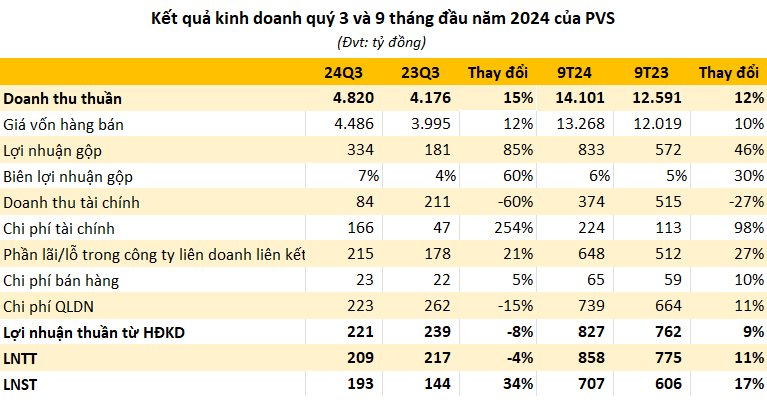

Petrovietnam Technical Services Corporation (PVS) has released its Q3 2024 financial report, revealing a 15% year-on-year surge in net revenue to VND 4,820 billion. With cost of goods sold increasing at a slower pace, the company’s gross profit climbed to VND 334 billion, marking an impressive 85% uptick. This led to a significant improvement in the gross profit margin, rising from 4% in Q3 2023 to 7% in the current quarter.

PVS witnessed a 60% decline in financial income, which stood at VND 84 billion. Conversely, financial expenses more than tripled from the previous year, reaching VND 166 billion. After accounting for various other expenses, the company reported a 4% year-on-year dip in pre-tax profit, amounting to VND 209 billion for the quarter.

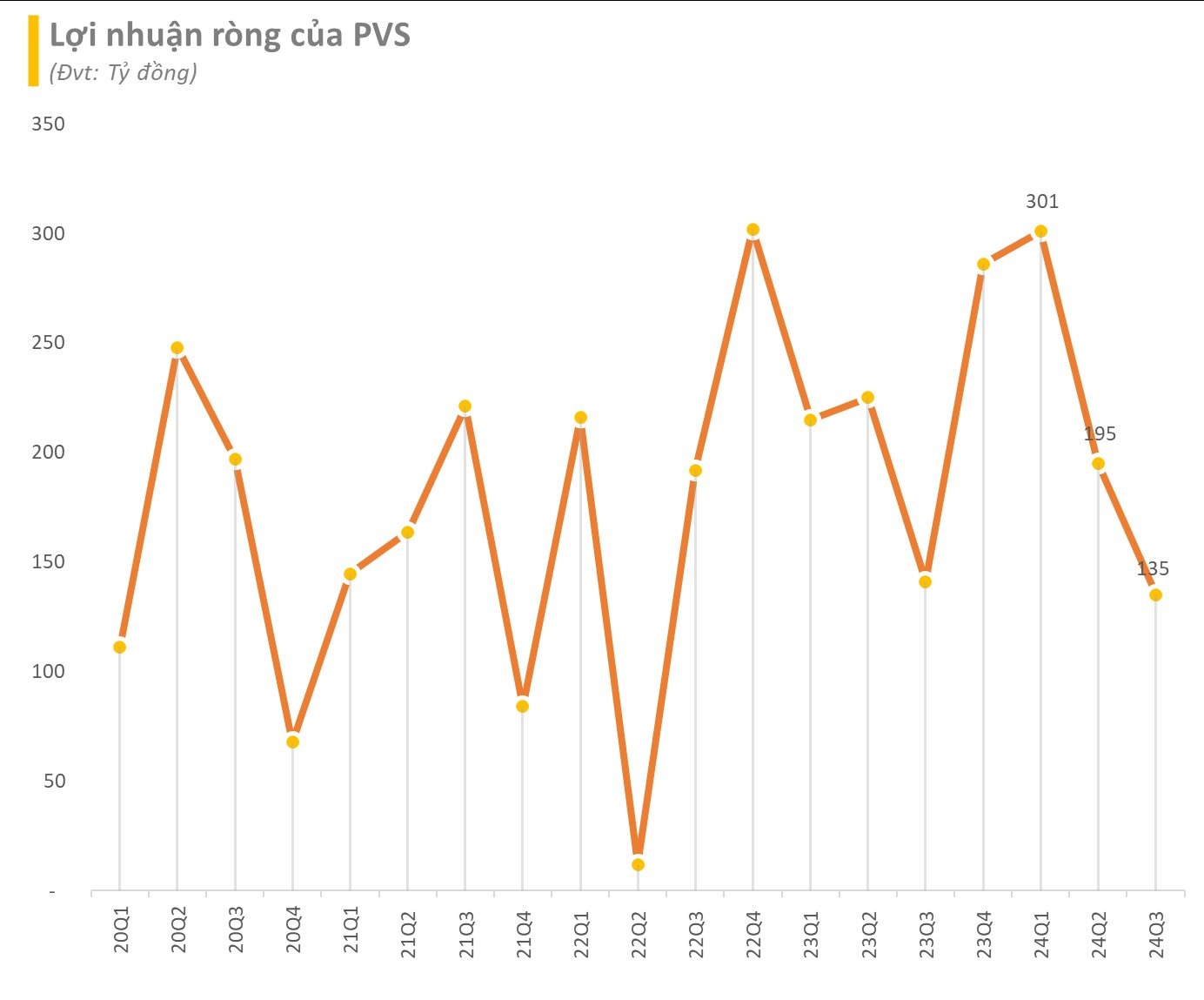

However, thanks to a deferred tax asset of over VND 57 billion, PVS’s net income rose sharply by 34% year-on-year to touch VND 193 billion. In contrast, net income attributable to the company’s owners (net profit) dipped by 4% to settle at VND 135 billion.

