling pressure eases, with a slight rebound in the indices. The VN-Index closed the session up 2.05 points, with a much healthier breadth of 211 gainers versus 162 losers.

Large-cap groups also turned green, with banks recording price increases in some strong pillars such as VCB, CTG, TCB, ACB, MBB, BID, and VPB, which held firm at the reference level. Financial services and materials stocks also surged, with VND rising 2.1%, FTS up 2.08%, and HCM, SSI, VCI, and MBS also performing well. The materials, energy, and information technology sectors, particularly Telecommunications, rebounded strongly, with VGI up 4.39%. The top stocks driving the market today included HPG, FPT, ACB, VCB, MSN, and TCB.

On the other hand, the real estate group was weighed down by the Vin family, with VHM falling 2.62%, VIC down 0.24%, and VRE losing 0.28%. These three stocks alone shaved off more than one point from the market. Other stocks in the sector performed well, including KDH, KBC, and NVL.

The earnings season is in full swing, but there aren’t any jaw-dropping profit figures due to high comparative bases. As a result, the market doesn’t benefit much from this catalyst, while external variables remain fluid. Nonetheless, selling pressure has almost dissipated, with combined matched transactions on the three exchanges today reaching VND12,200 billion, a rare low, indicating that a turning point is imminent.

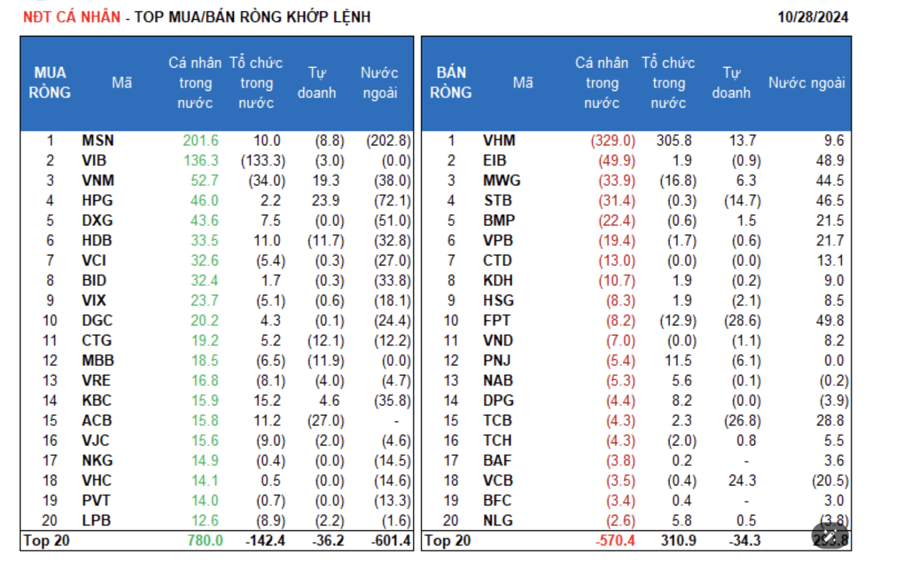

However, a negative point is that foreign investors still sold a net VND666.3 billion, with a net sell of VND385.7 billion in matched transactions. Their main net buy in matched transactions was in the Banking and Information Technology sectors. The top net buys in matched transactions by foreign investors included FPT, EIB, STB, MWG, TCB, VPB, BMP, PDR, CTD, and VHM.

On the net sell side in matched transactions was the Food and Beverage sector. The top net sells in matched transactions by foreign investors included MSN, HPG, DXG, VNM, KBC, HDB, VCI, DGC, and VCB. MSN suffered the largest net sell-off, with VND202 billion in matched transactions.

Individual investors net bought VND370.2 billion, of which VND351.5 billion was net bought in matched transactions.

In terms of matched transactions, they net bought 12 out of 18 sectors, mainly in the Food and Beverage sector. The top net buys by individual investors included MSN, VIB, VNM, HPG, DXG, HDB, VCI, BID, VIX, and DGC.

On the net sell side in matched transactions were six out of 18 sectors, mainly in the Real Estate, Construction, and Materials sectors. The top net sells included VHM, EIB, MWG, STB, BMP, VPB, KDH, HSG, and FPT.

Proprietary trading bought a net VND27.0 billion, with a net sell of VND84.6 billion in matched transactions.

In terms of matched transactions, proprietary trading net bought eight out of 18 sectors. The top net buys in matched transactions by proprietary trading today included VCB, HPG, VNM, VHM, MWG, PVD, HAH, FUEKIVFS, KBC, and PTB. The top net sell was in the Banking sector, with the top net-sold stocks being FPT, ACB, TCB, STB, CTG, MBB, HDB, GMD, MSN, and PNJ.

Domestic institutional investors net bought VND59.9 billion, with a net buy of VND118.9 billion in matched transactions.

In terms of matched transactions, domestic institutions net sold 10 out of 18 sectors, with the largest value being in the Banking sector. The top net sells included VIB, VNM, MWG, PDR, FPT, SHB, VJC, LPB, FRT, and VRE. The largest net buys were in the Real Estate sector, with the top net buys being VHM, KBC, PNJ, ACB, HDB, MSN, FUEVFVND, DPG, DXG, and GMD.

Today’s matched transactions totaled VND2,124.0 billion, up 49.8% from the previous week’s closing session and contributing 17.2% of the total transaction value.

There was a notable matched transaction in VIB today, with 21 million shares worth VND357 billion changing hands between individual investors.

Individual investors continued to trade in the Banking sector (SSB, HDB, SHB) and VIC.

The allocation of funds increased in Securities, Steel, Electrical Equipment, Warehousing, Logistics & Maintenance, and Building Materials & Interiors, while decreasing in Real Estate, Banking, Construction, Agricultural & Seafood Farming, and Food.

In terms of matched transactions, the allocation of funds increased in the mid-cap VNMID and small-cap VNSML groups, while decreasing in the large-cap VN30 group.

The Flow of Funds: Riding the Storm, How Far Will the Market Correction Go?

The stock market witnessed a steep decline of almost 33 points, or 2.5%, last week—the biggest drop since the end of June 2024. This significant downturn caused a break in the VN-Index’s support channel, which had been intact since the August 2024 lows. Experts unanimously deemed this a negative technical signal, a harbinger of potential challenges ahead for investors.

Stock Market Blog: Selling Pressure Eases, Stocks May Bottom Out Before Index

Today’s and this week’s anticipated signal is that of a depleted liquidity. The combined trading value of the two exchanges dipping below the 10 trillion threshold is an unusual occurrence, indicating that sellers may no longer possess the strength to control market oscillations.

“Equities Next Week (Oct 28 – Nov 1): Testing Investors’ Patience”

The gloom that has enveloped the stock market in recent days has cast a shadow over investor sentiment, with the VN-Index consistently shedding points to hover perilously close to the 1,250 mark.