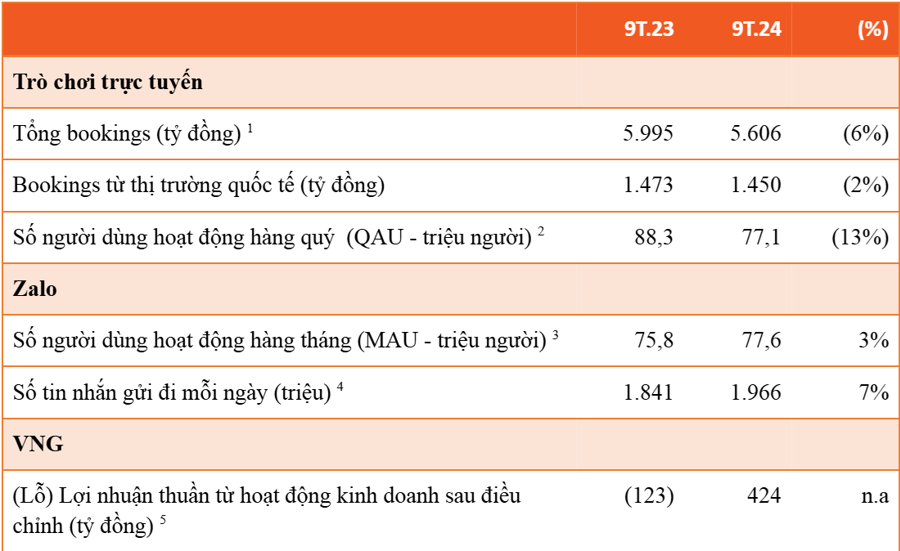

As of September 30, VNG Joint Stock Company (VNG: Upcom) has just announced its financial report for the third quarter of 2024 with positive figures: nine-month cumulative revenue reached VND6,892 billion, and profit from business activities after adjustments reached VND424 billion, a significant growth compared to a loss of VND123 billion in the same period last year.

Accordingly, in the first nine months of 2024, all core segments of VNG recorded growth. Specifically, Zalo reported good results from value-added services; Zalopay continuously expanded its platform scale; VNG Digital Business (VNG DB) achieved positive growth in revenue from enterprise customers, and revenue from international markets continued to increase, despite a slight decrease in revenue from the online gaming segment.

In particular, the total bookings for the online gaming segment reached VND5,606 billion, a slight decrease compared to the same period last year. Of this, 26% of bookings came from international markets. This segment also recorded a quarterly active user base (QAU) of over 77 million people.

Zalo recorded 77.6 million monthly active users (MAU), a 3% increase compared to the same period, and nearly 1.97 billion messages sent per day, growing in both users and revenue from services.

Zalopay grew by 38% in total payment volume, and revenue from financial services increased by 196% compared to the first nine months of 2023.

VNG DB recorded a 58% revenue growth compared to the same period in 2023, with revenue from the global market increasing by 14 times and accounting for 38% of total revenue.

By the end of September 2024, VNG’s total contributions to the state budget reached over VND700 billion.

Additionally, VNG continues to focus on strategic initiatives such as AI, collaborations with reputable domestic and international partners, and pursuing technology development goals to bring value to Vietnamese users and ensure social responsibility.

The AI Artian graphics platform, developed by the VNGGames team in its 2.0 version, helps reduce the time for generating image ideas by 30%, cuts down model illustration time by 50%, and enables the creation of video trailers in just a few minutes. Notably, VNGGames has consecutively collaborated with leading names in the global gaming industry, such as NCSOFT (South Korea) and Riot Games, to execute plans for League of Legends (LOL) eSports in 2025, among other strategic partnerships.

The Rise of the Securities Companies: Can Masan Reach its Audacious Target of 2,000 Billion VND Net Profit?

In the first nine months of 2024, Masan achieved a remarkable profit of 1.308 trillion Vietnamese dong after allocation of minority interests, surpassing its initial plans by a significant margin. With this impressive performance, the company is well on its way to achieving its ambitious full-year net profit target of 2 trillion Vietnamese dong, as per the positive scenario laid out.

“Overcoming ‘Breathalyzer’ Challenges, Sabeco, the Beer Industry Giant, Reports Profitable Q3 Growth with 70% of Assets in Cash”

For the first nine months of the year, Sabeco recorded net revenue of VND 22,940 billion and a remarkable after-tax profit of VND 3,504 billion, reflecting a 5% and nearly 7% increase, respectively, compared to the same period last year.

The Rising Cost of Goods and Expenses: Hoa Sen Group Reports Loss for the Quarter

The sharp rise in raw material and operating costs has resulted in Hoa Sen Group posting a post-tax loss of VND 186 billion, a 142% decline compared to the same period last year when they recorded a profit of VND 438 billion. Despite this setback, the company has managed to surpass its annual revenue and profit targets for the financial year.