CTCP Nova Consumer Group (code NCG) has just announced its financial report for Q4/2023, with net revenue reaching VND 947 billion, a 34% decrease compared to the same period in 2022. After deducting cost of goods sold, gross profit reached VND 80.3 billion, a nearly 41% decrease compared to Q4/2022. Gross profit margin narrowed from 9.5% in the same period of 2022 to 8.5%.

During the period, Nova Consumer’s financial revenue sharply decreased by 72% to VND 16.9 billion, while financial costs were reduced by 59% compared to the same period in 2022, reaching VND 16.8 billion. Selling expenses decreased by 69% to VND 15.3 billion, while business management expenses increased significantly by 3.7 times to over VND 211 billion.

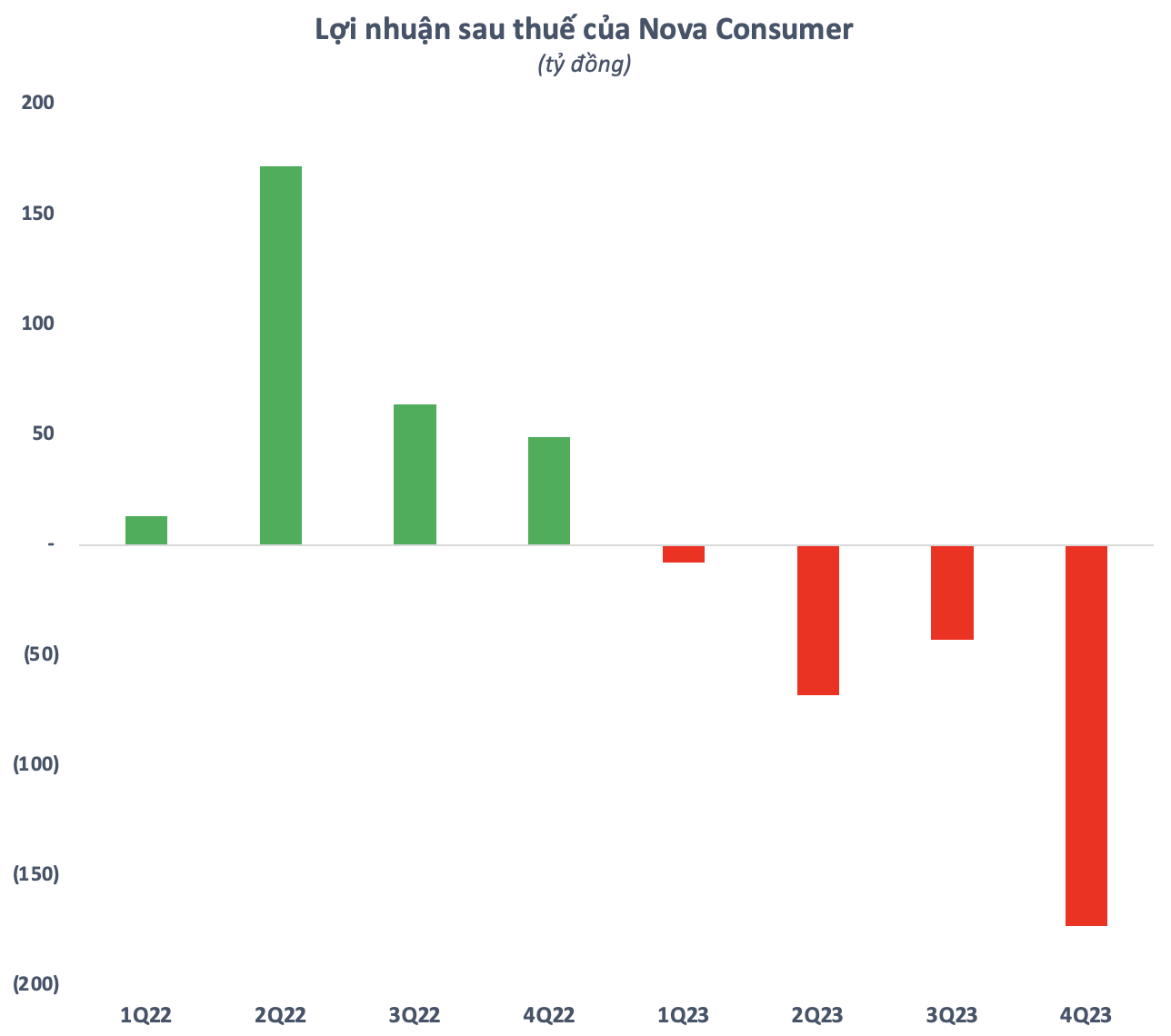

As a result, Nova Consumer suffered a post-tax loss of over VND 173 billion in Q4/2023, a sharp decrease compared to a profit of VND 24.6 billion in the same period in 2022. This is the largest loss the company has recorded in a quarter since its IPO at the beginning of 2022. With losses in all four quarters, Nova Consumer’s net loss for 2023 amounted to VND 247.7 billion.

