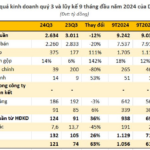

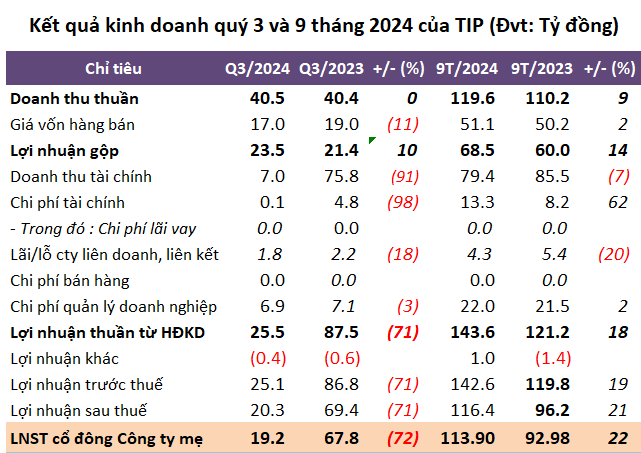

**Third Quarter Revenue for TIP Remains Unchanged, with a Gross Profit Increase of 10%**

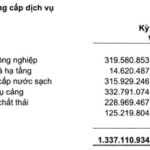

TIP’s third-quarter net revenue remained unchanged from the previous year, surpassing 40 billion VND. The primary source of income was infrastructure fees, which exceeded 14 billion VND, a slight increase from the same period last year. Due to a significant decrease in cost of goods sold, the gross profit, after deductions, reached nearly 24 billion VND, a 10% increase. The gross profit margin also improved from 53% to 58%.

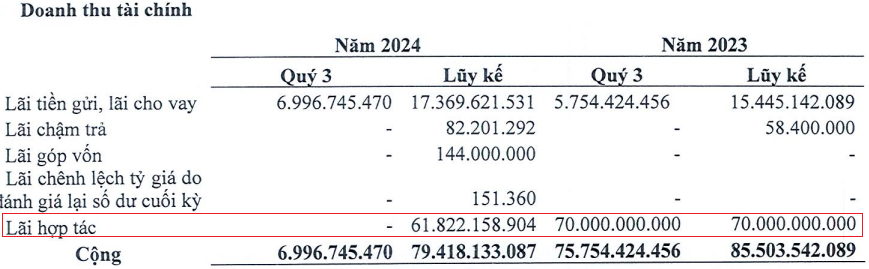

Notably, financial activity revenue decreased by 91%, amounting to nearly 7 billion VND, due to the absence of cooperation profit recognition (70 billion VND profit in the same period last year). TIP recorded this cooperation with UPCoM: PAP in Q2 2024.

Source: TIP

|

Despite a 41% reduction in total expenses, amounting to 7 billion VND, it was not significant enough to contribute to TIP’s growth for the quarter. As a result, net profit reached over 19 billion VND, a 72% decrease.

However, when combined with the improved business performance in the first half of the year, the nine-month revenue neared 120 billion VND, with a net profit of almost 114 billion VND, representing a 9% and 22% increase, respectively. In comparison to the 2024 targets of 264 billion VND in revenue and over 165 billion VND in after-tax profit, the company has achieved 76% and 70% of these goals, respectively.

Source: VietstockFinance

|

As of the end of Q3, TIP’s total assets exceeded 2,088 billion VND, a nearly 6% increase from the beginning of the year. Short-term receivables of nearly 1,408 billion VND, accounting for 67% of the capital sources, increased by 14%. The majority of this was comprised of cooperation receivables with PAP, amounting to over 1,033 billion VND.

Inventories totaled more than 145 billion VND, a 4% decrease, and consisted of unfinished business expenses for various projects, including the 18ha Tam Phuoc residential area (over 43 billion VND), the Thanh Phu residential area (over 59 billion VND), the real estate area near the market and shopping street (nearly 16 billion VND), and the construction of kiosk structures (approximately 5 billion VND). The remaining balance was comprised of real estate goods valued at over 22 billion VND.

Payables stood at over 261 billion VND, a 10% increase, mainly comprised of “savings” of nearly 188 billion VND, a 7% increase from the beginning of the year, accounting for 72% of total debt. TIP did not record any financial debt.

After more than 23 years of dedication, TIP’s Deputy Director resigns

“A Stellar Performance: Sonadezi Achieves 87% of Profit Plan in 9 Months”

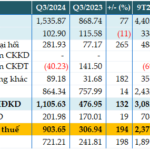

Sonadezi Corporation (Sonadezi, UPCoM: SNZ), a leading industrial development company, announced its third-quarter financial results, reporting a net profit of over VND 192 billion, an 8% decrease compared to the same period last year. Despite this quarterly decline, the company remains on a strong trajectory, having achieved 87% of its full-year net profit target in the first nine months of the year.

“Eximbank Triples Pre-Tax Profit in Q3, Borrowing Over VND 1,500 Billion from SBV”

The Q3 2024 consolidated financial statements show that the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Eximbank, HOSE: EIB) posted a remarkable performance with a pre-tax profit of nearly VND 904 billion, tripling its year-on-year earnings.

The Mighty Makeover: “Camau Protein’s Quarterly Profit Plunge: Hoarding a Staggering $9,000 Billion in Cash”

The explanation provided in the consolidated financial statements attributes the almost 63% increase in profit to the reduction in cost of goods sold, which outpaced the decrease in revenue. Additionally, this year’s revenue deductions were significantly lower than those of the previous year, contributing to the substantial growth in profit.