For the nine-month period ending September 30, 2024, PVS’s net revenue reached VND 14,101 billion, reflecting a 12% increase compared to the same period last year. However, net income suffered a 17% decline, amounting to VND 707 billion.

Looking at the full year 2024, the company has set consolidated revenue and net income targets of VND 15,500 billion and VND 660 billion, respectively. These targets represent decreases of 29% and 38% from the record-high levels achieved previously. Notably, with the aforementioned results, PVS has already surpassed its annual profit plan by 7% after just three quarters.

As of September 30, 2024, PVS’s total assets stood at VND 27,342 billion, indicating a rise of VND 926 billion from the start of the year. Notably, cash and bank deposits accounted for VND 11,488 billion, equivalent to 42% of the total assets. Short-term receivables also witnessed a slight increase, reaching VND 4,256 billion.

During the nine-month period, PVS earned VND 176 billion in interest income from deposits and loans. However, the company experienced a foreign exchange loss of over VND 176 billion.

As of September 30, PVS had invested VND 4,779 billion in joint ventures and associates. These entities primarily operate in the field of floating storage and offloading (FSO) for crude oil processing and export.

Anticipating significant benefits from Vietnam’s $12 billion offshore mega-project

As a subsidiary of the Vietnam Oil and Gas Group (PVN), PVS is the sole domestic provider of comprehensive oil and gas technical services (excluding drilling services). The company boasts a dominant market share in various related sectors, such as oil and gas technical vessels (97%), oil and gas mechanics, and port-based services (100% in the port segment). Additionally, PVS owns and operates a fleet comprising 21 service vessels, 3 FSO vessels, and 2 FPSO vessels, giving them a 60% market share in the FSO/FPSO segment.

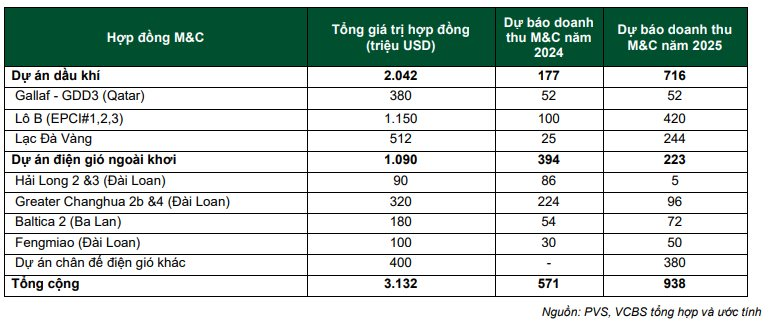

In a recent report, VCBS highlighted two key segments that hold the potential to drive substantial growth in PVS’s revenue and profits: traditional oil and gas, and renewable energy. The progress made in significant projects like the B – O Mon Lot and Lac Da Vang, recently approved by the government, falls under the traditional oil and gas segment. On the renewable energy front, the focus is on offshore and onshore wind power projects as the government actively promotes renewable energy sources to facilitate the energy transition. The resumption of domestic oil and gas projects sends a positive signal and is expected to contribute to PVS’s improved business performance. Specifically, for the Lac Da Vang project, PVS secured contracts worth $262 million for M&C and $250 million for FSO.

Furthermore, the B O Mon Lot has made significant strides, with the first gas flow to shore expected in 2027. On September 3, Phu Quoc Oil and Gas Operating Company officially awarded the EPCI 1 contract, valued at approximately $1.1 billion, to American firm McDermott and PetroVietnam Technical Services Corporation (PVS). PVS’s share of the contract is worth $500 million.

For the year 2024, VCBS anticipates continued robust performance from PVS, with a strong growth trajectory in revenue, expected to reach VND 24,323 billion, reflecting a 26% increase year-on-year. This growth will be driven by the expansion of the company’s oil and gas engineering and renewable energy segments. Net income is also projected to increase by 2% to VND 1,086 billion, surpassing the previous year’s performance and outpacing the set plan.

Deputy General Director Le Ngoc Son appointed as Member of the Board of Directors of PVN

Le Ngoc Son has been appointed as a Member of the Board of Directors of PetroVietnam (PVN). Mr. Son currently serves as the Deputy General Director of PVN, and his expertise in the oil and gas industry makes him a valuable asset to the organization. With his new role, Mr. Son will contribute to the strategic decision-making and leadership of PVN, ensuring its continued success in the energy sector.