Data administration activities, the application of data analysis technology are not new to organizations in the banking sector.

According to Mr. Nguyen Thanh Son, Director of the Training Center, Vietnam Banks Association (VNBA), since 2017, VNBA has organized many workshops and training programs for its members. While at that time, most were just paying attention and only a few were researching and finding ways to apply technology in business activities, making decisions, and managing risks, now, after 5-6 years, things have changed.

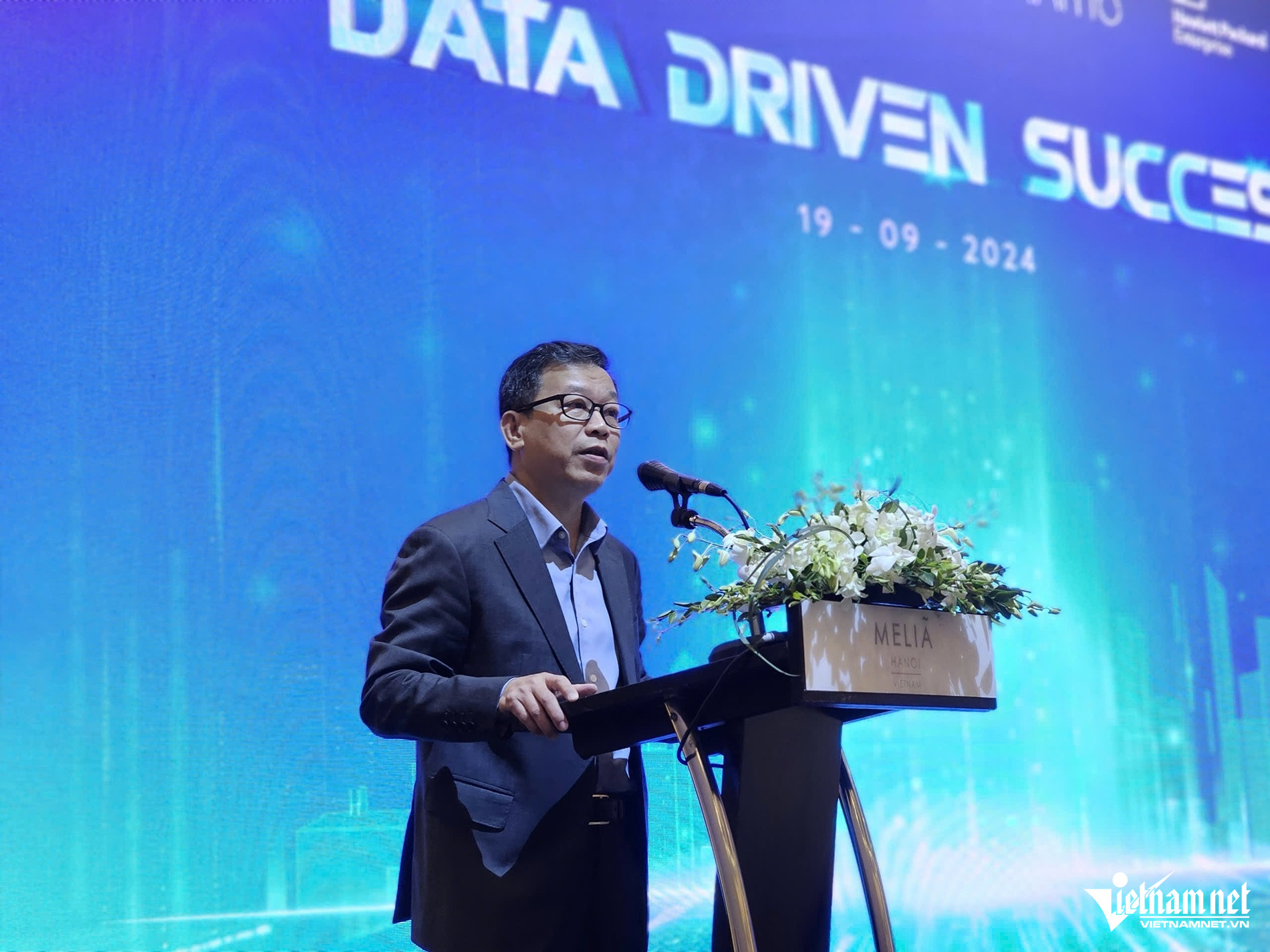

Speaking at the seminar “Leveraging Data for Success” on September 19 in Hanoi, Mr. Nguyen Thanh Son said that many banks have been and are applying new technology in fraud prevention and payment activities within the digital ecosystem, including data management applications.

