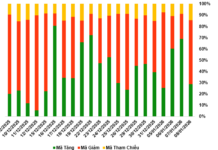

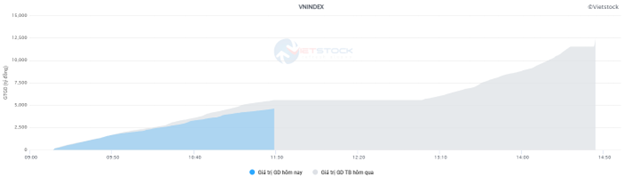

Market liquidity decreased compared to the previous trading session, with the VN-Index‘s matched trading volume reaching over 400 million shares, equivalent to a value of more than 9.2 trillion VND; the HNX-Index reached over 35.4 million shares, equivalent to a value of more than 563 billion VND.

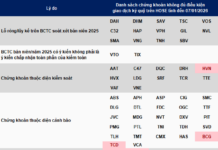

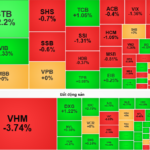

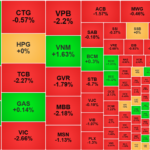

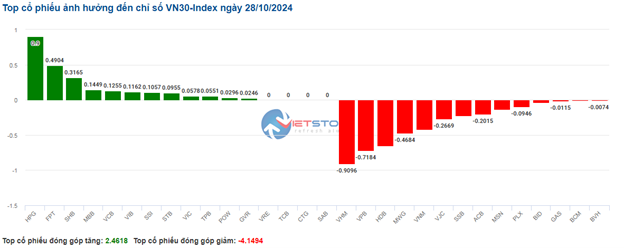

VN-Index continued to move sideways and fluctuate around the reference level, with a slight advantage to the bulls at the end of the afternoon session. In terms of impact, VHM, EIB, VNM, and HDB were the most negative stocks, taking away more than 2.1 points from the index. On the other hand, stocks such as HPG, FPT, VCB, and ACB had the most positive influence and contributed 1.3 points to the index.

| Top 10 stocks with the strongest impact on the VN-Index on October 28, 2024 |

Similarly, the HNX-Index did not show much optimism, as the index was negatively impacted by stocks such as SHS (-1.41%), NTP (-1.36%), and WCS (-6.02%)…

|

Source: VietstockFinance

|

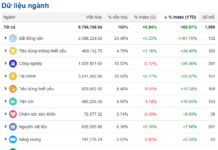

The telecommunications services sector maintained its positive momentum with stocks such as VGI up 4.39%, VNZ up 2.02%, CTR up 0.87%,… Following were the materials and information technology sectors, with increases of 0.74% and 0.7%, respectively. On the other hand, the real estate sector was in the red, as the industry leaders fell from the beginning of the session: VHM fell 2.62%, PDR fell 0.23%, VIC fell 0.24%, VRE fell 0.28%,…

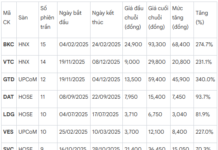

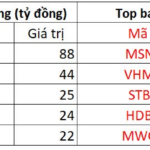

In terms of foreign trading, foreigners continued to net sell more than 473 billion VND on the HOSE exchange, focusing on stocks such as MSN (274.96 billion), HPG (72.44 billion), DXG (50.9 billion), and KBC (39.79 billion). On the HNX exchange, foreigners net sold more than 116 billion VND, focusing on SHS (111.08 billion), IVS (2.1 billion), VGS (1.84 billion), and BVS (1.37 billion).

| Foreigners’ buying and selling activities |

Morning Session: Lackluster Market

The lack of catalysts caused the market to continue to fluctuate around the reference level in the context of low liquidity. At the midday break, the main indices hovered around the reference level. Specifically, the VN-Index fell slightly by 0.03%, to 1,252.35 points; the HNX-Index stood at 224.54 points, down 0.04%. The market breadth kept shifting within a narrow range, and at the end of the morning session, there were 308 advancing stocks and 280 declining stocks.

The recent negative developments have kept investors cautious, and liquidity remained low. The matched trading volume of the VN-Index reached nearly 203 million units, equivalent to a value of more than 4.6 trillion VND. The HNX-Index recorded a matched trading volume of over 17 million units, with a value of more than 271 billion VND.

Source: VietstockFinance

|

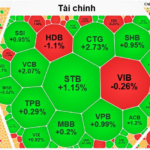

In terms of impact, VHM was the biggest “burden” on the index, taking away nearly 1.3 points from the VN-Index. The remaining stocks in the top 10 impacts on the VN-Index did not have a significant impact on the index, with the most notable being VNM (-0.3 points), HDB (-0.2 points); HPG (+0.3 points) and VCB (+0.27 points).

