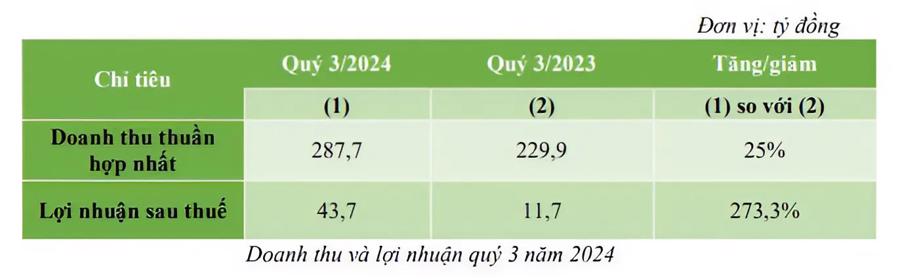

BCG Land Joint Stock Company (UPCoM: BCR) has just announced its Q3/2024 financial report, recording impressive growth with a revenue of VND 287.3 billion, a 25% increase compared to the same period in 2023. Notably, a 273.3% surge in after-tax profit indicates the company’s strong recovery and effective business operations.

For the first nine months of 2024, BCR’s consolidated revenue and after-tax profit reached VND 594.9 billion and VND 105.4 billion, respectively, completing 27.2% and 24.9% of the plans set at the 2024 Annual General Meeting of Shareholders. The main sources of this revenue and profit were the handover of two resort projects: Malibu Hoi An and Hoian D’or. Specifically, in the first nine months, BCR handed over six villas, 147 condotel units at Malibu, and six shophouses at Hoian D’or.

Expenses such as selling and management expenses continued to be efficiently controlled. Specifically, selling expenses in Q3/2024 were recorded at VND 14.2 billion, only 38.4% compared to the same period last year. Management expenses for Q3/2024 amounted to VND 18 billion, bringing the nine-month total for 2024 to VND 51.5 billion, almost equivalent to the same period in 2023 (VND 49.6 billion).

Additionally, as of September 30, 2024, BCG Land maintained a safe debt-to-equity ratio of 1.19, resulting from effective debt management and a secure financial structure. Compared to Q2/2024, the company’s payables decreased slightly by VND 19.4 billion, reaching VND 7,197.8 billion. New loans taken during the year are being utilized to expand the real estate project portfolio in strategic locations, including Ho Chi Minh City, paving the way for long-term growth.

Notably, under the “Advance from Customers” item, the company recorded VND 1,174 billion as of the end of September, including VND 386.4 billion from the Malibu project and VND 759.9 billion from Hoian D’or. This represents the company’s potential future revenue, especially as it accelerates product handovers in the coming periods. The Malibu Hoi An project has already met the requirements to accommodate guests from October 2024.

Once the handover process is completed, this amount will be directly recognized as the company’s revenue. In late November 2024, the company will also launch the King Crown Infinity project, expected to create a new wave in the real estate market with its unique advantages. This project is anticipated to generate a substantial cash flow for BCG Land.

The Malibu Hoi An project is one of BCG Land’s prominent seaside resort projects, having received approval from Quang Nam Province to accommodate guests during the year-end season. BCG Land is finalizing the last steps to hand over the project to the international operator Radisson Hotel Group, a reputable brand in luxury hotel management, to ensure international-standard services for customers and investors. In November, Phase 1 of the project will complete 14 villas, alongside the implementation of Phase 2, which comprises 12 villas.

Overall, BCG Land had a very successful Q3, demonstrating a strong recovery and growth potential in the current real estate market landscape. Riding on this financial growth, the company is accelerating plans to launch the premium King Crown Infinity project – a new iconic development by BCG Land in the heart of Thu Duc, Ho Chi Minh City.

King Crown Infinity is not just a luxury real estate project but also an ideal destination for those seeking a sophisticated and convenient living space. With its diverse amenities and prime location, the project is expected to make a strong impression on the real estate market and attract not only investors but also generate positive revenue, delivering sustainable value to customers and shareholders towards the year-end.

Backed by the extensive ecosystem of the Bamboo Capital Group (HoSE: BCG), BCG Land is well-positioned to seize golden opportunities as the Vietnamese real estate market enters a recovery phase. The company remains focused on expanding its project portfolio, ranging from luxury apartments to world-class resorts. With a determination to continuously enhance value for shareholders and customers, BCG Land is eager to embrace new opportunities, enabling investors to tap into lucrative potential and strive for a more prosperous future.

The Mobile World Reports Q3 Profit of Over $33 Million, Far Surpassing Full-Year Plan

With impressive results, the company has achieved nearly 80% of its annual revenue target and surpassed its annual after-tax profit goal by 20%.