Nova Consumer is one of the pillars of NovaGroup, led by Mr. Bui Thanh Nhon, along with Novaland, Nova Service, and five other members. In March 2022, the company completed its initial public offering (IPO) of 10.9 million shares at an offering price of VND 44,000 per share, raising nearly VND 480 billion.

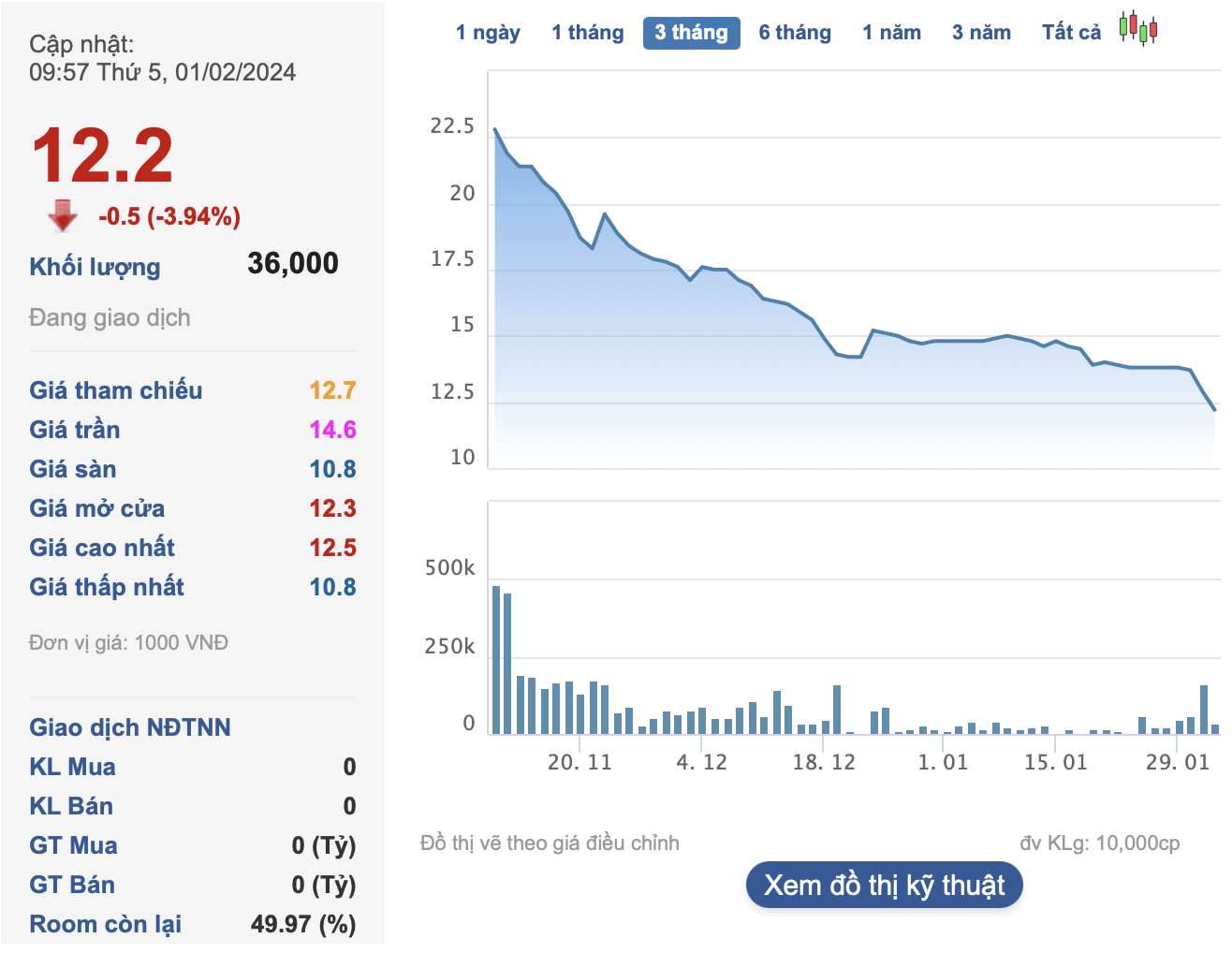

Nova Consumer’s NCG shares officially began trading on UPCoM on November 9, 2023, with a reference price of VND 38,000 per share. The stock immediately dropped to its floor price (-40%) in the first trading session and continued to hit rock bottom. As of January 31, NCG’s market price was only VND 12,900 per share, corresponding to a market capitalization of about VND 1,550 billion, equal to 1/3 of the IPO time.

According to Nova Consumer, in addition to listing its shares, the company also aims to achieve billion-dollar revenue in the agriculture and retail sectors. In the 2022-2026 period, Nova Consumer targets to increase its profit from 4-5 times compared to the VND 300 billion level in 2021, reaching from VND 1,300 to 1,500 billion.

Along with that, Nova Consumer aims to achieve a market capitalization of over USD 1 billion within 3 years after the IPO. However, with the declining business situation and no signs of recovery in the stock price, Nova Consumer’s ambition is becoming increasingly elusive.