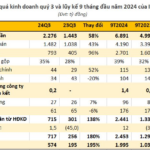

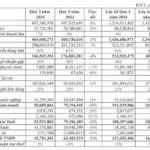

DIC Corporation (DIG) released its Q3 2024 financial report, revealing a significant drop in revenue compared to the previous year. The company’s primary source of income, real estate business operations, declined by 80%, with a 38% decrease in revenue from the transfer of CSJ apartment units, transfer of rough construction works in the Dai Phuoc project in Hau Giang, and transfer of land use rights in the Nam Vinh Yen project.

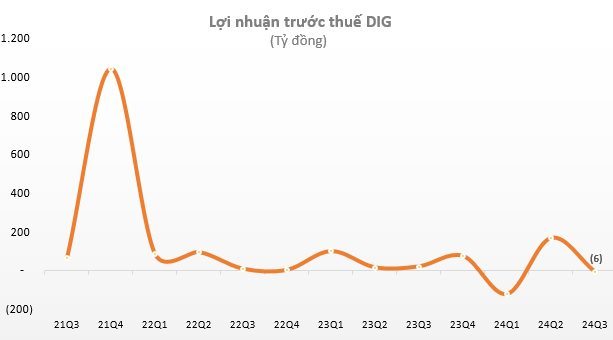

Despite the challenging quarter, DIC Corp’s financial revenue increased by 124% year-on-year, reaching VND 24 billion, mainly due to recognized interest income from deposits and lending activities. Expenses remained relatively stable during this period. The company reported a pre-tax loss of nearly VND 6 billion, a stark contrast to the VND 22 billion profit in the same period last year. However, by deferring corporate income tax expenses, DIC Corp recorded an after-tax profit of VND 11 billion in Q3, a 7% decrease year-on-year.

Figure 1: DIC Corp’s Q3 2024 Financial Snapshot

A deep dive into the company’s cash flow statement reveals a substantial negative business cash flow of nearly VND 1,200 billion in Q3, a significant deviation from the VND 125 billion negative cash flow in the same period last year. This indicates a potential strain on the company’s liquidity and ability to generate cash from its core operations.

For the first nine months of 2024, DIC Corp’s cumulative revenue stood at VND 869 billion, a 47% decrease year-on-year, while pre-tax profit plummeted by nearly 70% to VND 42 billion. Post-tax profit also took a hit, declining by almost 85% to nearly VND 16 billion. With these results, DIC Corp has achieved 37% of its annual revenue target and 4% of its profit goal.

Looking ahead, DIC Corp has set ambitious goals for 2024, targeting a revenue of VND 2,300 billion and a pre-tax profit of VND 1,010 billion, which represent increases of 72% and 509%, respectively, compared to the previous year. However, it’s important to note that the company fell short of its high targets in 2023.

The projected profit for 2024 is based on the planned business operations and expected revenue from the transfer of products in various projects, including the Dai Phuoc Eco-Tourism Urban Area (Dong Nai), Lam Ha Center Point Urban Area (Ha Nam), DIC Nam Vinh Yen City (Vinh Phuc), DIC Victory City (Hau Giang), Hiep Phuoc Residential Area, Vung Tau Gateway Apartment Building, and CSJ Phase 1.

As of September 30, DIC Corp’s total assets amounted to VND 18,153 billion, a 7.8% increase from the beginning of the year. This includes VND 3,785 billion in cash and cash equivalents, reflecting a significant boost of over VND 1,200 billion since the start of 2024. Short-term receivables and inventory make up a significant portion of the company’s total assets, standing at VND 5,985 billion and VND 7,864 billion, respectively.

In terms of capital structure, DIC Corp’s total liabilities increased by 14% year-to-date, reaching VND 10,204 billion. Notably, the company’s debt accounts for 36% of this figure, amounting to VND 3,679 billion. Shareholders’ equity stands at VND 7,949 billion, with undistributed profits of VND 480 billion.

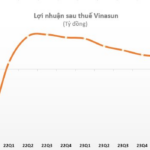

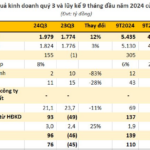

The Power of Profits: How a Power Company’s Quarterly Earnings Report Sent Stock Prices Skyrocketing

This enterprise has soared to new heights, surpassing its annual profit plan by a remarkable 180% in just nine months.

The Pennies-for-Dollars Stock List

As of the market close on 11/10/2024, the VN-Index stood at 1,288 points, marking a notable 14% increase since the beginning of the year, equivalent to a rise of 157 points. However, not all stocks have fared equally well. Some have plummeted or stagnated over the past year, lingering in the notoriously low-priced “tea and chat” zone.