“Accelerated depreciation on certain vessels,” Au Lac explained. The Q3 financial statements also showed that fully depreciated assets doubled since the beginning of the year, reaching 542 billion VND. By front-loading depreciation expenses, the company may report higher costs and losses in the current period, but it will benefit from lower costs in subsequent periods, especially during challenging economic times.

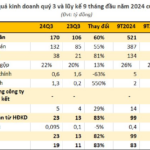

The main driver of the quarterly loss was the surge in depreciation expenses on fixed assets in Q3, which jumped to 169 billion VND compared to around 59 billion VND in the previous quarters. Despite this, revenue remained robust, reaching 373 billion VND, a 13% increase.

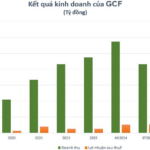

For the first nine months of the year, revenue stood at 1,170 billion VND, fulfilling 90% of the annual plan. Profit before tax was 195 billion VND, exceeding the full-year target of 187 billion VND. Net profit reached nearly 156.7 billion VND, a 19% increase compared to the previous year.

As of the end of Q3, Au Lac’s total assets exceeded 2,100 billion VND, a 10% decrease from the beginning of the year, mainly due to the repayment of short-term and long-term loan principals. The company maintained a high level of cash and cash equivalents, amounting to 745 billion VND, representing 30% of total assets. Additionally, the company still has over 144 billion VND in other long-term receivables related to a deposit for the transfer of land use rights agreed upon in March 2020.

According to the report, the members of the Board of Directors and the Management Board earned a total income of nearly 6.8 billion VND in the first nine months. Mr. Mai Van Tung, in his role as a member of the Board of Directors and General Director, received the highest income of nearly 2.9 billion VND, equivalent to approximately 317 million VND per month. In contrast, Ms. Ngo Thu Thuy, the Chairman, earned 562 million VND during the same period, or over 62 million VND per month.

Source: Au Lac

|

Ms. Ngo Thu Thuy’s company cautiously projected a 24% decrease in profit before tax for 2024 compared to 2023 due to concerns about potential objective challenges that may negatively impact their business. These include environmental regulations, pressure to reduce carbon emissions, and additional costs for an aging fleet of over a decade…

On a positive note, Au Lac will benefit from the new tariff framework under Circular 39, which took effect on February 15, 2024. This regulation increased the prices of warehouse, port, and tugboat services by an average of 10%.

Looking ahead, between now and 2030, the maritime transport company intends to build or acquire 8-10 additional oil/chemical tankers with a capacity ranging from 13,000DWT to 20,000DWT to replace or supplement their existing fleet. The new vessels are likely to be built in South Korea. The company’s leadership previously expressed optimism about their ship trading strategy, anticipating profits three times higher than those from self-operation.

The Miracle of Aloe Vera: Unlocking Record-Breaking Profits and Soaring Stock Prices.

For the first nine months of the cumulative year, the company reported a profit after tax of nearly VND 55 billion, up 138% over the same period and exceeding the yearly plan.

The Chairman of TTC AgriS: Working in the Interests of 91% of Shareholders and Investors

In her capacity as Chairman of the Board of Directors of TTC Agri-Biotech Joint Stock Company (TTC AgriS) (HOSE: SBT), Ms. Dang Huynh Uc My has asserted the company’s commitment to ensuring fairness and transparency for its shareholders, investors, and stakeholders. As TTC AgriS attracts the participation of international investors and prominent financial institutions, Ms. My has emphasized the importance of equitable treatment and transparent disclosure for all involved parties.