The industry groups were mixed. The telecommunications group was the most prominent with a strong increase of 3.58%. This was mainly contributed by VGI (+4.69%), VNZ (+2.02%), YEG (+4.12%), FOX (+0.67%), and CTR (+0.63%). The information technology, materials, utilities, and financial groups maintained a slight gain in the morning session. The most notable stocks were CMG (+1.38%), FPT (+0.52%); HPG (+0.76%), HSG (+1.97%), NKG (+1.71%), GDA (+3.26%); HND (+2.29%), DNW (+13.54%), HNA (+7%); BMI (+4%), PGB (+3.61%),…

On the downside, the pressure from VHM (-2.85%) caused the real estate group to be at the bottom of the table with a decrease of 0.53%. Most of the remaining stocks in the group rose or fell slightly around the reference level, with the most notable gainer being NVL (+1.96%). Following was the healthcare group, with a decrease of 0.43%, mainly influenced by IMP (-1.34%), OPC (-2.12%), DBT (-3.2%), and PMC (-5.59%).

Foreigners continued to net sell more than 338 billion VND on the HOSE exchange in the morning session. Notably, a sudden surge in selling volume appeared in the MSN stock (nearly 226 billion). On the HNX exchange, foreigners also net sold more than 47 billion VND, focusing on selling the SHS stock (41.65 billion).

10:45 am: Fluctuating around the reference level

As of 10:40 am, the VN-Index fluctuated around the reference level and edged higher, reaching 1,252.81 points. Meanwhile, the HNX-Index also inched higher, trading around 224.69 points.

Stocks in the VN30 basket were mixed, with a slight dominance of red stocks. Specifically, VHM, VPB, HDB, and MWG took away 0.91 points, 0.72 points, 0.65 points, and 0.47 points from the overall index, respectively. Conversely, stocks such as HPG, FPT, SHB, and MBB remained in the green and contributed nearly 2 points to the VN30-Index.

Source: VietstockFinance

|

The telecommunications services group was the top-performing group in the market this morning, with a gain of 4.28%. Among the group, VGI rose 5.45%, CTR rose 1.34%, VNZ rose 2.02%, YEG rose 2.37%,… As of 10:40 am, this group had the strongest growth in the morning session.

Following was the information technology group, with a positive impact mainly from the large-cap stock FPT, which increased by 0.45%, and other stocks such as CMG, which rose by 1.58%, POT, which climbed by 7.47%, and PCM and VBH, which hit the daily limit-up with gains of 14.41% and 14.74%, respectively.

On the other hand, the leaders in the materials sector also maintained their optimism from the beginning of the session, with HPG up 0.95%, GVR up 0.47%, HSG up 2.22%, and NKG up 2.2%,…

In contrast, the energy sector was the most negative group in the market this morning, with stocks such as BSR down 0.47%, PVS down 0.26%, PVC down 0.81%, and AAH down 7.14%,… The remaining stocks in the group were either unchanged or slightly in the green.

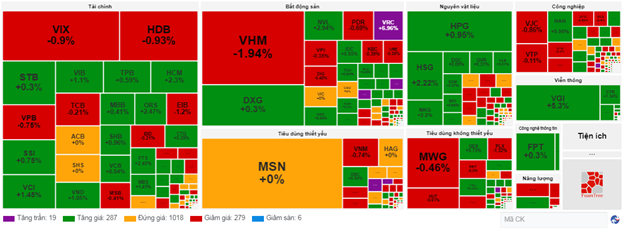

Compared to the opening, buyers and sellers were locked in a tight battle, with nearly 1,020 stocks unchanged and buyers slightly dominating with 287 advancing stocks (19 hitting the ceiling) while 279 stocks declined (6 hitting the floor).

Source: VietstockFinance

|

Opening: Maintaining a slight gain

At the start of the October 28 session, as of 9:30 am, the VN-Index rose more than 1 point to 1,253.81 points. In contrast, the HNX-Index edged lower to 224.5 points.

Oil prices in Asia fell more than 4% in the morning session of October 28, as Israel’s retaliatory attack over the weekend did not target Iran’s oil fields and nuclear facilities and did not disrupt energy supplies, thus easing geopolitical tensions in the Middle East. Specifically, Brent oil was at $72.88 per barrel, down 4.2%, while WTI oil fell 4.4% to $68.65 per barrel.

As of 9:30 am, large-cap stocks such as HPG, GVR, and LPB were pulling the market up, with a total increase of nearly 1 point. On the other hand, VPB, VNM, and VCB led the negative impacts on the market, but the decline was less than 0.5 points.

The telecommunications services sector maintained its stable growth from the beginning of the session, with stocks such as VGI up 3.18%, CTR up 0.39%, VNZ up 2.02%, ELC up 0.84%, and FOC up 2.73%,… The remaining stocks in the group were either unchanged or slightly in the red.

Tomorrow’s Stock Market Outlook: Anticipating Real Estate and Banking Stocks to Lead the Charge

Although the VN-Index fell during the October 30th session, it was a positive day for many bank and real estate stocks, which saw their share prices rise.

The VN-Index Plunges to a 12-Week Low: A Bold Move to Cut Losses and Look to the Future

The market suffered a brutal sell-off in the afternoon, with trading liquidity on both exchanges doubling from the morning session, and stocks plunging across the board. The VN-Index evaporated 1.06% (-13.49 points) and broke through the short-term bottom at the beginning of October, falling to 1257.41 points.