With the huge advantage of having a huge data repository, if they know how to take advantage of it, banks will increase their competitive advantage, enhance their brand, and reduce risks.

Mr. Nguyen Thanh Son, Director of the Training Center, Vietnam Banks Association (VNBA), gave the opening remarks at the seminar “Leveraging Data for Success” on September 19 in Hanoi. Photo: Thai Khang |

However, to exploit this asset, we must first control and process, or in other words, manage data effectively.

According to VNBA representatives, large banks have issued data strategies, have a governance framework, leaders, staff, and specialized units, along with policies defining the roles of stakeholders, set strategies for each phase, and deploy them systematically. Meanwhile, smaller banks implement data strategies at a lower level.

Ms. Dinh Hong Hanh, Deputy General Director and Head of Financial Advisory Services at PwC Vietnam, stated that the benefits derived from data originate from data governance. Good, sustainable, and safe governance tools can effectively leverage data.

Another benefit of effective data governance for banks is that it helps them adapt to and comply with legal requirements that are constantly changing globally.

In the Southeast Asian region, the maturity of data governance in financial institutions is increasing due to the pressure from legal requirements, as well as the drivers of digital transformation and the need for cross-border data management.

Application of technology helps banks break through

In the banking sector, the application of new technologies such as Generative Artificial Intelligence (GenAI) and machine learning brings breakthrough solutions by understanding customers’ preferences and behaviors. Meanwhile, Big Data analysis personalizes services, suggests suitable products, meets individuals’ financial goals, and thus increases customer satisfaction and engagement with the bank.

In addition, GenAI’s learning capabilities automate complex processes, reduce errors, and save time in operations, while also enhancing risk management. GenAI and other new technologies improve risk management by understanding abnormal behavior patterns and thus preventing fraudulent activities.

Through historical data analysis, GenAI can forecast market trends, make smarter and more accurate decisions, and open up opportunities to develop new products and services that meet the rapidly changing market demands.

According to a study by the McKinsey Institute, AI in general, and GenAI in particular, can contribute up to 340 billion USD by increasing productivity. Meanwhile, according to Statista, the banking industry’s investment in GenAI is expected to reach 85 billion USD by 2030.

Banks are using GenAI for the following activities: Summarization, deep information retrieval, conversion/translation, extension/enhancement of existing content, Q&A, and creation of new content.

However, as the application of AI in operations increases, the amount of data and models generated will also increase, leading to risks related to cybersecurity, privacy, operations, legal, and compliance. Therefore, it is crucial to apply AI responsibly to mitigate potential risks.

By Du Lam

“J&T Express Honored at Vietnam Digital Awards 2024 for Its Relentless Efforts in Digital Transformation”

On October 5th, at the prestigious Vietnam Digital Awards 2024, J&T Express was once again recognized for its outstanding achievements in digital transformation. The company was honored in the category of “Excellent Digital Transformation Enterprise”…

The Golden Ticket to Landing a Job in Finance and Banking

At the seminar “Personal Financial Management and Job Opportunities in the Finance and Banking Industry” held on October 4 at the National University of Economics, renowned experts in the field of finance and banking shared their insights, guidance, and tips to help students create a “passport to success” when applying for jobs in the banking industry.

Why Did Vietnam’s Largest Auto Expo Change Its Name?

The Vietnam Motor Show 2024 has suffered a significant blow with the withdrawal of several major car brands, including Audi, Mercedes-Benz, Volvo, Volkswagen, and Ford. In an attempt to salvage the event, the organizers have had to resort to inviting motorcycle companies to participate and fill the void left by these prominent automotive brands.